Kentucky Payout Agreement

Description

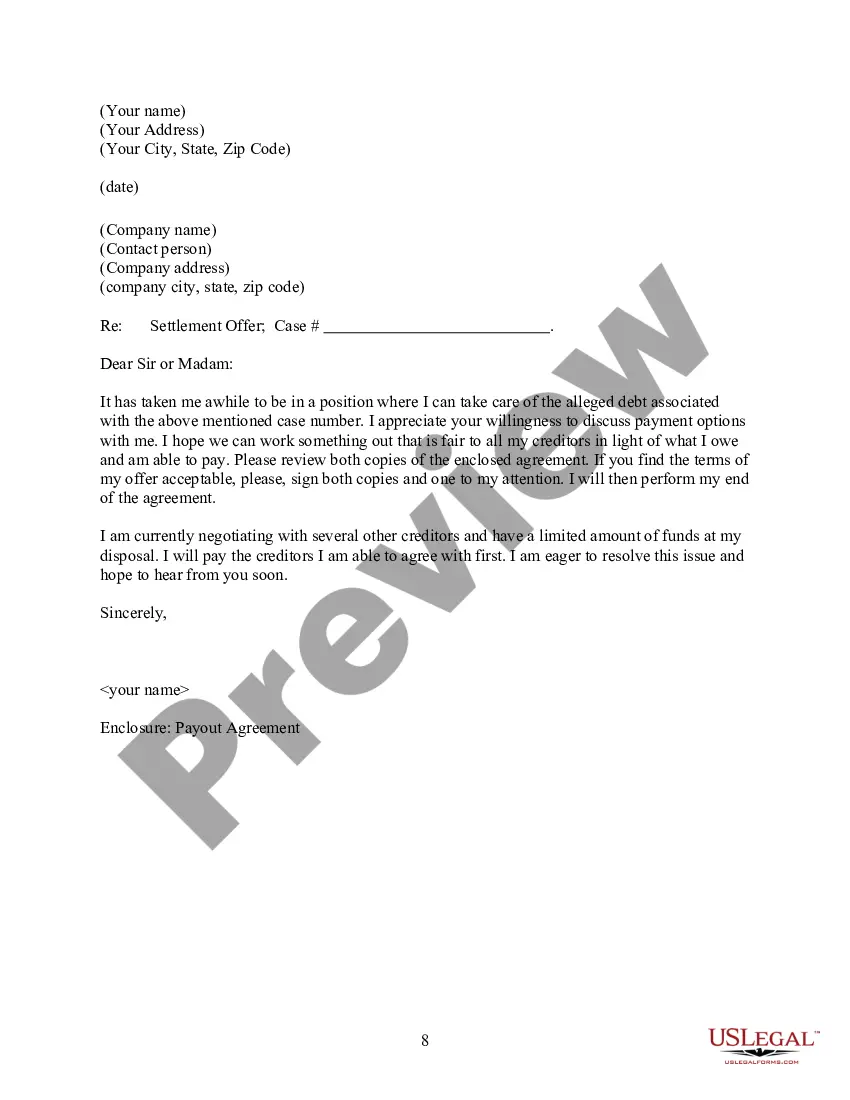

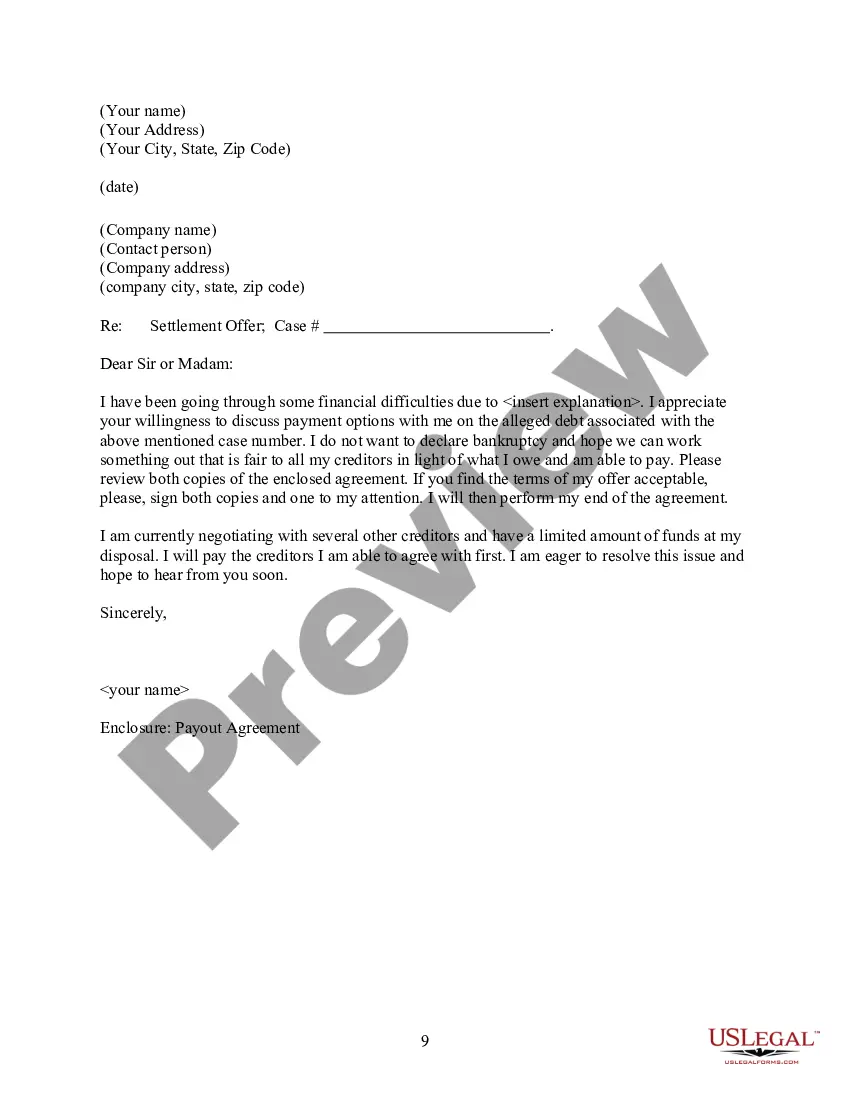

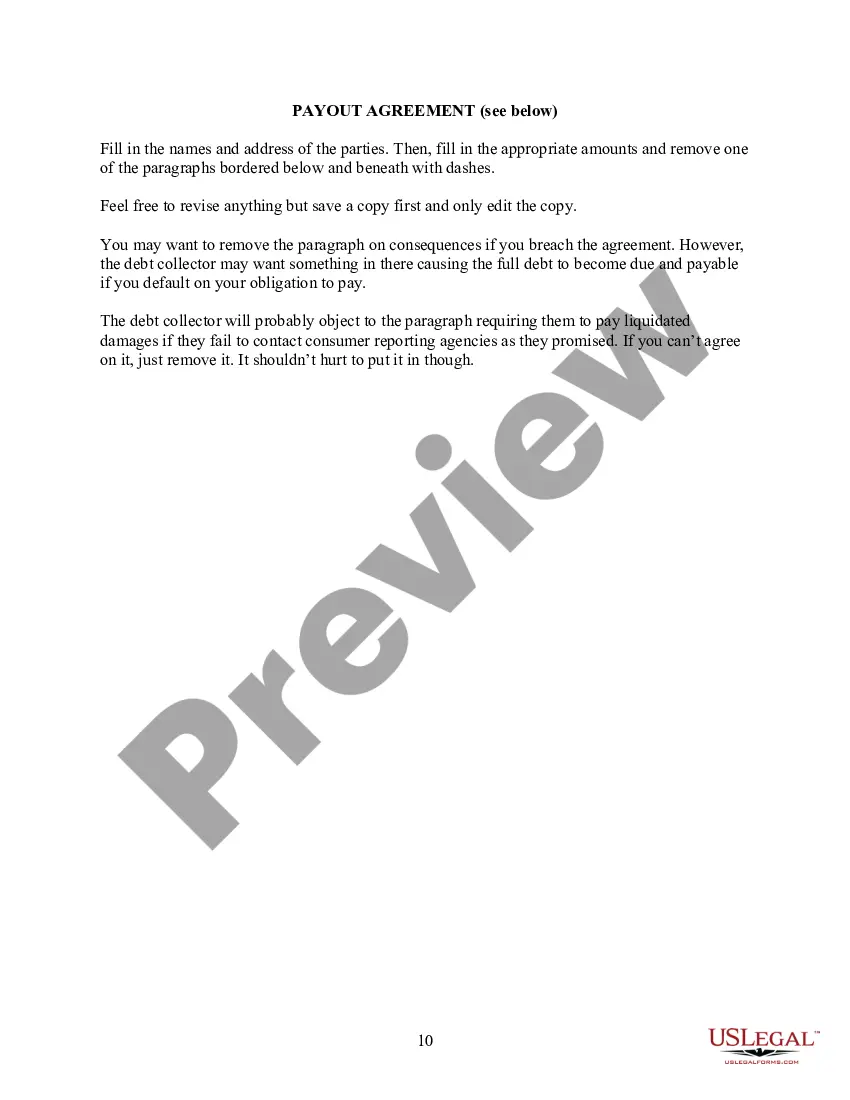

How to fill out Payout Agreement?

If you require to total, download, or print valid document templates, utilize US Legal Forms, the premier selection of legal forms, which are accessible online.

Capitalize on the site's user-friendly and convenient search feature to locate the documents you need.

Numerous templates for business and personal use are categorized by types and states, or by keywords. Use US Legal Forms to find the Kentucky Payout Agreement in just a few clicks.

Every legal document template you purchase is your property forever. You can access all the forms you saved within your account. Select the My documents section and choose a form to print or download again.

Act promptly to download and print the Kentucky Payout Agreement with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to obtain the Kentucky Payout Agreement.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to verify the form's content. Remember to read the explanation.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of your legal form template.

- Step 4. Once you have located the form you require, click the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Kentucky Payout Agreement.

Form popularity

FAQ

