Kentucky Contract with Independent Contractor to Work as a Consultant

Description

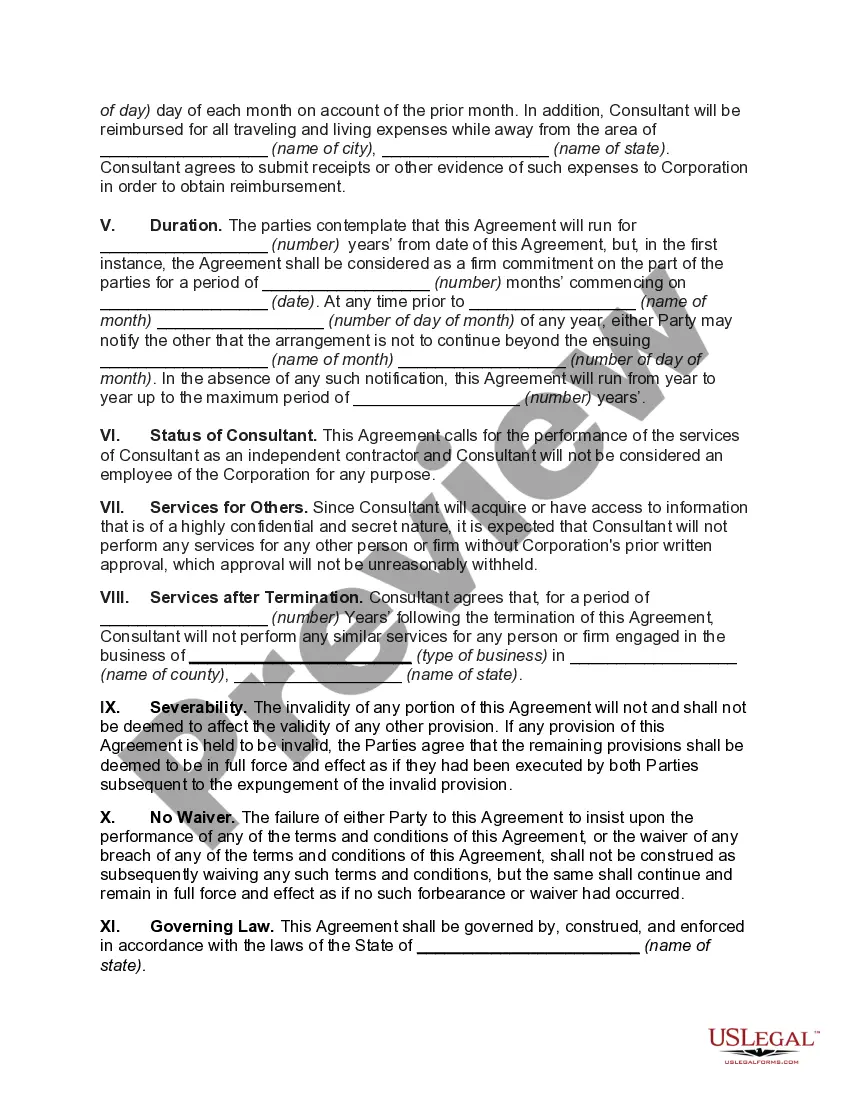

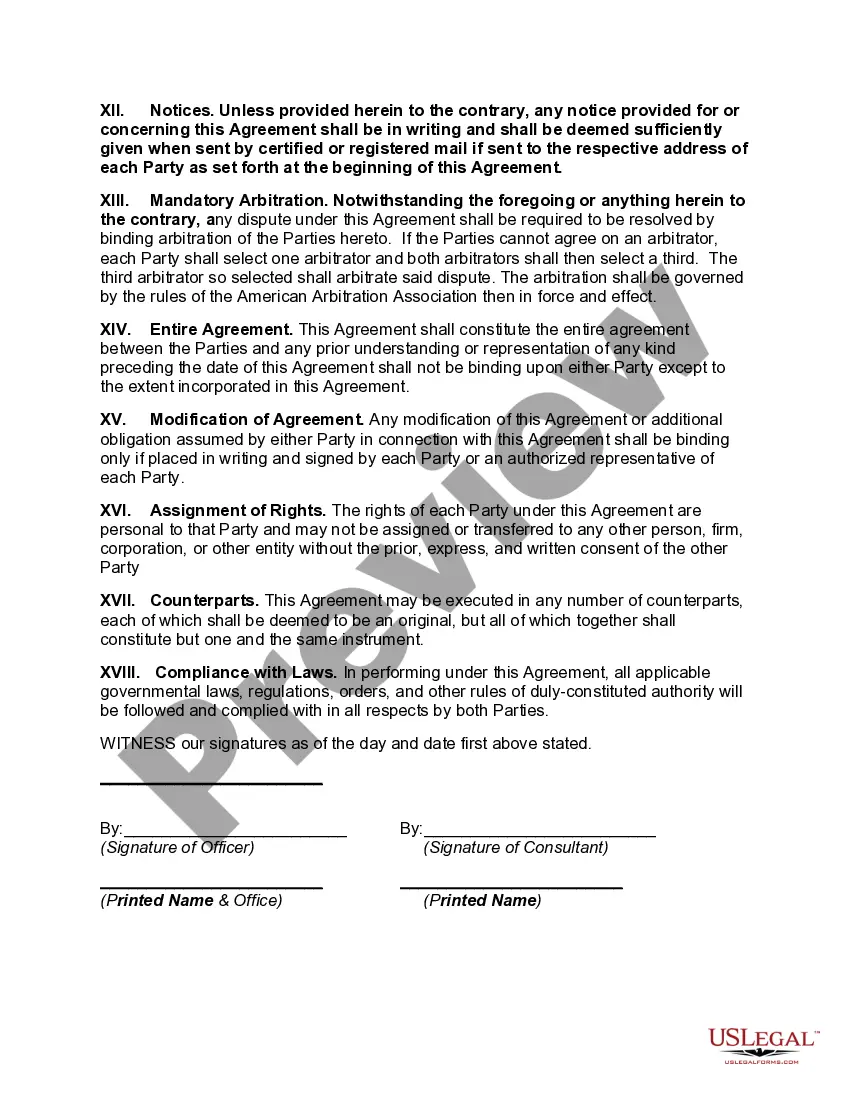

How to fill out Contract With Independent Contractor To Work As A Consultant?

