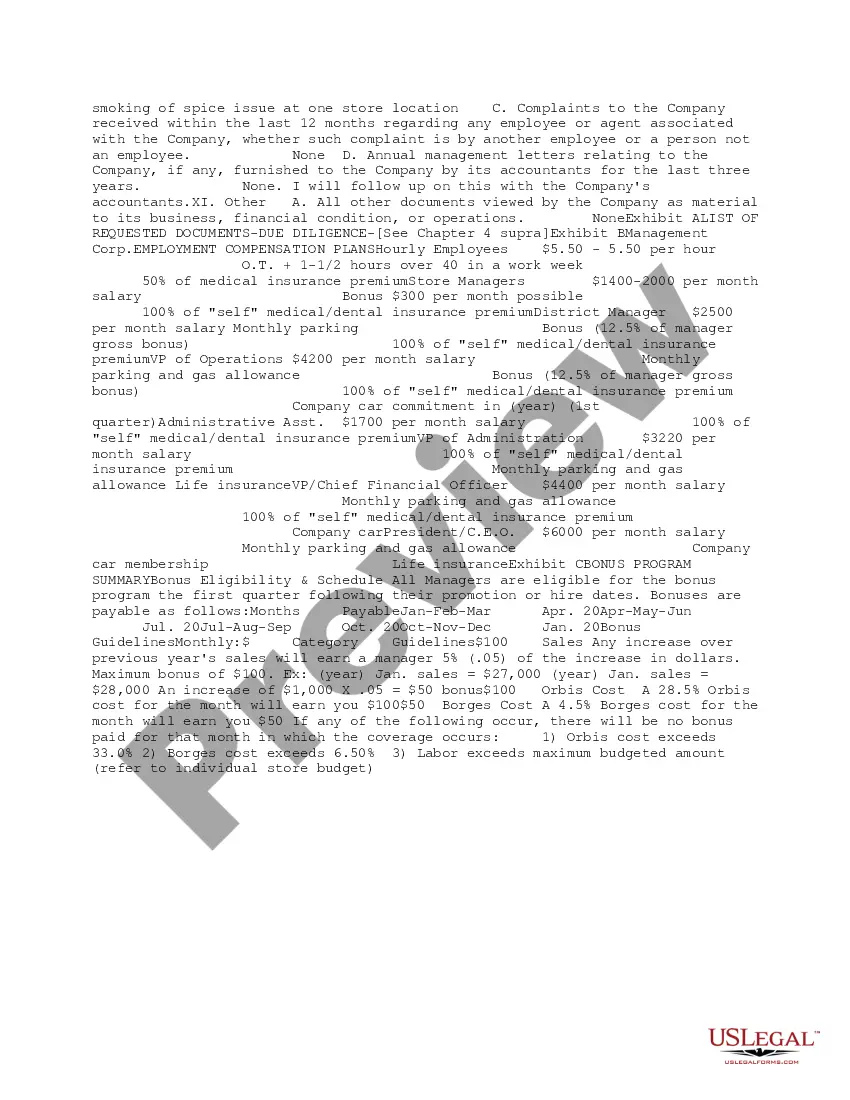

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

Kentucky Summary Initial Review of Response to Due Diligence Request

Description

How to fill out Summary Initial Review Of Response To Due Diligence Request?

You can spend time online trying to locate the appropriate legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by professionals.

You can easily download or print the Kentucky Summary Initial Review of Response to Due Diligence Request from the service.

Read the document description to confirm you have selected the right form.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Afterward, you can fill out, modify, print, or sign the Kentucky Summary Initial Review of Response to Due Diligence Request.

- Every legal document template you purchase becomes your own permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

Form popularity

FAQ

Seth's Law in Kentucky establishes guidelines for how courts should evaluate claims related to the summary initial review of response to due diligence requests. This law aims to protect individuals and businesses by ensuring transparency in the due diligence process. When engaging with Kentucky Summary Initial Review of Response to Due Diligence Request, understanding Seth's Law can significantly aid in navigating legal complexities. Utilizing platforms like US Legal Forms can provide you with the necessary resources to ensure compliance and thorough understanding of these regulations.

The 4 P's of due diligence refer to Product, Process, People, and Performance. Each aspect examines different components of the transaction, ensuring a holistic view of the business or investment. Understanding these elements is vital when conducting a Kentucky Summary Initial Review of Response to Due Diligence Request. Utilizing a platform like uslegalforms can guide you through this complex process and simplify your analysis.

The initial due diligence report is a crucial document that outlines the findings from preliminary investigations. It includes essential information, such as financial performance, legal compliance, and operational details. This report serves as a foundation for a comprehensive Kentucky Summary Initial Review of Response to Due Diligence Request. By analyzing this report, you can make more informed decisions about the potential deal.

A red flag during due diligence indicates potential issues or concerns that may affect the transaction's viability. For instance, inconsistencies in financial statements or unclear ownership can raise doubts. Identifying these red flags can guide you in conducting a Kentucky Summary Initial Review of Response to Due Diligence Request. Alerting your legal team about these flags early on helps you address them effectively.

Part of the due diligence process of a proposal review includes examining the proposal's financial, operational, and legal aspects. You should assess the market conditions, competitor landscape, and potential risks involved. A well-documented Kentucky Summary Initial Review of Response to Due Diligence Request will assist in presenting these findings clearly, ensuring everyone involved understands the proposal's implications.

The due diligence process of a proposal review entails evaluating the proposal's various elements, including financial viability and alignment with strategic goals. This process ensures that all relevant factors are considered before making a decision. Creating a Kentucky Summary Initial Review of Response to Due Diligence Request can help summarize these evaluations, making it easier for stakeholders to perceive the overall merit of the proposal.

The due diligence review process is a detailed examination of all relevant information prior to finalizing a transaction. This process typically includes analyzing financial records, legal documents, and operational practices. By conducting this review thoroughly, you can develop a Kentucky Summary Initial Review of Response to Due Diligence Request that highlights critical insights and potential risks.

When completing financial due diligence, you should address several essential questions. Start by examining the financial health of the entity, asking about revenue trends, expenses, and profitability. Additionally, inquire about any debts and liabilities that could impact the proposal, enabling you to create a comprehensive Kentucky Summary Initial Review of Response to Due Diligence Request.

The due diligence process involves several key steps. First, you'll want to gather all relevant documents and information related to the potential deal. Next, conduct a thorough analysis of the financial, legal, and operational aspects of the proposal. Finally, compile a Kentucky Summary Initial Review of Response to Due Diligence Request to present your findings, ensuring all parties are informed and aligned.

A due diligence review is a thorough assessment conducted to evaluate the details of a business or investment before finalizing a deal. This process often involves examining financial records, legal compliance, and operational aspects. The Kentucky Summary Initial Review of Response to Due Diligence Request helps streamline this assessment by providing a concise overview of the relevant findings. Understanding due diligence can significantly mitigate risks and inform better decision-making.