Kentucky Order Confirming Chapter 12 Plan - B 230A

Description

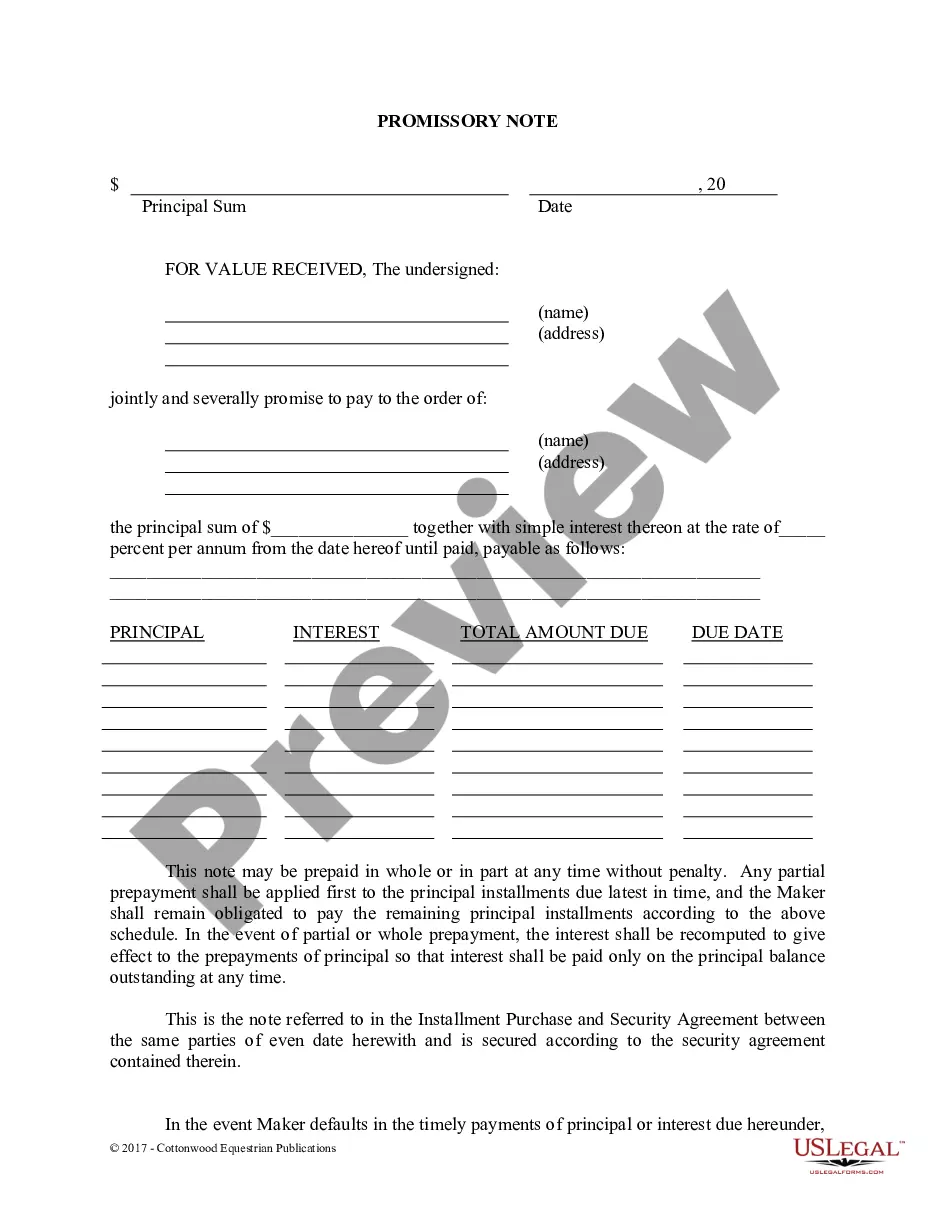

How to fill out Order Confirming Chapter 12 Plan - B 230A?

You can spend hours on the web looking for the legitimate file design that fits the federal and state specifications you will need. US Legal Forms supplies 1000s of legitimate forms which can be reviewed by pros. It is possible to acquire or produce the Kentucky Order Confirming Chapter 12 Plan - B 230A from our support.

If you already possess a US Legal Forms profile, you are able to log in and then click the Acquire switch. Afterward, you are able to total, revise, produce, or signal the Kentucky Order Confirming Chapter 12 Plan - B 230A. Every single legitimate file design you purchase is your own permanently. To obtain another version associated with a bought type, go to the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms internet site initially, adhere to the easy directions under:

- Initial, make certain you have chosen the best file design for your county/area of your choosing. Browse the type explanation to ensure you have picked out the right type. If accessible, use the Preview switch to check from the file design also.

- If you wish to discover another model of your type, use the Look for area to find the design that suits you and specifications.

- Upon having found the design you need, click Buy now to carry on.

- Pick the costs plan you need, type in your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You can utilize your Visa or Mastercard or PayPal profile to cover the legitimate type.

- Pick the formatting of your file and acquire it to your device.

- Make alterations to your file if possible. You can total, revise and signal and produce Kentucky Order Confirming Chapter 12 Plan - B 230A.

Acquire and produce 1000s of file templates utilizing the US Legal Forms Internet site, that offers the greatest collection of legitimate forms. Use professional and status-specific templates to take on your small business or individual needs.

Form popularity

FAQ

In order to be eligible to file for Chapter 13 Bankruptcy, the filing individual(s) must owe less than $1,184,200 in liquidated, noncontingent secured debts, and less than $394,725 in liquidated, noncontingent unsecured debts. 11 U.S.C. §109(e).

"Cram down" simply means the process by which the bankruptcy court can, as part of the confirmation of a Chapter 12 Bankruptcy Plan, force treatment upon an objecting creditor, provided the Plan otherwise meets all of the other confirmation criteria under Section 1225 of the Bankruptcy Code.

The individual or individual and spouse must be engaged in a farming operation or a commercial fishing operation. The total debts (secured and unsecured) must not exceed $11,097,350 (if a family farmer) or $2,268,550 (if a family fisherman).

Chapter 13 Eligibility Any individual, even if self-employed or operating an unincorporated business, is eligible for chapter 13 relief as long as the individual's combined total secured and unsecured debts are less than $2,750,000 as of the date of filing for bankruptcy relief. 11 U.S.C. § 109(e).