US Legal Forms - one of the largest collections of legal templates in the country - offers a vast array of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, categorized by types, states, or keywords. You can find the most recent forms, such as the Kentucky Contract with Independent Contractor to Work as a Consultant, in just seconds.

If you already possess a subscription, Log In to download the Kentucky Contract with Independent Contractor to Work as a Consultant from the US Legal Forms library. The Download button will appear on every form you examine. You can access all previously downloaded forms in the My documents section of your account.

Select the format and download the form to your device.

Make modifications. Fill, edit, print, and sign the downloaded Kentucky Contract with Independent Contractor to Work as a Consultant.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

- Read the form description to ensure you have picked the appropriate form.

- If the form doesn't meet your requirements, use the Search box at the top of the screen to find a suitable one.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your desired pricing plan and provide your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

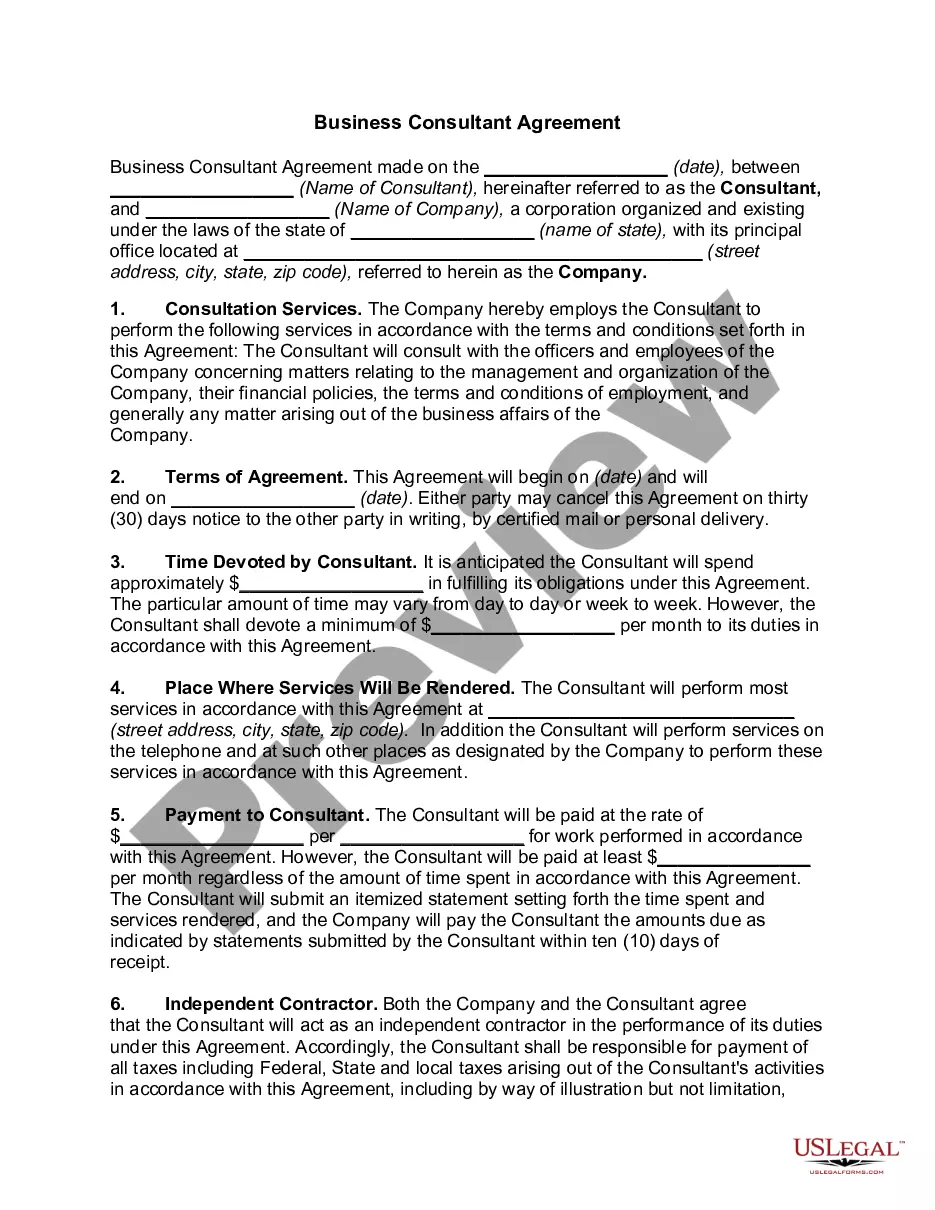

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

No, they cannot. To stress, any employee who has rendered at least one year of service, whether such service is continuous or broken, shall be considered a regular employee. Note that no declaration or appointment paper is necessary to make one a regular employee.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Pay self-employment taxAs an independent consultant you are considered self-employed, so if you earn more than $400 for the year, the IRS expects you to pay your own tax. The self-employment tax rate is 15.3% of your net earnings.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.