Kentucky Restructuring Agreement

Description

How to fill out Restructuring Agreement?

Are you in a place where you require paperwork for possibly company or specific purposes virtually every day time? There are a lot of lawful papers templates available online, but discovering types you can trust is not straightforward. US Legal Forms offers a huge number of kind templates, just like the Kentucky Restructuring Agreement, which can be published to satisfy state and federal demands.

If you are already informed about US Legal Forms site and also have your account, merely log in. Next, you may acquire the Kentucky Restructuring Agreement design.

Should you not come with an bank account and need to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you will need and make sure it is for the proper metropolis/region.

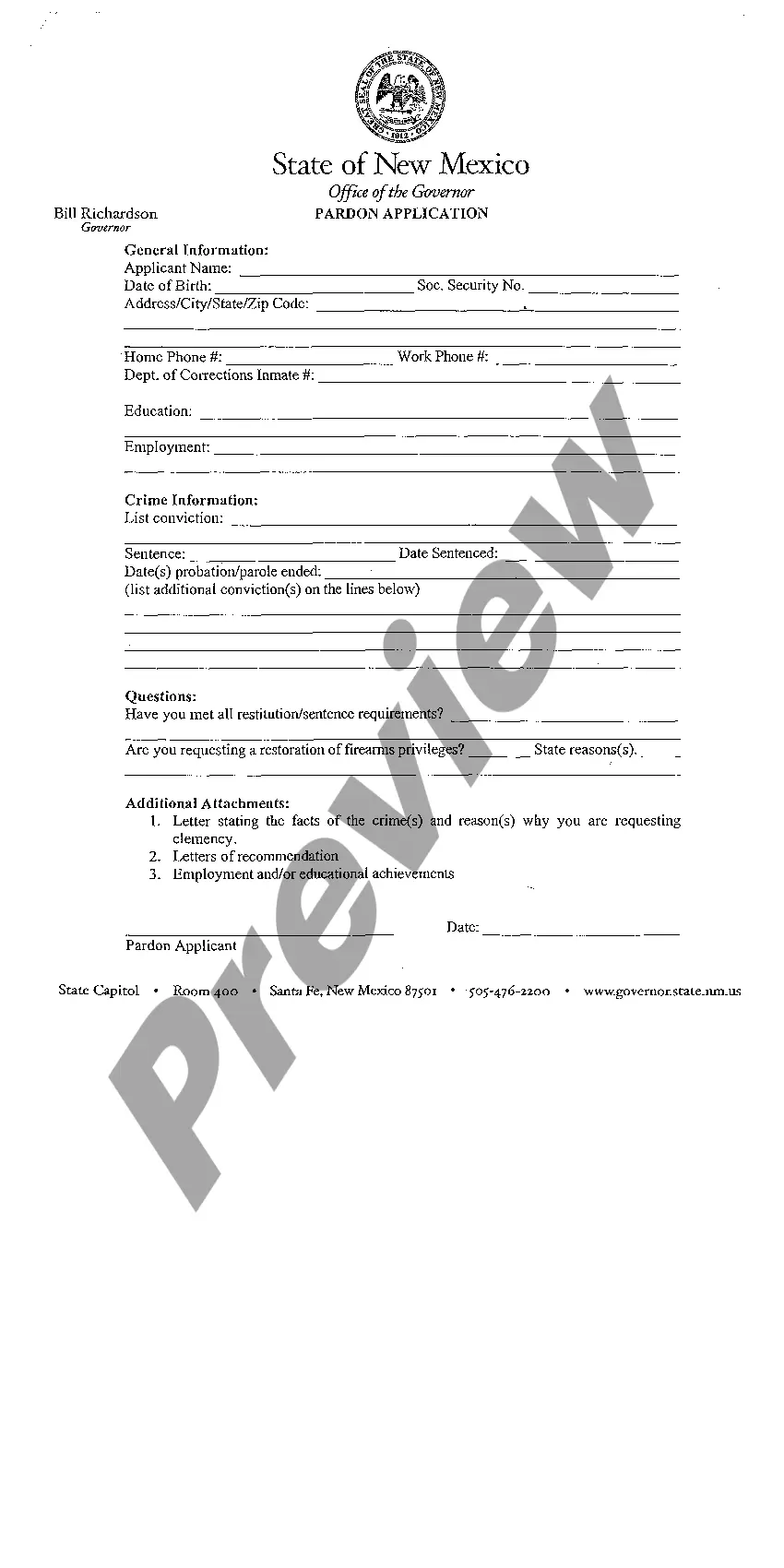

- Make use of the Review switch to examine the form.

- Read the description to actually have selected the correct kind.

- In case the kind is not what you are looking for, utilize the Search discipline to find the kind that fits your needs and demands.

- When you get the proper kind, simply click Buy now.

- Pick the rates prepare you need, fill in the specified information and facts to produce your account, and pay money for your order using your PayPal or charge card.

- Pick a hassle-free paper format and acquire your duplicate.

Find every one of the papers templates you may have purchased in the My Forms food list. You can aquire a more duplicate of Kentucky Restructuring Agreement anytime, if needed. Just click on the necessary kind to acquire or printing the papers design.

Use US Legal Forms, by far the most considerable selection of lawful kinds, in order to save some time and stay away from blunders. The support offers professionally produced lawful papers templates which you can use for a range of purposes. Produce your account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

File with the Secretary of State: When a corporation wishes to cease doing business, Articles of Dissolution must be filed with the Secretary of State if authorized by statute. Articles of Dissolution for a business corporation must comply with KRS 271B.

In Kentucky, business entities are required by law to formally dissolve. In order to properly close, a domestic entity must file articles of dissolution, and a foreign entity must file a certificate of withdrawal. These forms are available for download on this website.

If a foreign corporation or foreign LLC registered in Kentucky no longer wants to do business there, it can apply to withdraw its registration in the state. To do so, the corporation or LLC would submit a Certificate of Withdrawal, and an exact copy, to the Kentucky Secretary of State (SOS) by mail or in person.