Kentucky Qualifying Event Notice Information for Employer to Plan Administrator

Description

How to fill out Qualifying Event Notice Information For Employer To Plan Administrator?

Selecting the appropriate legal document format can be quite a challenge.

It goes without saying that there are numerous templates available on the internet, but how do you acquire the legal type you require.

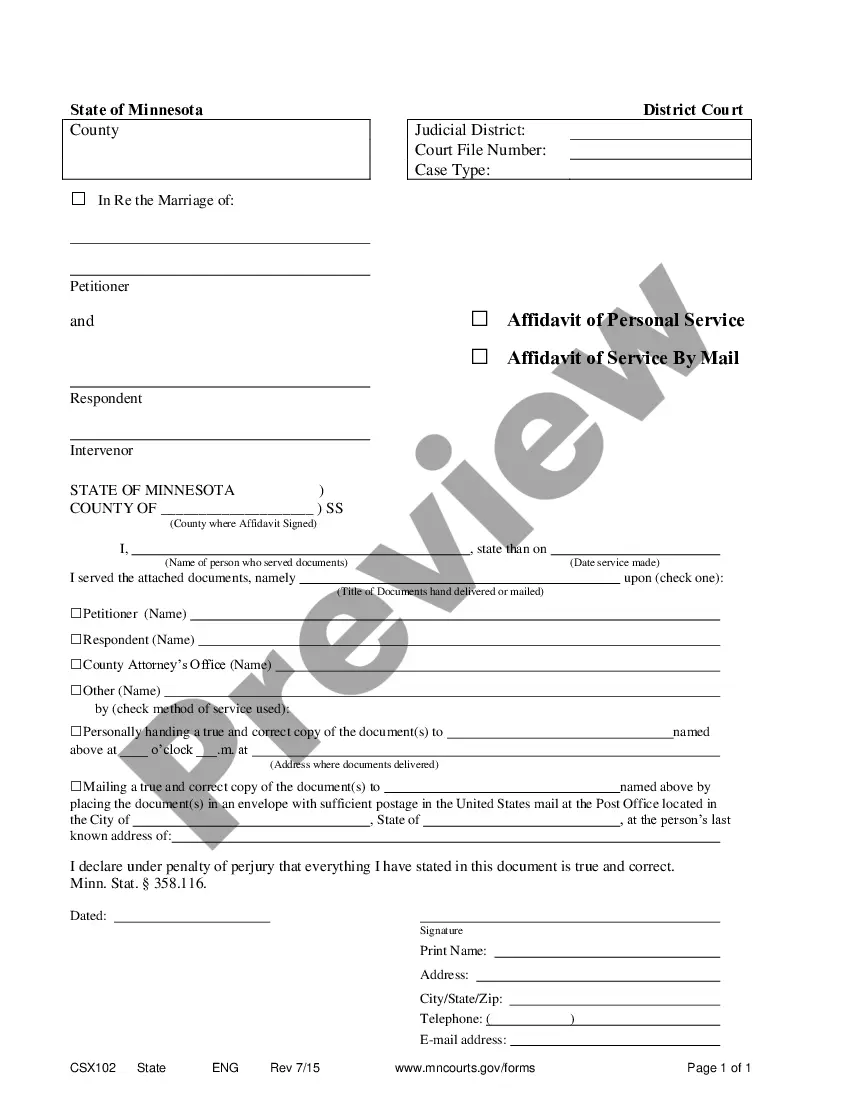

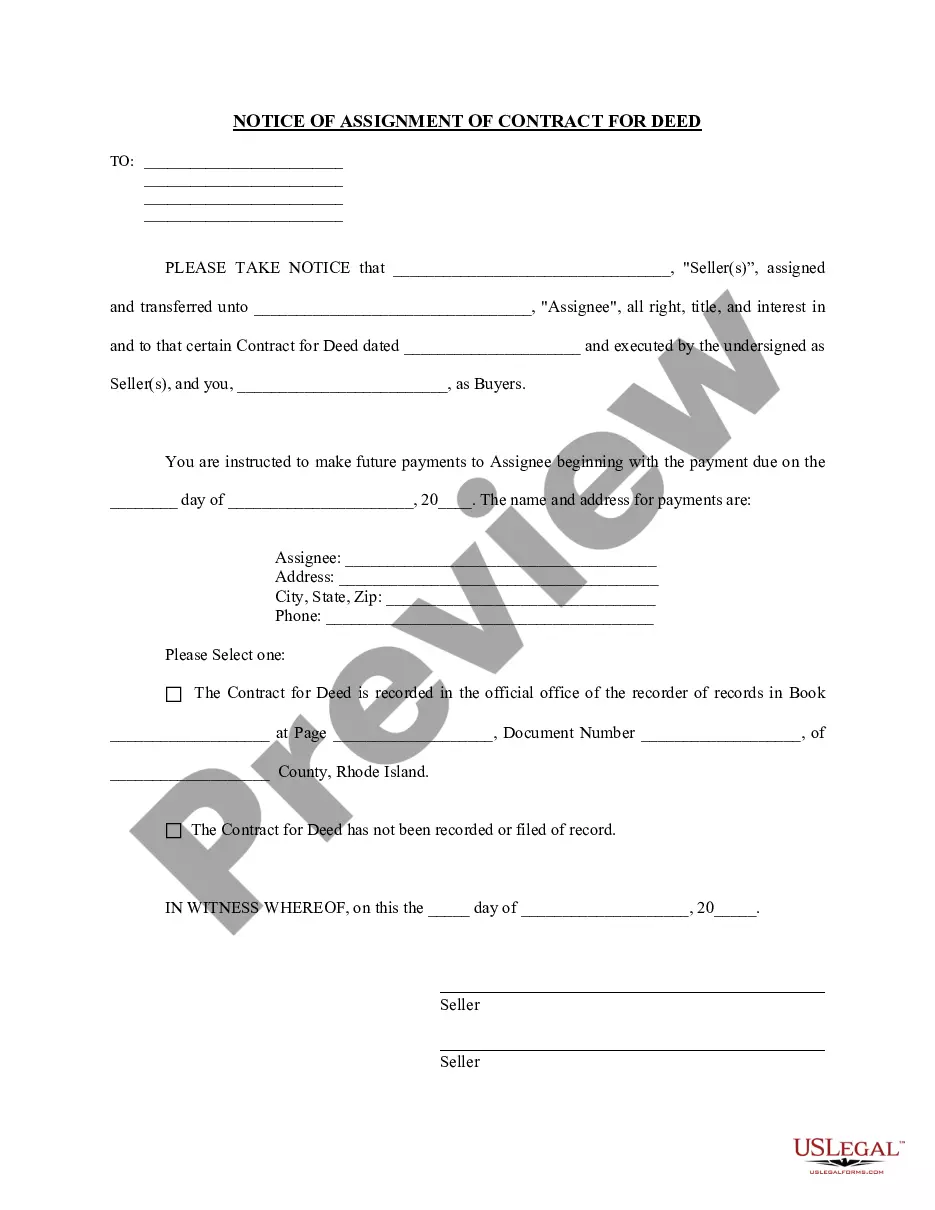

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Kentucky Qualifying Event Notice Information for Employer to Plan Administrator, that can be utilized for business and personal needs.

You can review the document using the Preview option and read the form description to ensure this is the right one for you.

- All of the documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Acquire button to locate the Kentucky Qualifying Event Notice Information for Employer to Plan Administrator.

- Use your account to search through the legal documents you have purchased in the past.

- Navigate to the My documents section of your account and obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, make sure you have selected the correct form for your city/county.

Form popularity

FAQ

The 60-day loophole refers to a situation where individuals can potentially delay their decision to elect COBRA coverage for up to 60 days after a qualifying event. During this period, they must receive their election notice and understand their options. This aspect ties closely to Kentucky Qualifying Event Notice Information for Employer to Plan Administrator, as it emphasizes the importance of clear communication regarding coverage timelines. To assist your HR efforts, uslegalforms offers comprehensive resources to navigate these nuanced details.