Kentucky Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

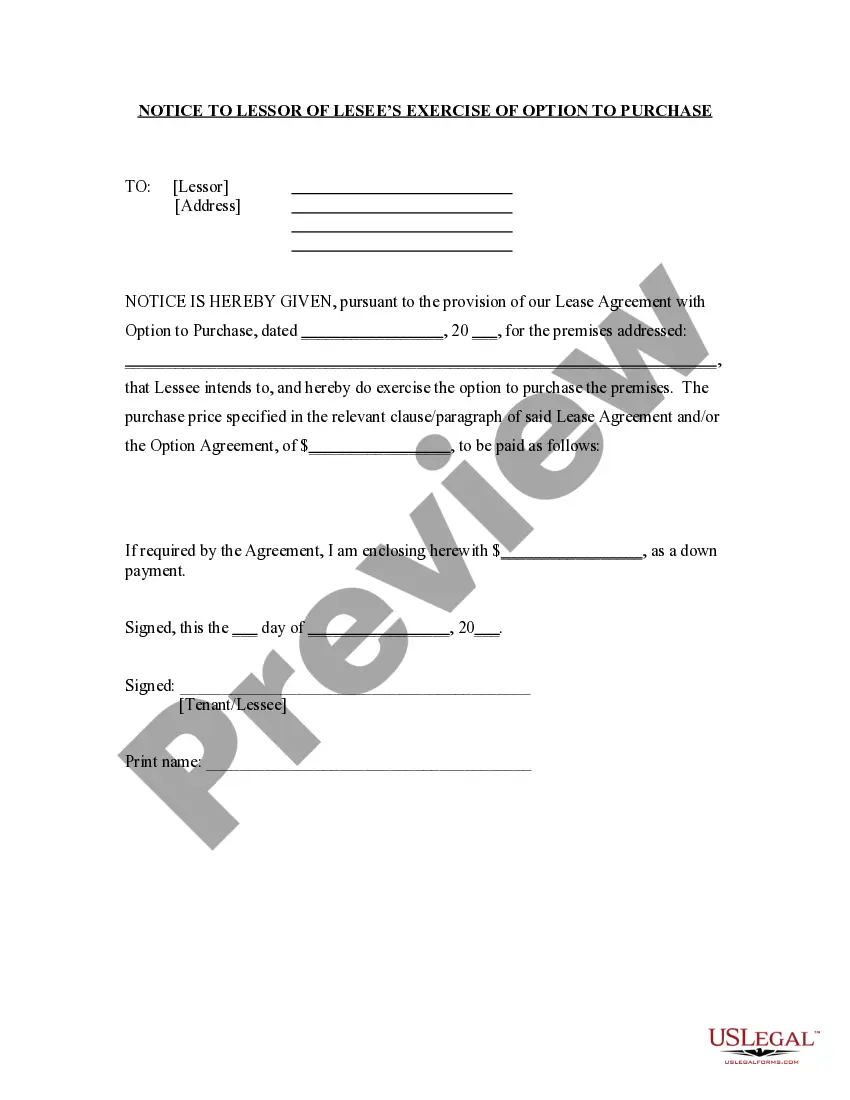

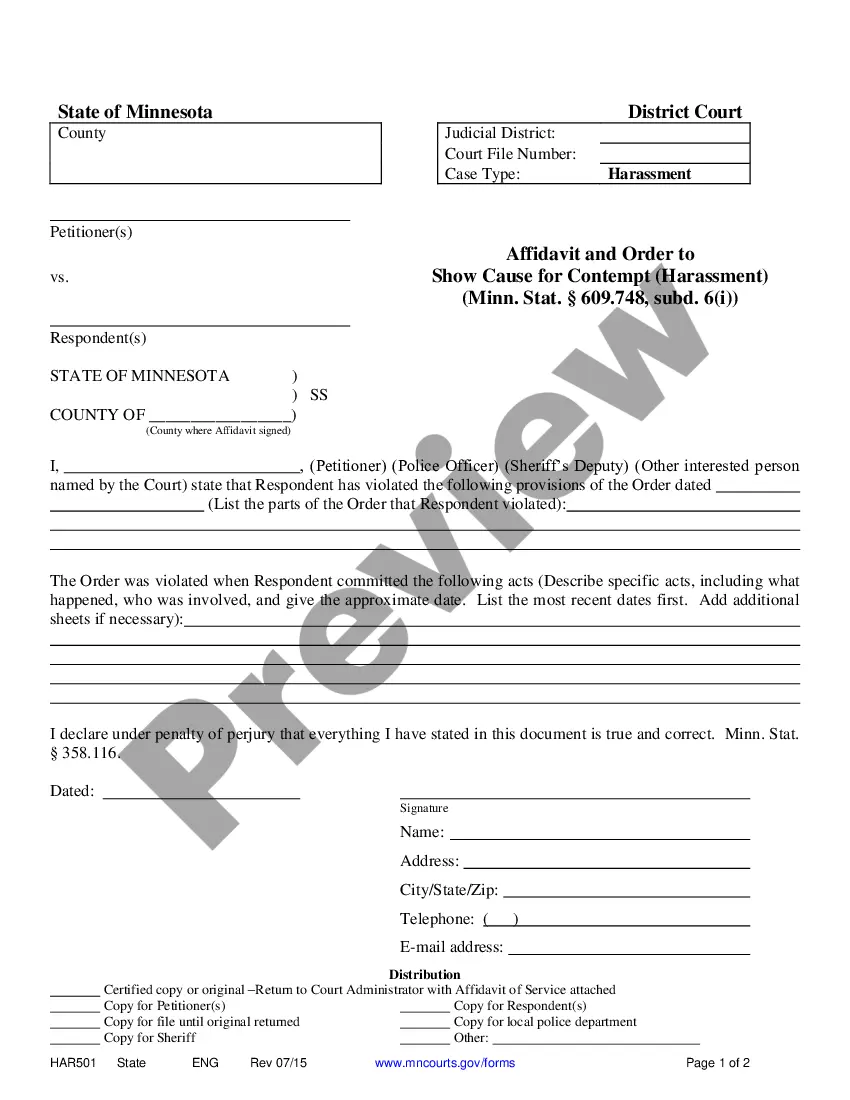

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal document templates you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, claims, or keywords. You can obtain the latest forms such as the Kentucky Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status in just minutes.

If you already have an account, Log In and download the Kentucky Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status from the US Legal Forms library. The Download button will be present on every form you view. You can access all your previously saved forms in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the stored Kentucky Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status. Every template you add to your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire. Gain access to the Kentucky Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status with US Legal Forms, the most extensive library of legal document templates. Utilize a plethora of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have chosen the correct form for your city/area.

- Click the Preview button to view the form's details.

- Review the form summary to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the payment plan you prefer and provide your credentials to register for the account.

Form popularity

FAQ

In Kentucky, tax trusts work by allowing individuals to set aside assets for specific beneficiaries while avoiding some tax implications. These trusts can help manage wealth and reduce taxable estates effectively. By considering a Kentucky Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status, you may gain significant tax advantages that support your charitable goals. Contact a knowledgeable attorney to discuss your options.

