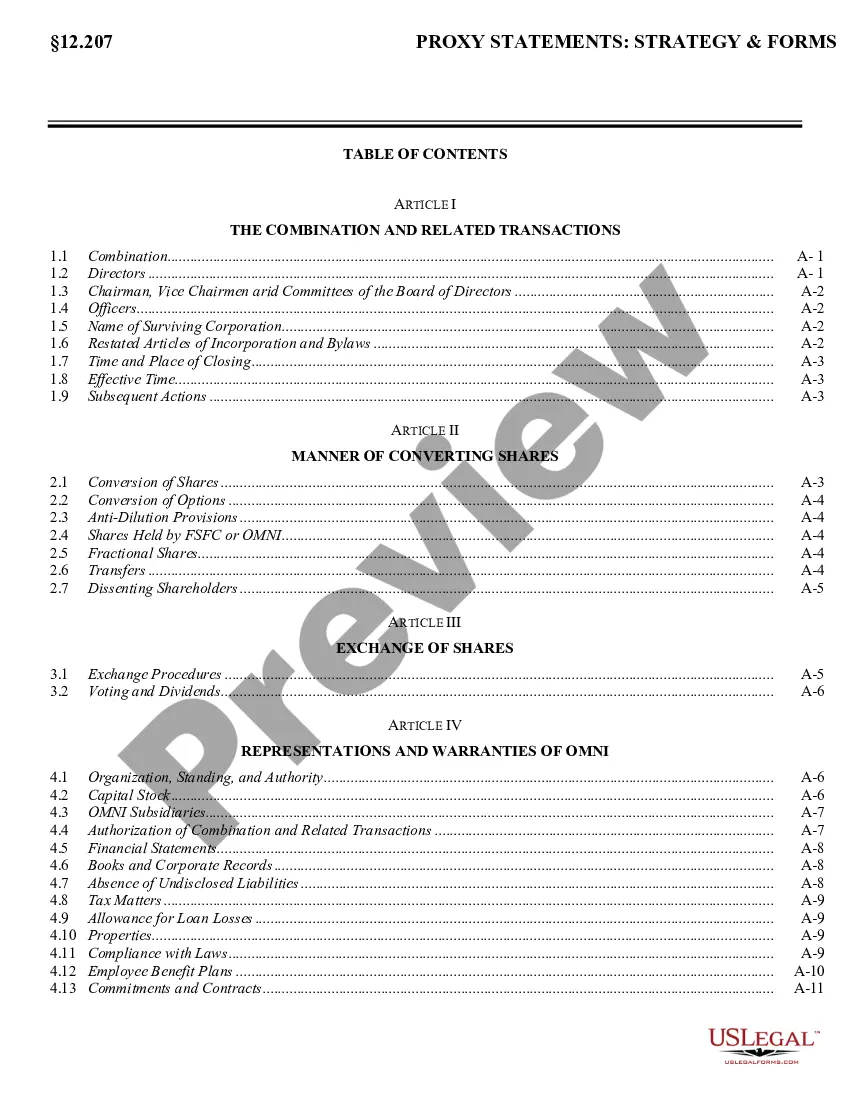

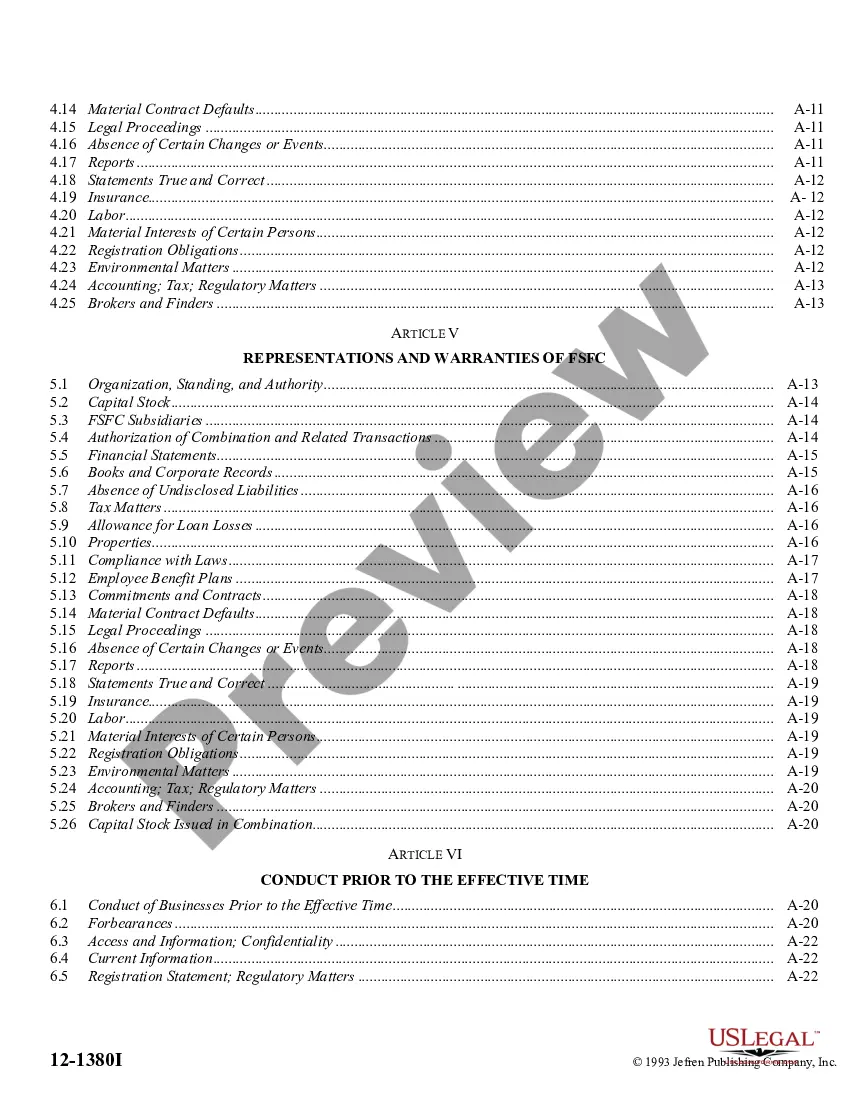

