Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

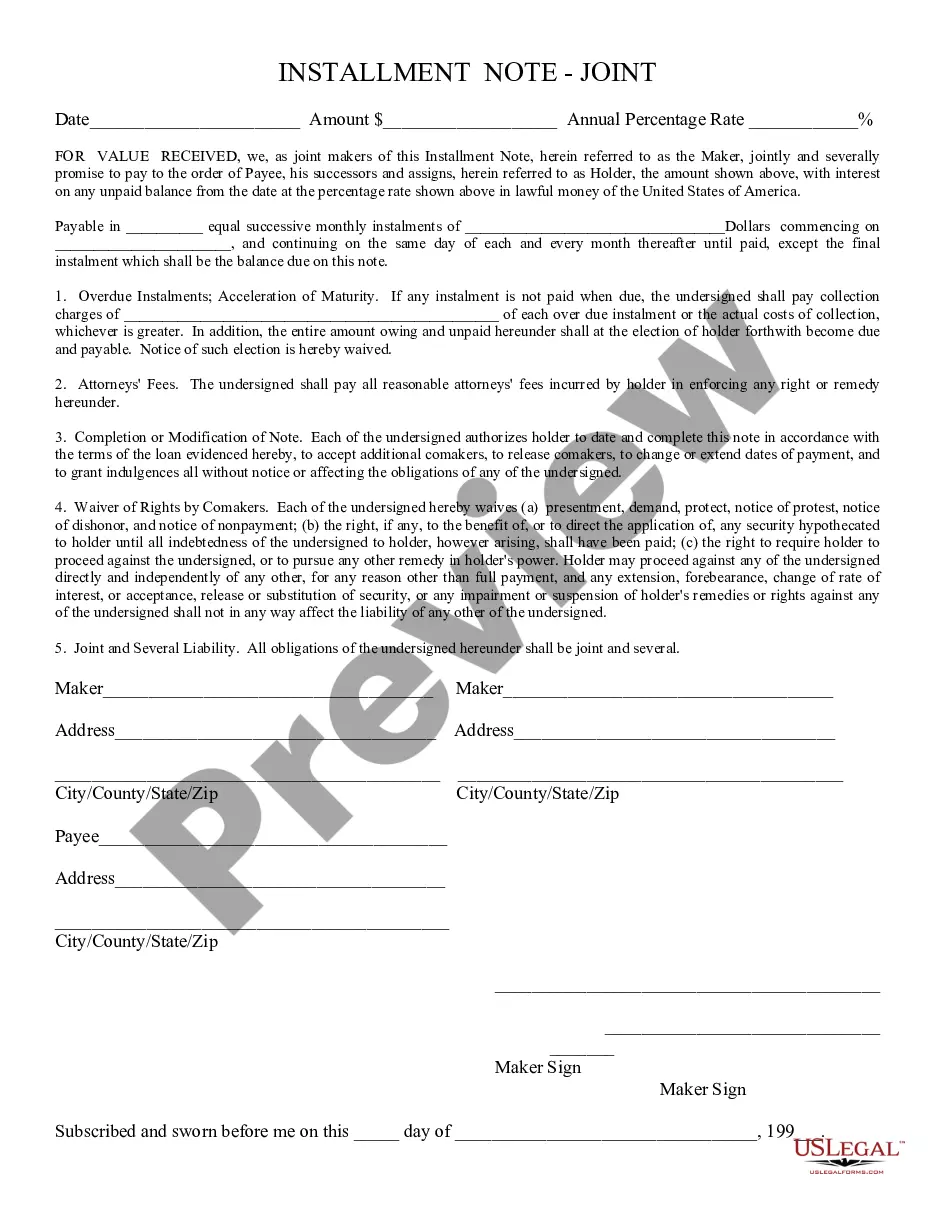

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

It is feasible to spend hours on the web trying to discover the legal document format that aligns with the federal and state requirements you will require.

US Legal Forms offers a vast array of legal templates that have been reviewed by professionals.

You can obtain or print the Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate from the service.

If available, use the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you may complete, modify, print, or sign the Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

- Every legal document format you purchase belongs to you permanently.

- To acquire another copy of any purchased template, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for your area/city of choice.

- Review the document description to confirm you have selected the correct form.

Form popularity

FAQ

Filling out a personal guaranty involves several steps. Start with your complete name, contact information, and the date. Clearly specify the lease or purchase details that you are guaranteeing. It is essential to sign and date the document, confirming your understanding of the obligations. Using a reliable service like US Legal Forms can simplify this process, providing clear templates and guidance for creating a Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

While a personal guarantee does not always require notarization, having it notarized can provide additional legal protection and validity. In many situations involving a Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, landlords may prefer notarized guarantees as evidence of the guarantor's commitment. Always verify specific requirements with legal professionals to ensure compliance.

A lease is a legal document that outlines the terms and conditions of renting a property, while a guaranty is a separate agreement where an individual agrees to take responsibility for the lease's obligations. In the case of a Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, the guarantor provides additional security for the landlord by promising to cover the tenant's responsibilities if needed. Understanding this distinction is crucial for anyone entering into such agreements.

To fill out a personal guarantee, begin by providing your personal information, including your name and address. Next, clearly state the obligations you are guaranteeing, specifically in terms of the lease or purchase of real estate. Always read the document carefully to ensure that you understand your responsibilities, particularly in the context of a Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

A personal guarantee clause is a statement in a lease agreement where an individual agrees to be responsible for fulfilling the contract obligations if the primary signer defaults. For example, in a Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, the clause might say that the guarantor will cover any unpaid rent or damages. This ensures that landlords have additional security in case of non-payment.

The purpose of a personal guaranty is to protect landlords and property owners by ensuring that someone is legally responsible for lease obligations regardless of the tenant's circumstances. This is especially important in commercial leases, where the financial stakes can be high. By signing a personal guaranty, individuals demonstrate their investment and commitment to the lease agreement. Learn more about how a Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can play a pivotal role in securing a successful leasing experience.

A guaranty on a lease is a promise made by a third party to take responsibility for the lease obligations if the tenant fails to meet them. This ensures that landlords have recourse for unpaid rent or damages. It often adds an extra layer of security for property owners, particularly in commercial settings. When considering a Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, it is essential to grasp how it safeguards landlord interests.

Yes, it is common to require a personal guarantee on a commercial lease. This often gives landlords additional security, especially when leasing to new or small businesses. A personal guarantee ensures that the individual signing the lease will be responsible for the lease obligations, making the landlord feel more confident in the decision to lease the property. Understanding the implications of a Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can help business owners navigate these requirements.

Yes, a personal guarantee is generally enforceable in a court of law, as long as it meets legal requirements. This means that if the primary debtor defaults, the creditor can pursue the guarantor for the owed amount. To secure your financial position, familiarize yourself with the details of Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

A personal guaranty agreement is a formal contract where one party agrees to take responsibility for another's financial obligations. It typically outlines the specific terms of the guarantee and the obligations under which the guarantor will be held accountable. If you're involved in real estate, understanding Kentucky Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate is critical for securing your interests.