Kentucky Joint Trust with Income Payable to Trustors During Joint Lives

Description

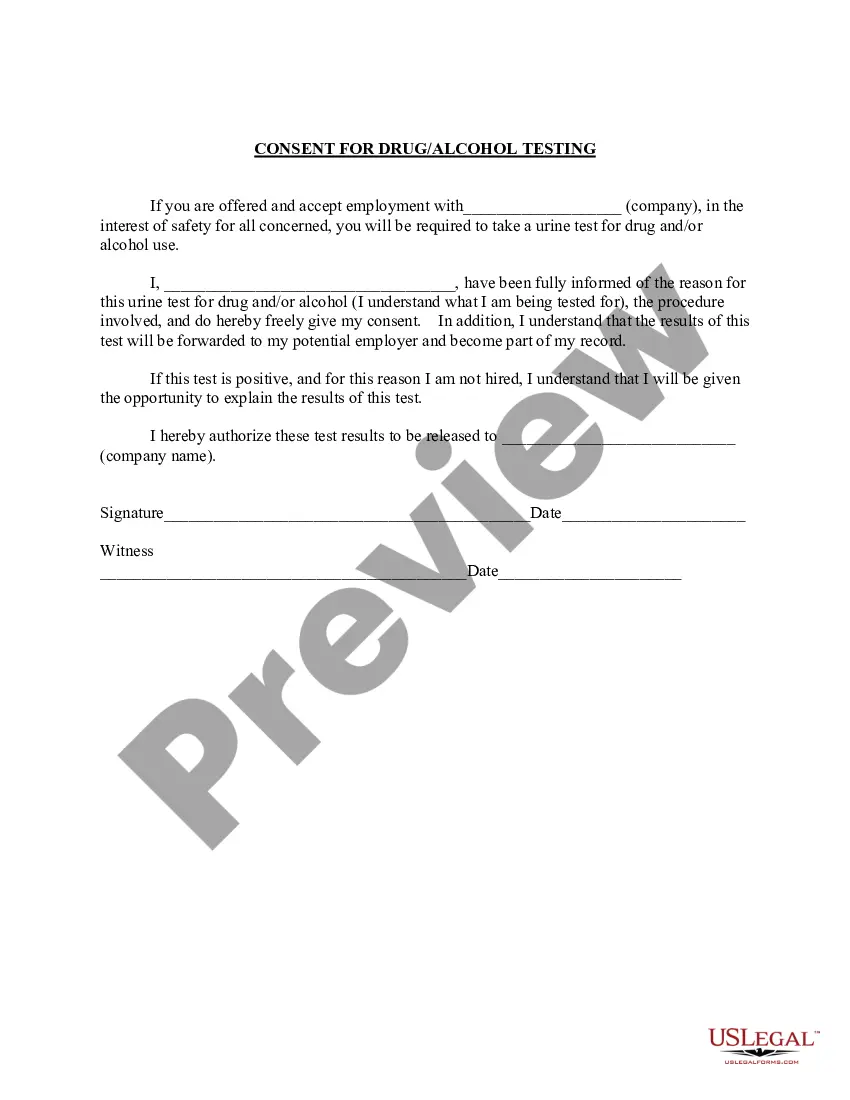

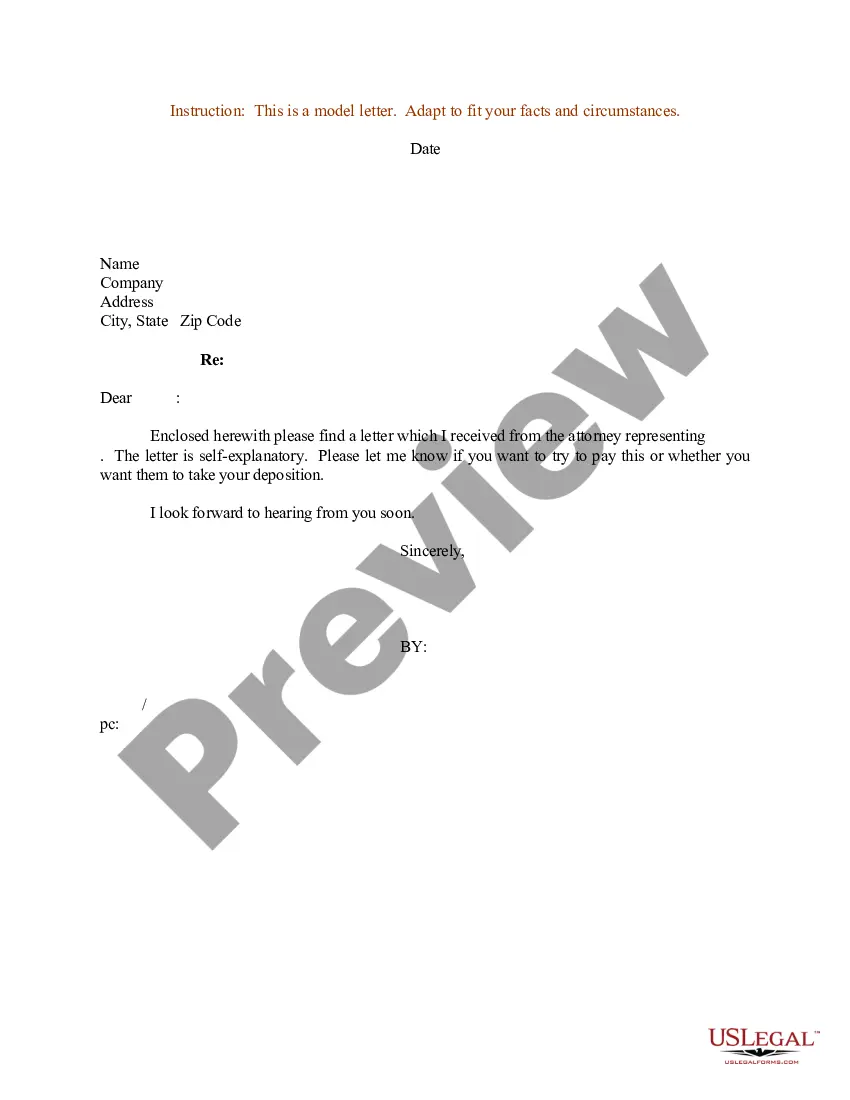

How to fill out Joint Trust With Income Payable To Trustors During Joint Lives?

If you have to complete, acquire, or printing lawful papers layouts, use US Legal Forms, the most important variety of lawful forms, which can be found on the web. Make use of the site`s simple and convenient research to get the papers you need. Different layouts for company and specific purposes are categorized by groups and suggests, or search phrases. Use US Legal Forms to get the Kentucky Joint Trust with Income Payable to Trustors During Joint Lives in a number of click throughs.

In case you are previously a US Legal Forms buyer, log in to the account and then click the Acquire switch to have the Kentucky Joint Trust with Income Payable to Trustors During Joint Lives. You can also accessibility forms you earlier saved within the My Forms tab of your respective account.

Should you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape to the correct town/land.

- Step 2. Utilize the Review solution to look over the form`s articles. Never forget to see the explanation.

- Step 3. In case you are unhappy using the type, utilize the Look for area near the top of the display to discover other variations from the lawful type template.

- Step 4. When you have found the shape you need, click on the Get now switch. Choose the prices plan you prefer and include your accreditations to sign up to have an account.

- Step 5. Method the financial transaction. You may use your credit card or PayPal account to perform the financial transaction.

- Step 6. Choose the format from the lawful type and acquire it on your system.

- Step 7. Total, change and printing or signal the Kentucky Joint Trust with Income Payable to Trustors During Joint Lives.

Every single lawful papers template you purchase is yours forever. You have acces to each type you saved with your acccount. Select the My Forms area and decide on a type to printing or acquire once more.

Remain competitive and acquire, and printing the Kentucky Joint Trust with Income Payable to Trustors During Joint Lives with US Legal Forms. There are many specialist and state-specific forms you can use to your company or specific requires.

Form popularity