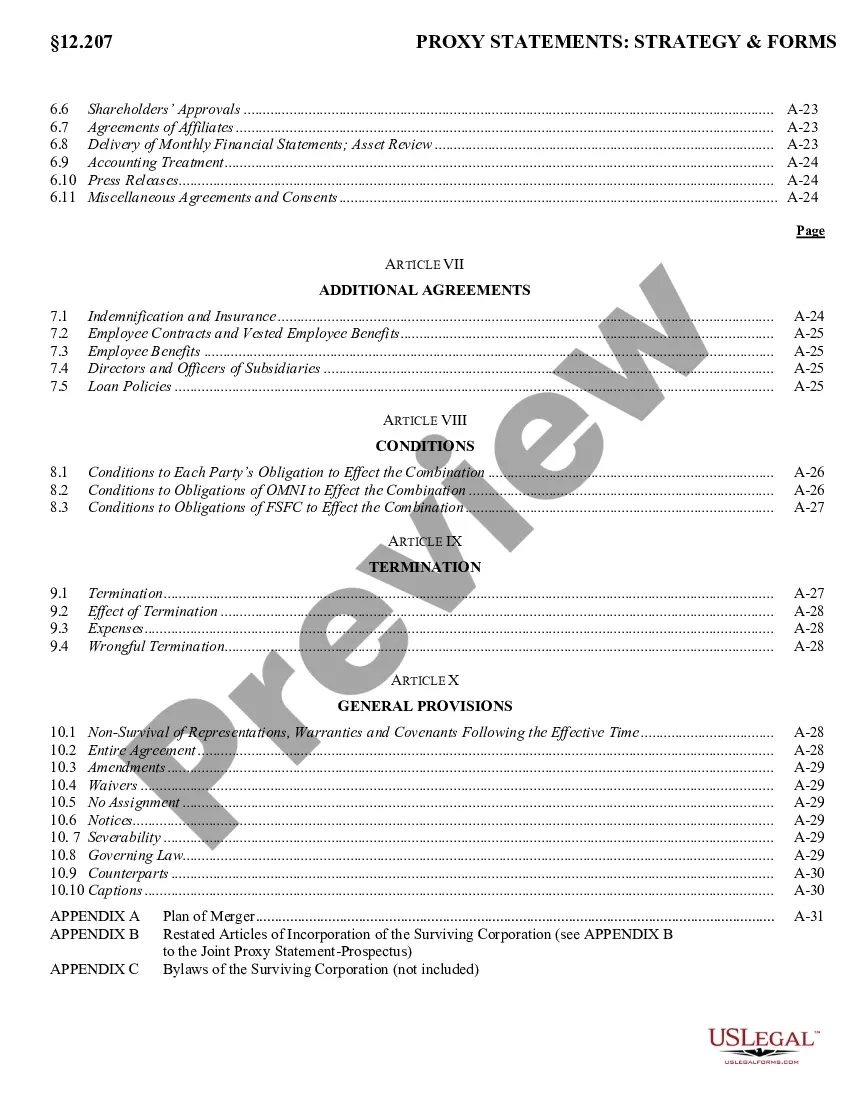

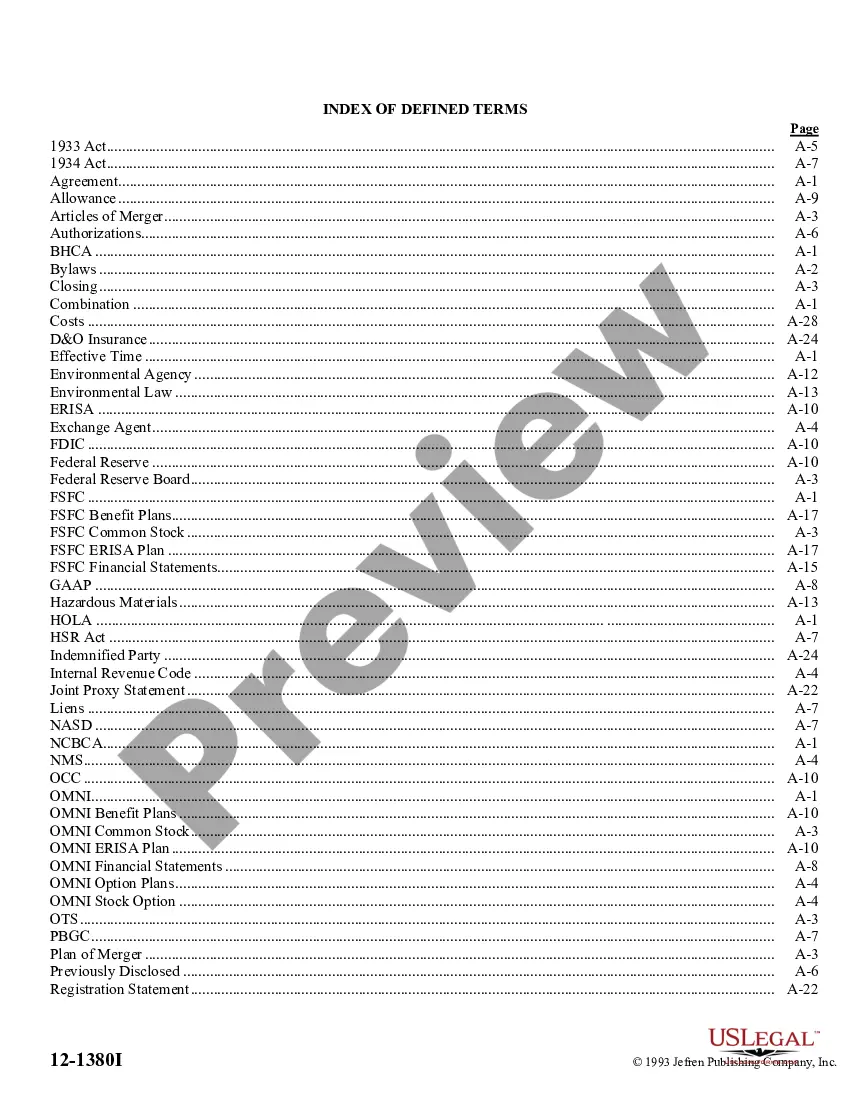

Kentucky Agreement of Combination

Description

How to fill out Agreement Of Combination?

