Kentucky Resolution of Meeting of LLC Members to Pursue Lawsuit

Description

How to fill out Resolution Of Meeting Of LLC Members To Pursue Lawsuit?

Selecting the optimal sanctioned document template can be rather challenging. Clearly, there are numerous templates accessible online, but how will you locate the sanctioned document you require? Utilize the US Legal Forms website.

The service provides thousands of templates, including the Kentucky Resolution of Meeting of LLC Members to Pursue Lawsuit, which can be utilized for both business and personal purposes. All forms are verified by experts and comply with state and federal requirements.

If you are already registered, Log In to your account and click the Download button to acquire the Kentucky Resolution of Meeting of LLC Members to Pursue Lawsuit. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you desire.

Finally, complete, modify, print, and sign the acquired Kentucky Resolution of Meeting of LLC Members to Pursue Lawsuit. US Legal Forms is the largest repository of legal templates where you can access a variety of document formats. Utilize the service to download professionally-crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are clear steps for you to follow.

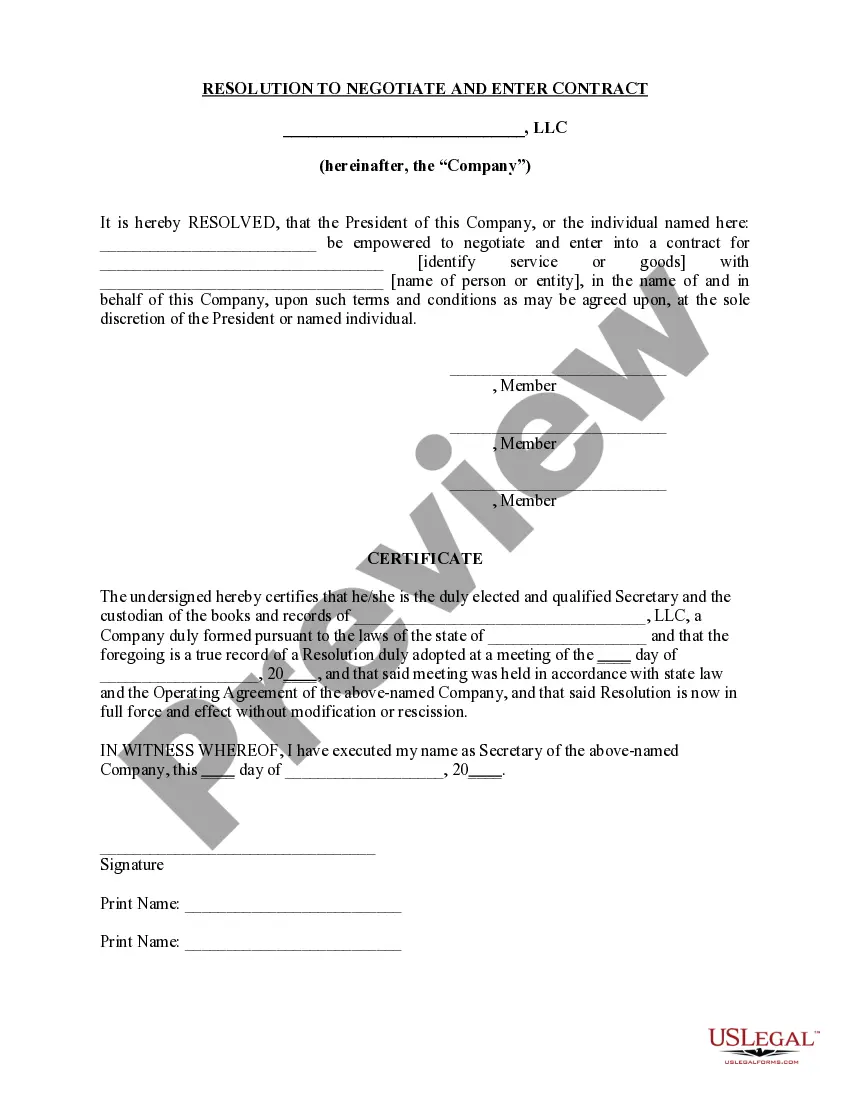

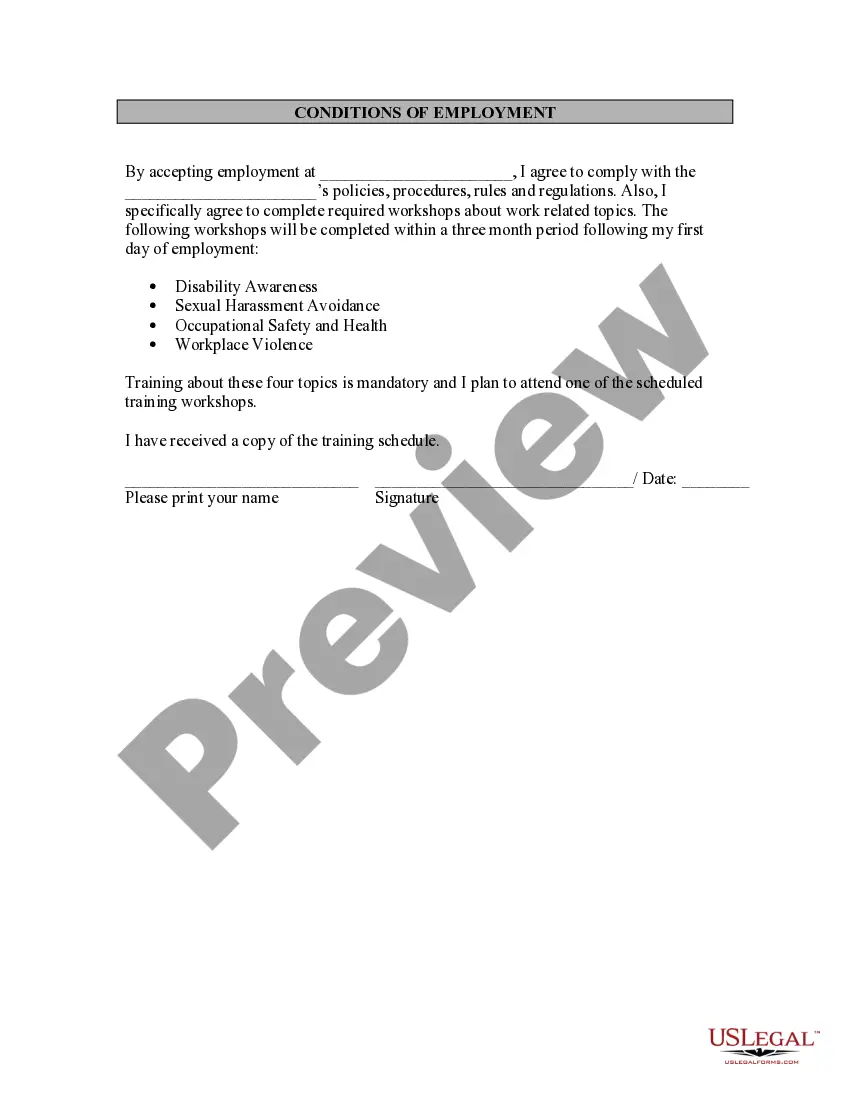

- First, ensure you have selected the correct document for your area/region. You may preview the document using the Review option and check the form details to ensure it is the right one for you.

- If the document does not meet your requirements, use the Search field to find the correct document.

- Once you are confident the document is suitable, click on the Purchase Now button to acquire the document.