The IRS groups the 501(c)(9), 501(c)(4), and 501(c)(17) together when the latter two are employees' associations.

A "tax-exempt" entity is a corporation, unincorporated association, or trust that has applied for and received a determination letter from the Franchise Tax Board stating it is exempt from California franchise and income tax (California Revenue and Taxation Code Section 23701).

Every organization exempt from federal income tax under Internal Revenue Code section 501(a) must file an annual information return except: A church, an interchurch organization of local units of a church, a convention or association of churches. An integrated auxiliary of a church.

A first important distinction to make is that granting nonprofit status is done by the state, while applying for tax-exempt designation (such as 501(c)(3), the charitable tax-exemption) is granted by the federal government in the form of the IRS.

A qualified charitable organization is recognized as tax-exempt in the pursuit of philanthropic, nonprofit, or civic activities. Section 501(c)(3) is the specific portion of the U.S. Internal Revenue Code (IRC) and a specific tax category for nonprofit organizations.

File Form 1023 with the IRS. Most nonprofit corporations apply for tax-exempt status under Sec. 501(c)(3).

Exempt Organization TypesCharitable Organizations.Churches and Religious Organizations.Private Foundations.Political Organizations.Other Nonprofits.

The first step in applying for a property tax exemption is to complete the application form (Revenue Form 62A023) and submit it along with all supporting documentation to the property valuation administrator (PVA) of the county in which the property is located.

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.