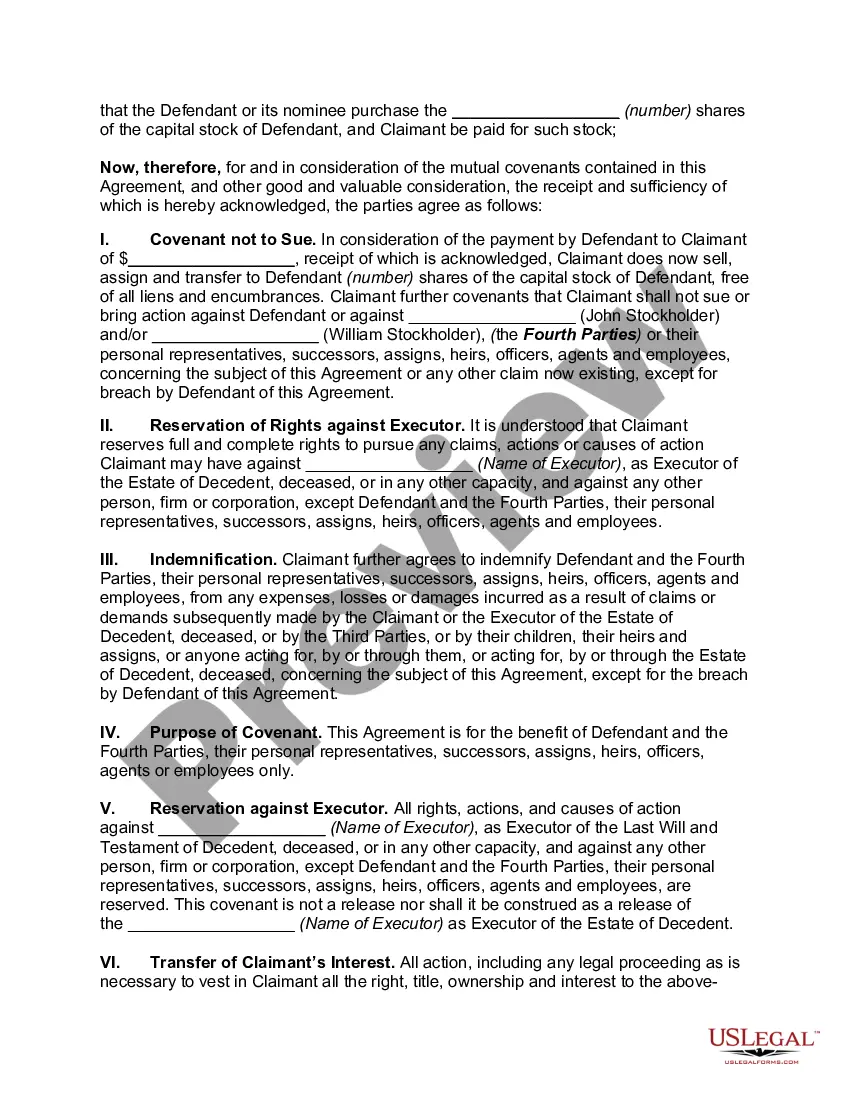

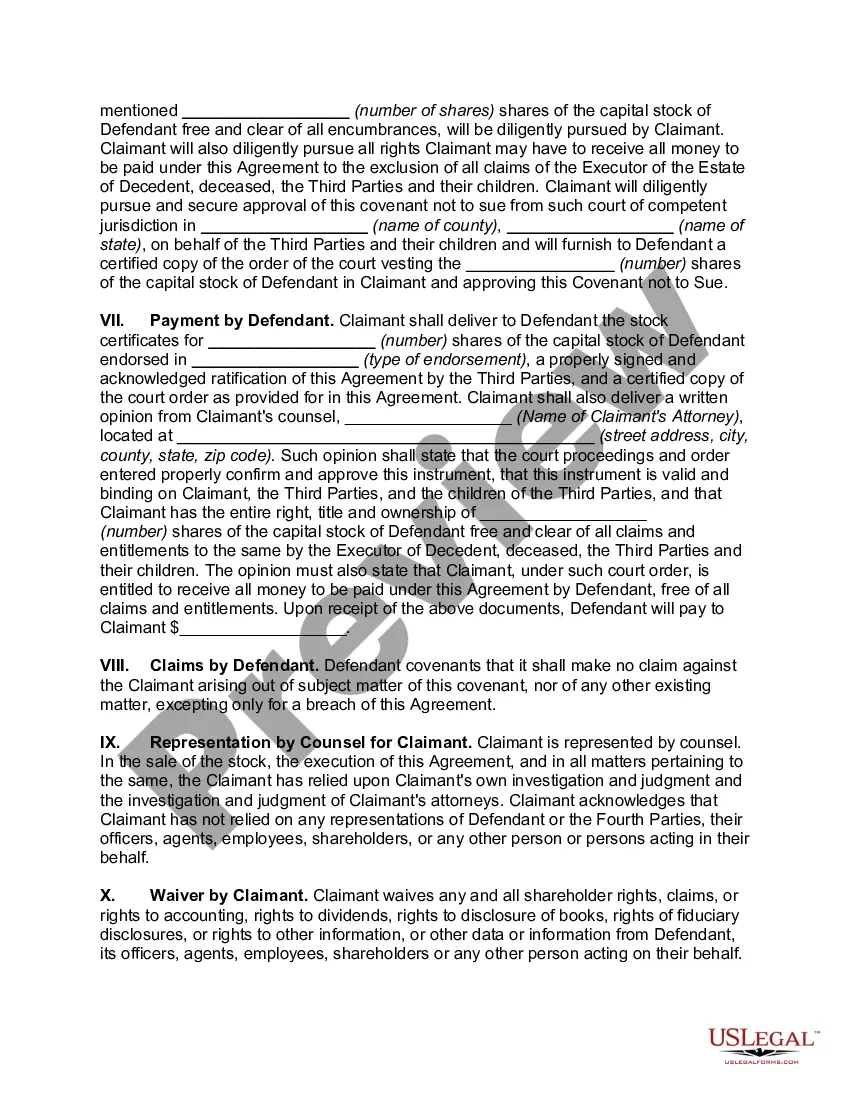

Kentucky Covenant Not to Sue by Widow of Deceased Stockholder

Description

How to fill out Covenant Not To Sue By Widow Of Deceased Stockholder?

Are you in a position where you occasionally need documents for either business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of form templates, such as the Kentucky Covenant Not to Sue by Widow of Deceased Stockholder, which are designed to comply with both state and federal regulations.

Once you find the appropriate form, click on Buy now.

Choose the pricing plan you prefer, enter the required details to create your account, and complete your purchase using your PayPal or Visa/Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you will be able to download the Kentucky Covenant Not to Sue by Widow of Deceased Stockholder template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and confirm it is for your correct city/county.

- Utilize the Review option to evaluate the document.

- Check the information to ensure you have chosen the right form.

- If the form does not meet your needs, use the Lookup field to find the document that suits your requirements.

Form popularity

FAQ

In California, a community property state, the surviving spouse is entitled to at least one-half of any property or wealth accumulated during the marriage (i.e. community property), absent a pre-nuptial or post-nuptial agreement that states otherwise.

Kentucky has a peculiar set of laws called dower and curtesy, which provide that certain property passes directly to a surviving spouse even before creditors are paid. The first $15,000 of personal property or money on hand goes to the surviving spouse.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

In Kentucky, living trusts can be used to avoid probate for essentially any asset you own. That would include real estate, bank accounts, vehicles, and so on. You need to create a trust document that names someone to serve as successor trustee, the one to take over as trustee after your death.

In Kentucky, the spouse of a deceased person will get everything if there are no children or other descendants, but if there are descendants, spouses generally receive half of the estate.

The surviving spouse will get one-third of the separate property if the couple have two or more children, with the children getting the other two-thirds.

The surviving spouse generally stands to inherit first, followed by the decedent's children, their parents, their siblings and so forth. Under certain circumstances, stepchildren may have priority to inherit over other heirs.

The Spouse's Share in Kentucky In Kentucky, if you die without a will, your spouse will inherit property from you under a law called "dower and curtesy." Usually, this means that your spouse inherits 1/2 of your intestate property. The rest of your property passes to your descendants, parents, or siblings.

Anything that is jointly owned by you and your spouse will pass to the surviving partner automatically, but you can allocate any solely owned property to whomever you choose.