- Choose the pricing plan you need and enter the necessary information. Create your account and finalize your purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

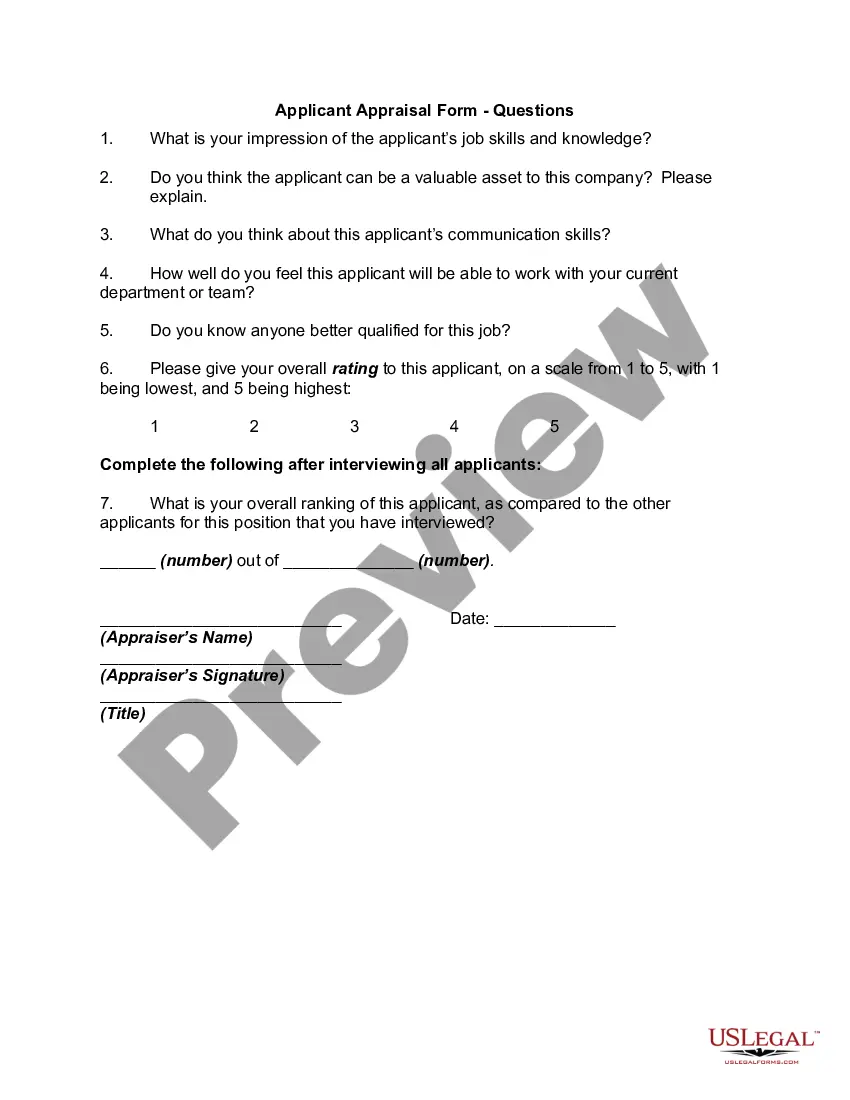

3. Negligence. A common question that many people have is, Can I sue my business partner for negligence? The short answer to this question is yes.

