Kentucky Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker

Description

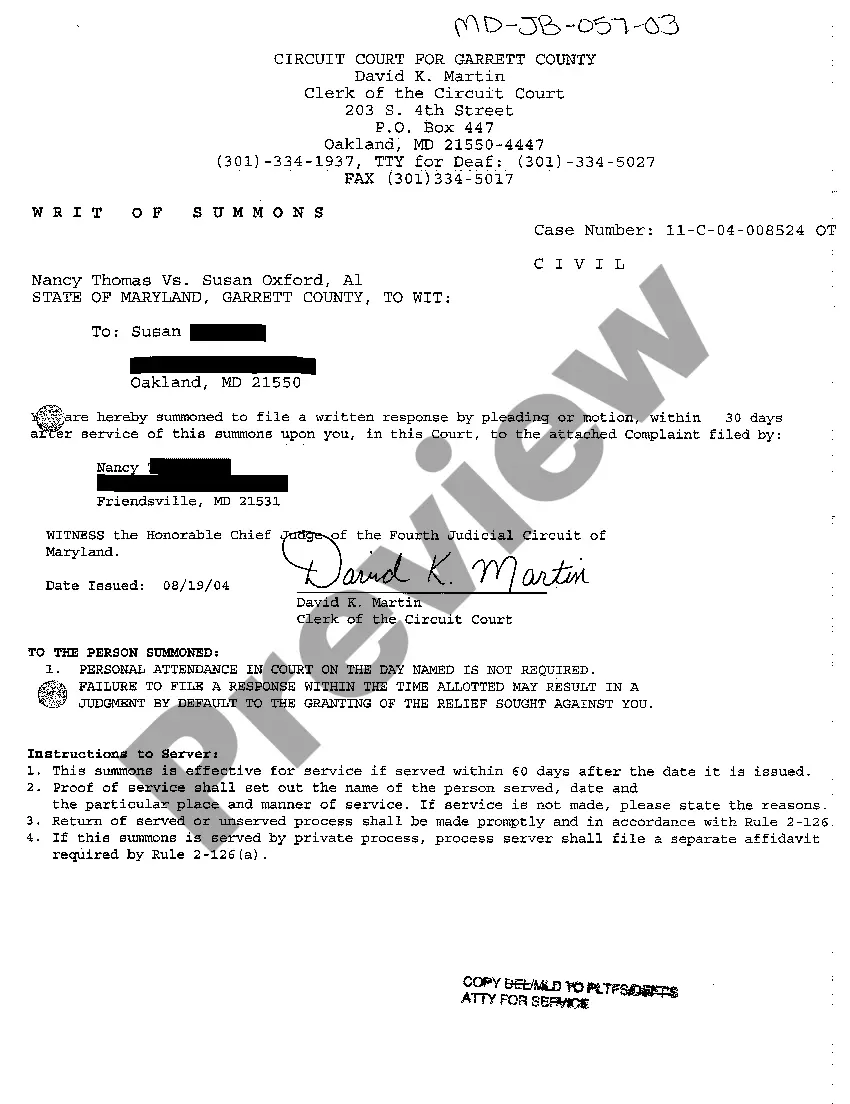

How to fill out Sample Letter For Application Of Unsecured Creditors For An Order Authorizing Employment Of Investment Banker?

Discovering the right legal file template might be a battle. Needless to say, there are plenty of layouts available on the Internet, but how would you get the legal form you require? Take advantage of the US Legal Forms site. The service delivers a huge number of layouts, such as the Kentucky Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker, which can be used for enterprise and private demands. Each of the varieties are examined by specialists and satisfy state and federal needs.

When you are presently registered, log in for your account and then click the Acquire key to get the Kentucky Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker. Utilize your account to look throughout the legal varieties you have acquired previously. Visit the My Forms tab of your respective account and obtain an additional version of your file you require.

When you are a whole new customer of US Legal Forms, listed here are basic instructions that you should comply with:

- Initially, make sure you have selected the proper form for your area/area. You can examine the form while using Preview key and browse the form outline to guarantee this is basically the best for you.

- In case the form does not satisfy your requirements, use the Seach area to get the proper form.

- Once you are certain the form would work, go through the Buy now key to get the form.

- Choose the rates program you desire and enter the necessary information and facts. Create your account and buy an order utilizing your PayPal account or charge card.

- Select the data file file format and acquire the legal file template for your product.

- Complete, revise and produce and signal the received Kentucky Sample Letter for Application of Unsecured Creditors for an Order Authorizing Employment of Investment Banker.

US Legal Forms is the greatest catalogue of legal varieties that you will find numerous file layouts. Take advantage of the company to acquire expertly-produced paperwork that comply with state needs.

Form popularity

FAQ

Unsecured creditors can include suppliers, customers, HMRC and contractors. They rank after secured and preferential creditors in an insolvency situation. Preferential creditors are generally employees of the company, entitled to arrears of wages and other employment costs up to certain limits.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged).

Creditors' Rights for Unsecured Claims As an unsecured creditor, you can file a proof of claim, attend the first meeting of creditors, and file objections to the discharge. You can review the bankruptcy papers that were filed to determine whether there are any inaccuracies.

Understanding Unsecured Debt A loan is unsecured if it is not backed by any underlying assets. Examples of unsecured debt include credit cards, medical bills, utility bills, and other instances in which credit was given without any collateral requirement.

A creditor who has no security over any of the debtor's assets for the debt due to it. Unsecured creditors in a corporate insolvency process most commonly include trade creditors, the Redundancy Payments Service and HMRC.

In the event of the bankruptcy of the debtor, the unsecured creditors usually obtain a pari passu distribution out of the assets of the insolvent company on a liquidation in ance with the size of their debt after the secured creditors have enforced their security and the preferential creditors have exhausted ...

Also known as general creditor and general unsecured creditor. A creditor holding an unsecured claim, or having no liens against a debtor's property. Unsecured creditors have no rights against specific property of the debtor. Also, they generally have no right to receive postpetition interest in a bankruptcy case.

An unsecured loan is not protected by any collateral. If you default on the loan, the lender can't automatically take your property. The most common types of unsecured loan are credit cards, student loans, and personal loans.