When you indicate that you want to claim exemption from Kentucky withholding, you are stating that you believe you will owe no state tax for the year. This claim can affect your paycheck by reducing the amount withheld for tax purposes. If you have a Kentucky Payout Agreement, it’s essential to communicate this clearly to your employer to ensure accurate withholdings. Always consult with a tax professional if you are unsure about claiming this exemption.

If you receive a request for payment letter from Revenue and you cannot pay, you should contact the telephone number in the letter to discuss your options. These will include the option to pay in instalments through a Phased Payment Arrangement (PPA).

To pay by check or money order, make payment payable to FRANCHISE TAX BOARD and write your account number on your payment. Mail your payment to: STATE OF CALIFORNIA, FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0011.

If your debt is currently being handled by the Division of Collections you can set up your own payment plan by going to the following website . You will need your case number from any Division of Collections' letter. Follow the on-line instructions.

Ohio and Kentucky have a reciprocal agreement. This means that if you live in one of these states but work in the other, you'll only need to file a return for the state in which you live. Therefore, you'll need to file a Kentucky State Return.

What if I am not eligible or unable to apply or revise a payment plan online?Individuals can complete Form 9465, Installment Agreement Request.If you prefer to apply by phone, call 800-829-1040 (individual) or 800-829-4933 (business), or the phone number on your bill or notice.10-Mar-2022

Late Payment and Failure to Withhold or Collect Tax as Required by Law - Two (2) percent of the total tax due for each 30 days or fraction thereof that a payment is late. The maximum penalty is 20 percent of the tax not timely withheld, collected or paid. The minimum penalty is $10.

Kentucky residents are taxed on all sources of income even if earned and tfffded in another state. However, a credit is available in KRS 141.070(1) for individual income tax paid to another state. The credit is only available if the income tax is actually assessed and paid to the other state.

HOW TO PAYYou may pay your estimated tax installments using the following options: Pay by check using Form 740-ES. Make check payable to Kentucky State Treasurer, and write your Social Security Number on the face of the check.

Electronic payment: Choose to pay directly from your bank account or by credit card. Service provider fees may apply. Tax Payment Solution (TPS): Register for EFT payments and pay EFT Debits online. Filing Login: Utility Gross Receipts License Tax online filing.