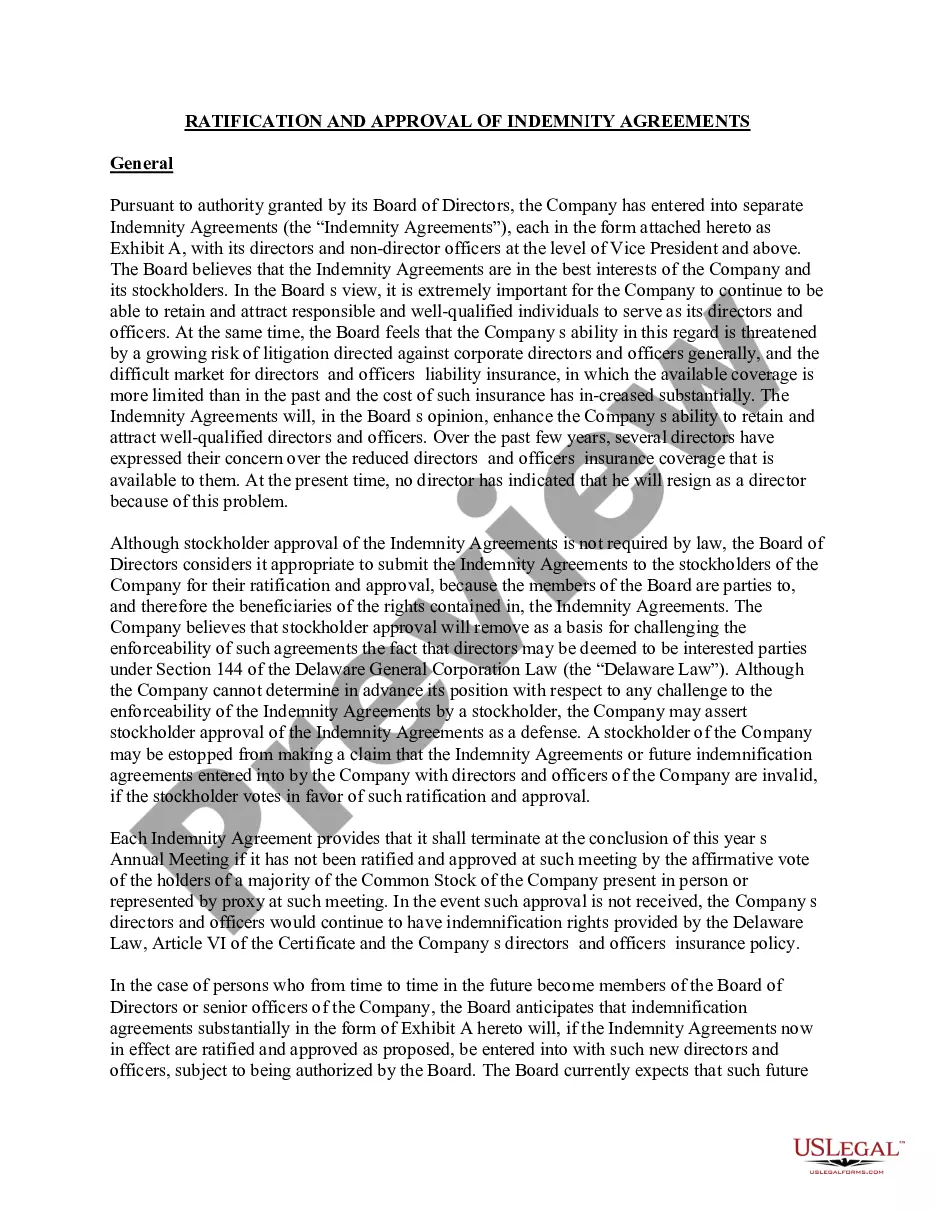

Financial Rights of an LLC Member For example, members have the right to share in the distribution of the entity's profits and losses. They also have the right to a share in the allocation of the company's financial assets during its existence, liquidation, and dissolution.

A member of the LLC should have an ethical responsibility to meet the obligations of the firm. They should have duty of care.

Unfortunately, many LLCs form without drafting any sort of contracts about the rights and duties of the parties. In those cases, members in an LLC can only sue one another if they can prove that they have been personally harmed apart from the other members or the business.

What is the difference between a "member" and a "manager" of an LLC? A member is an owner of the LLC and is similar to a stockholder of a corporation. A manager is a person chosen by the members to manage the LLC and is similar to a director of a corporation.

Those LLC members who operate the business owe the fiduciary duties of loyalty and reasonable care to the non-managing LLC owners. Depending upon your state, LLC members may be able to revise, broaden, or eliminate these fiduciary duties by contract or under the conditions of their LLC operating agreement.

