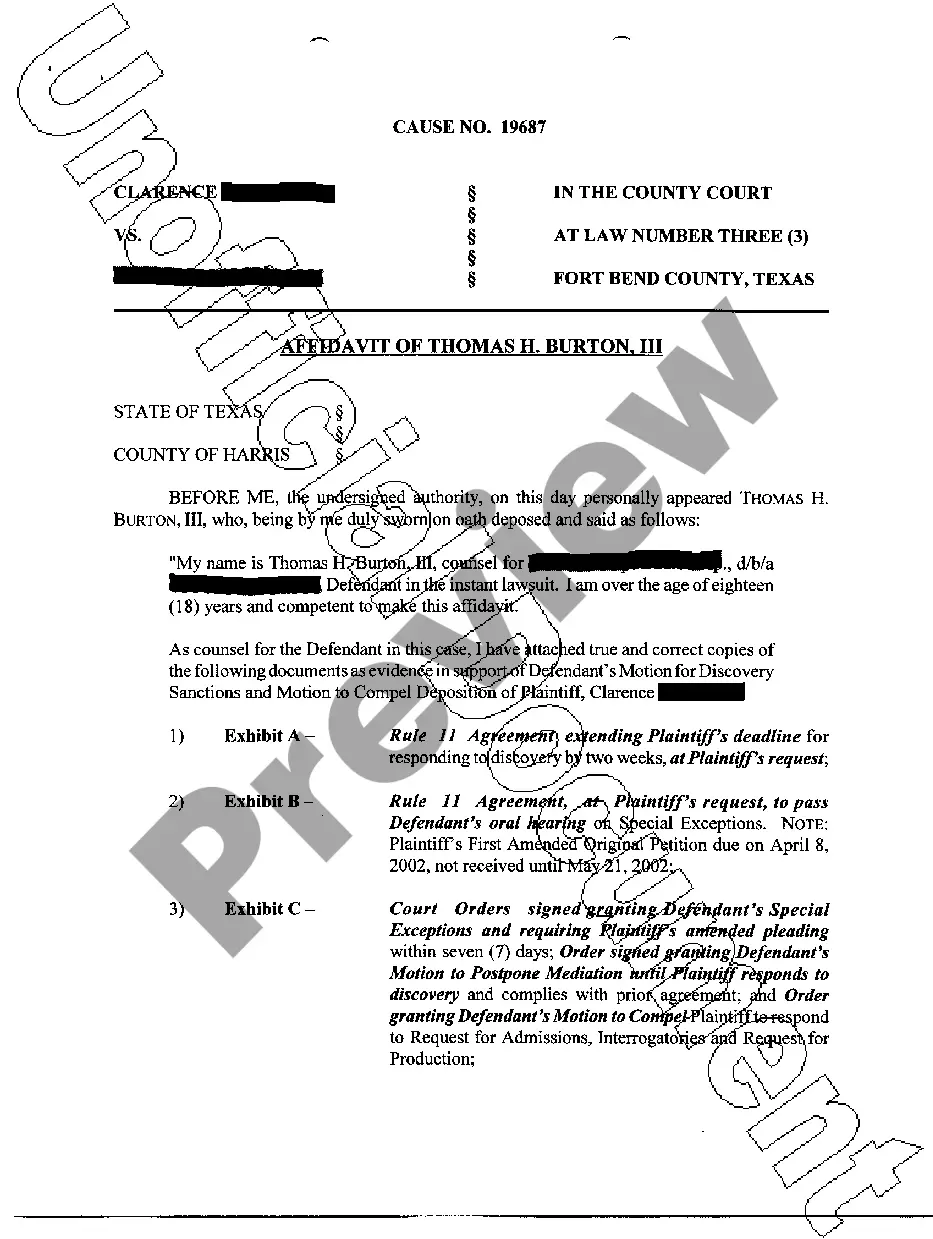

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes using a document designed to falsely imply that it issued from a state or federal source or creates a false impression as to its source, authorization or approval.

Kentucky Notice to Debt Collector - Falsely Representing a Document's Authority

Description

How to fill out Notice To Debt Collector - Falsely Representing A Document's Authority?

You can dedicate hours on the web attempting to locate the valid document template that meets the local and national requirements you need.

US Legal Forms offers thousands of valid forms that are vetted by experts.

You can download or print the Kentucky Notice to Debt Collector - Falsely Representing a Document's Authority from their service.

If available, utilize the Review option to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- Subsequently, you can complete, modify, print, or sign the Kentucky Notice to Debt Collector - Falsely Representing a Document's Authority.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of a purchased form, go to the My documents section and choose the relevant option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you've selected the correct document template for your desired location/city.

- Review the form summary to verify that you have chosen the correct form.

Form popularity

FAQ

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Honesty: Debt collectors cannot mislead you about who they are, how much money you owe or the legal repercussions of not paying your debt for instance, by threatening arrest. Challenging the debt: You have a right to dispute the debt.

Debt collectors are generally prohibited under federal law from using any false, deceptive, or misleading misrepresentation in collecting a debt. The federal law that prohibits this is called the Fair Debt Collection Practices Act (FDCPA).

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Debt collectors cannot make false or misleading statements. For example, they cannot lie about the debt they are collecting or the fact that they are trying to collect debt, and they cannot use words or symbols that falsely make their letters to you seem like they're from an attorney, court, or government agency.

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

A debt collector's No. 1 goal is to collect their missing funds. They can't curse at you or make empty threats, but they can say other things to try and scare you into paying up. Staying calm, keeping the call short and keeping your comments to a minimum are the best ways to deal with persistent bill collectors.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.