Kentucky Ratification and Approval of Indemnity Agreements

Description

How to fill out Ratification And Approval Of Indemnity Agreements?

Are you currently inside a position in which you will need files for sometimes organization or person reasons almost every day time? There are tons of legitimate file web templates available on the Internet, but discovering ones you can trust isn`t straightforward. US Legal Forms provides thousands of kind web templates, just like the Kentucky Ratification and Approval of Indemnity Agreements, that happen to be created to satisfy federal and state specifications.

If you are previously knowledgeable about US Legal Forms web site and get an account, simply log in. Following that, you may acquire the Kentucky Ratification and Approval of Indemnity Agreements web template.

Should you not provide an account and need to start using US Legal Forms, abide by these steps:

- Find the kind you want and ensure it is to the appropriate town/state.

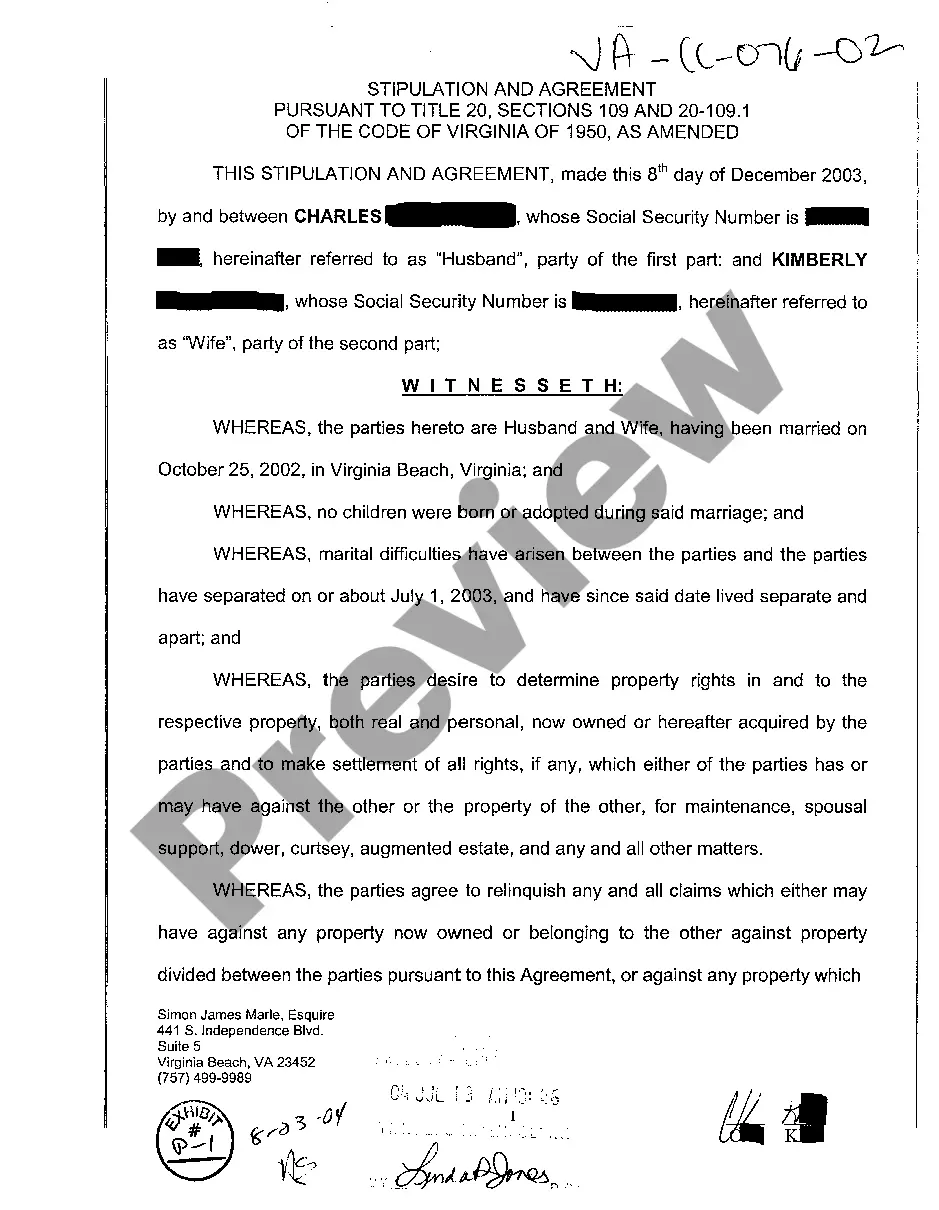

- Make use of the Preview button to analyze the shape.

- See the information to ensure that you have selected the appropriate kind.

- In the event the kind isn`t what you`re looking for, take advantage of the Research field to find the kind that meets your requirements and specifications.

- If you find the appropriate kind, click on Purchase now.

- Pick the costs plan you need, complete the desired info to generate your money, and pay money for your order using your PayPal or Visa or Mastercard.

- Choose a practical document structure and acquire your copy.

Find every one of the file web templates you have bought in the My Forms food list. You can get a extra copy of Kentucky Ratification and Approval of Indemnity Agreements at any time, if possible. Just click the needed kind to acquire or produce the file web template.

Use US Legal Forms, one of the most extensive variety of legitimate types, in order to save efforts and stay away from faults. The assistance provides skillfully manufactured legitimate file web templates which can be used for a range of reasons. Create an account on US Legal Forms and initiate generating your life easier.

Form popularity

FAQ

The person who promises to indemnify for a loss is the Indemnifier. On the other hand, the person whose losses the indemnifier promises to make good is the Indemnified.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

Introduction to Letter of Indemnity Typically, these letters are prepared and drafted by a third-party institution, such as banks and insurers, who agree to compensate either of the party when the other party fails to meet the terms of the contract.

The obligation to indemnify requires the indemnifying party to: Reimburse the indemnified party for its paid costs and expenses, referred to as losses. Advance payment to the indemnified party for its unpaid costs and expenses, such as: Liabilities.

The most common example of indemnity in the financial sense is an insurance contract. For instance, in the case of home insurance, homeowners pay insurance to an insurance company in return for the homeowners being indemnified if the worst were to happen.

Typically, an insurance contract dictates that the insurer, also known as the indemnitor, agrees to compensate the other party involved (the insured or the indemnitee) for any damage or losses in return for premiums paid by the insured. University of Wisconsin System. "Hold Harmless and Indemnity Agreements."

Such letters are traditionally drafted by third-party institutions like banks or insurance companies, which agree to pay financial restitution to one of the parties, should the other party fail to live up to its obligations.

This is made possible by the LOI. The language used is crucial since, in the end, a LOI is a contract. For this reason, it is always advised that the letter be drafted and countersigned by a bank, insurance, or other expert with knowledge in these areas.