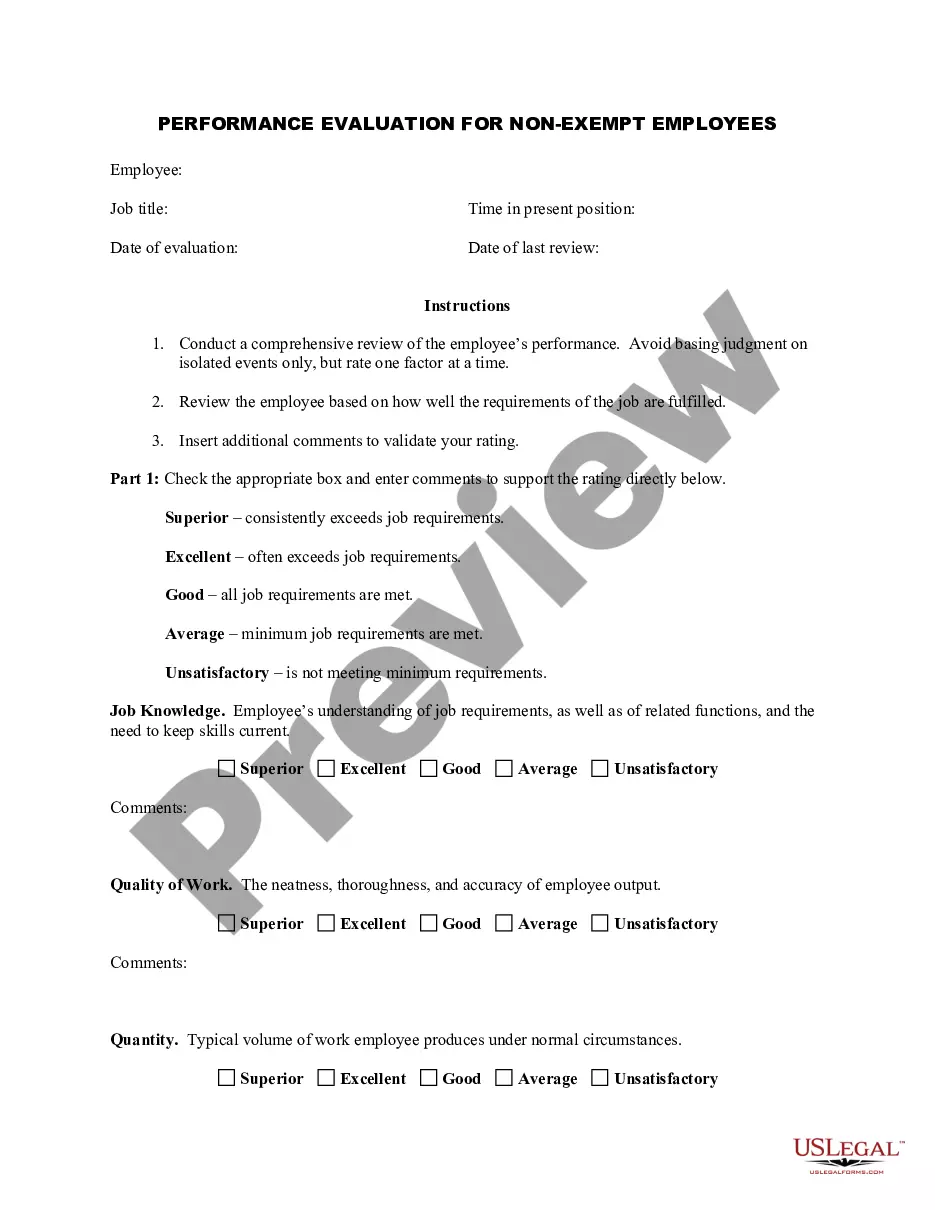

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities.

LLC members and managers are generally not liable for the LLC's debts and other liabilities. However, California Corporations Code Section 17703.04 establishes specific instances in which members or managers may be held personally liable for company debts and other liabilities.

The eponymous characteristic of the limited liability company (LLC) is that the LLC, as a separate legal entity, is liable for its obligations to others and that no other person, whether as owner or agent, is vicariously liable for those same obligations.

Under most circumstances, members of a limited liability company, or LLC, are protected against being personally named in a lawsuit against the business entity, but that is not always the case.