If you have to complete, obtain, or produce lawful record layouts, use US Legal Forms, the greatest assortment of lawful types, that can be found on the Internet. Make use of the site`s basic and handy search to get the documents you require. Numerous layouts for business and specific uses are categorized by types and states, or search phrases. Use US Legal Forms to get the Kentucky Agreement of Combination within a number of clicks.

If you are currently a US Legal Forms client, log in to your accounts and click on the Download option to find the Kentucky Agreement of Combination. You can even entry types you in the past delivered electronically inside the My Forms tab of your accounts.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for the proper area/land.

- Step 2. Use the Review method to examine the form`s content. Don`t forget about to learn the outline.

- Step 3. If you are not happy together with the kind, take advantage of the Look for industry near the top of the display to find other variations of your lawful kind design.

- Step 4. Upon having located the form you require, select the Purchase now option. Choose the rates plan you choose and include your credentials to sign up on an accounts.

- Step 5. Procedure the financial transaction. You should use your credit card or PayPal accounts to finish the financial transaction.

- Step 6. Pick the structure of your lawful kind and obtain it in your gadget.

- Step 7. Full, revise and produce or sign the Kentucky Agreement of Combination.

Every lawful record design you acquire is the one you have for a long time. You may have acces to each and every kind you delivered electronically with your acccount. Click on the My Forms area and decide on a kind to produce or obtain once more.

Be competitive and obtain, and produce the Kentucky Agreement of Combination with US Legal Forms. There are thousands of specialist and state-certain types you can utilize for your personal business or specific requirements.

Form popularity

FAQ

The state of Kentucky imposes income tax on all income earned within the state's borders. This applies to people who live in another state and work in Kentucky. These individuals must file a nonresident Kentucky state tax return each year even if they live in Tennessee which does not have a state income tax.

Kentucky has reciprocal agreements with Illinois, Indiana, Michigan, Ohio, Virginia, West Virginia and Wisconsin. These agreements provide for taxpayers to be taxed by their state of residence, and not the state where income is earned. Kentucky does not allow a credit for tax paid to a reciprocal state.

A reciprocal agreement is an agreement between two states that allows employees that work in one state but live in another to request exemption from tax withholding in their employment state.

Kentucky Franchise Tax The tax is calculated using the lesser of $0.095/$100 of Kentucky gross receipts or $0.75/$100 of Kentucky gross profits. Regardless of which calculation method is used, business owners are required to pay a minimum Kentucky LLET of $175.

Kentucky has reciprocal agreements with Illinois, Indiana, Michigan, Ohio, Virginia, West Virginia and Wisconsin. These agreements provide for taxpayers to be taxed by their state of residence, and not the state where income is earned. Kentucky does not allow a credit for tax paid to a reciprocal state.

Reciprocal tax agreements allow residents of one state to work in another state without having income taxes withheld in the state they work in. The income they earn in their work state is taxed based on the the tax rules of the state they reside in.

Note: For taxable periods beginning on or after January 1, 2019, every corporation doing business in Kentucky that is a member of a unitary business must file a combined report (Form 720U) per KRS 141.202(3), unless they elect to file a consolidated return as part of an affiliated group.

A Limited Liability Entity Tax (LLET) applies to both C corporations and Limited Liability Pass-Through Entities (LLPTEs) and is not an alternative to another tax. However, corporations paying the LLET are allowed to apply that amount as a credit towards its regular corporate income tax.