FAQ

Kentucky is not a community property state; it follows the equitable distribution approach for marital property. This means that assets acquired during marriage are divided fairly, but not necessarily equally, at the time of death or divorce. Understanding how this affects your Kentucky Joint Trust with Income Payable to Trustors During Joint Lives can guide you in planning your estate effectively. Consulting with experts through platforms like uslegalforms can clarify your options.

There is no law that says both spouses need to be listed on a mortgage. If your spouse isn't a co-borrower on your mortgage application, then your lender generally won't include their details when qualifying you for a loan. Depending on your spouse's situation, this could be a good thing or a bad thing.

Yes, one spouse can purchase a home without the other's name on the new mortgage application or title. In communal property states, the home would still belong to both partners during divorcee proceedings.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

Kentucky is in the majority as an equitable distribution or common law state. This means marital property isn't automatically assumed to be owned by both spouses and therefore should be divided equally in a divorce.

By state law in Kentucky, if you buy a property in your sole name, your spouse will instantly have an ownership interest in that property just by the fact that you are legally married. Names on deeds do not solely determine ownership; Names PLUS marital status does.

If you created a revocable living trust with your spouse, you can change the whole trust or part of the trust following the his or her death. A living trust allows to you make any changes to the terms by creating amendments or by creating a new trust entirely.

In a common-law state, you can apply for a mortgage without your spouse. Your lender won't be able to consider your spouse's financial circumstances or credit while determining your eligibility. You can also put only your name on the title.

A joint revocable trust is a single trust document that two persons establish to hold title to assets which they typically own together as a married couple. While both spouses are alive and competent, they both retain full control of the trust assets and can change the trust at any time.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.