Kentucky Rules and Regulations for Shopping Center

Description

How to fill out Rules And Regulations For Shopping Center?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a broad selection of legal document templates that you can acquire or print.

While using the website, you can discover thousands of templates for business and personal use, classified by categories, states, or keywords. You can access the most current versions of documents such as the Kentucky Guidelines and Regulations for Shopping Center in moments.

If you already have a subscription, Log In and download the Kentucky Guidelines and Regulations for Shopping Center from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the payment.

Select the format and download the document to your device. Edit it. Fill out, modify, print, and sign the downloaded Kentucky Guidelines and Regulations for Shopping Center. Each document you added to your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, simply navigate to the My documents section and click on the document you need.

Obtain the Kentucky Guidelines and Regulations for Shopping Center with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the correct document for your city/region.

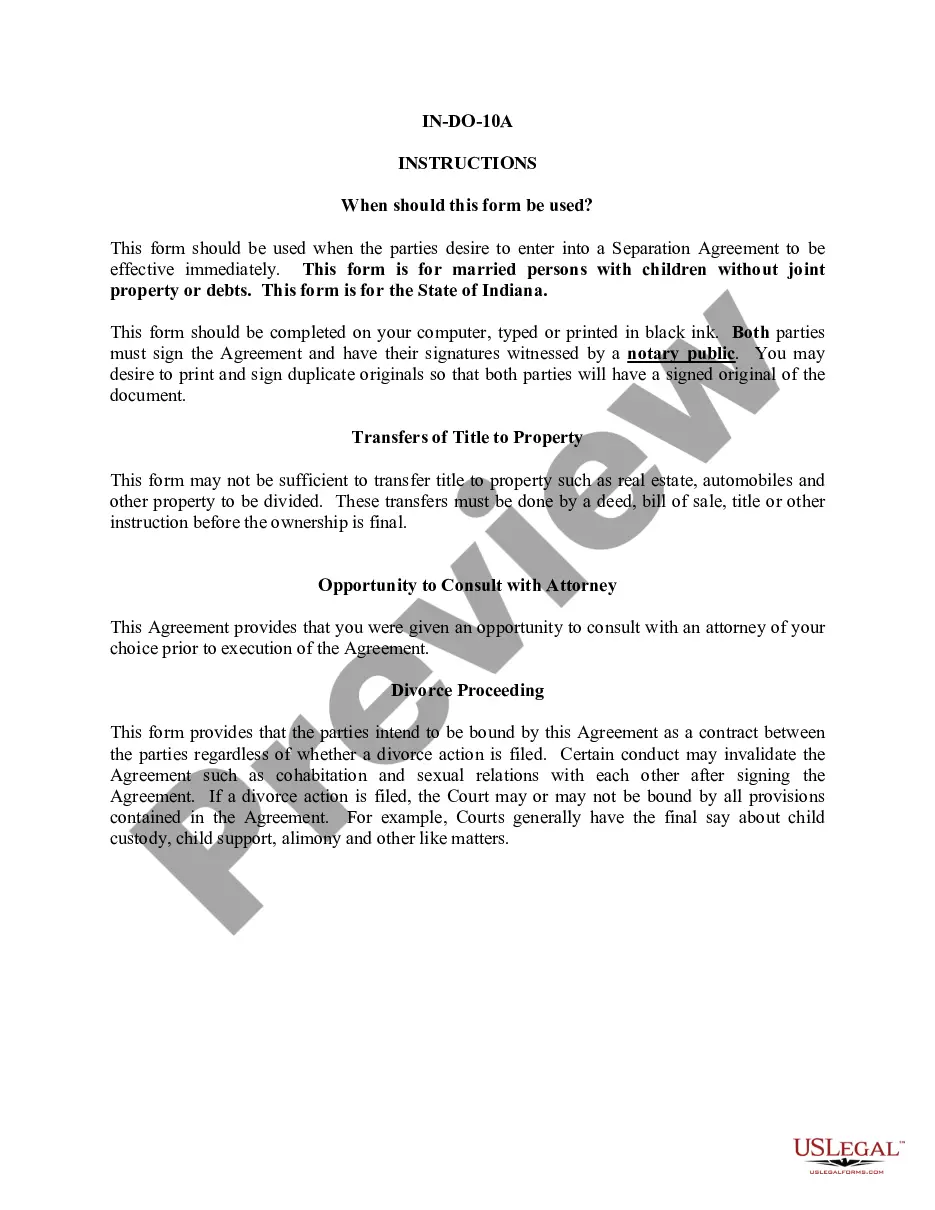

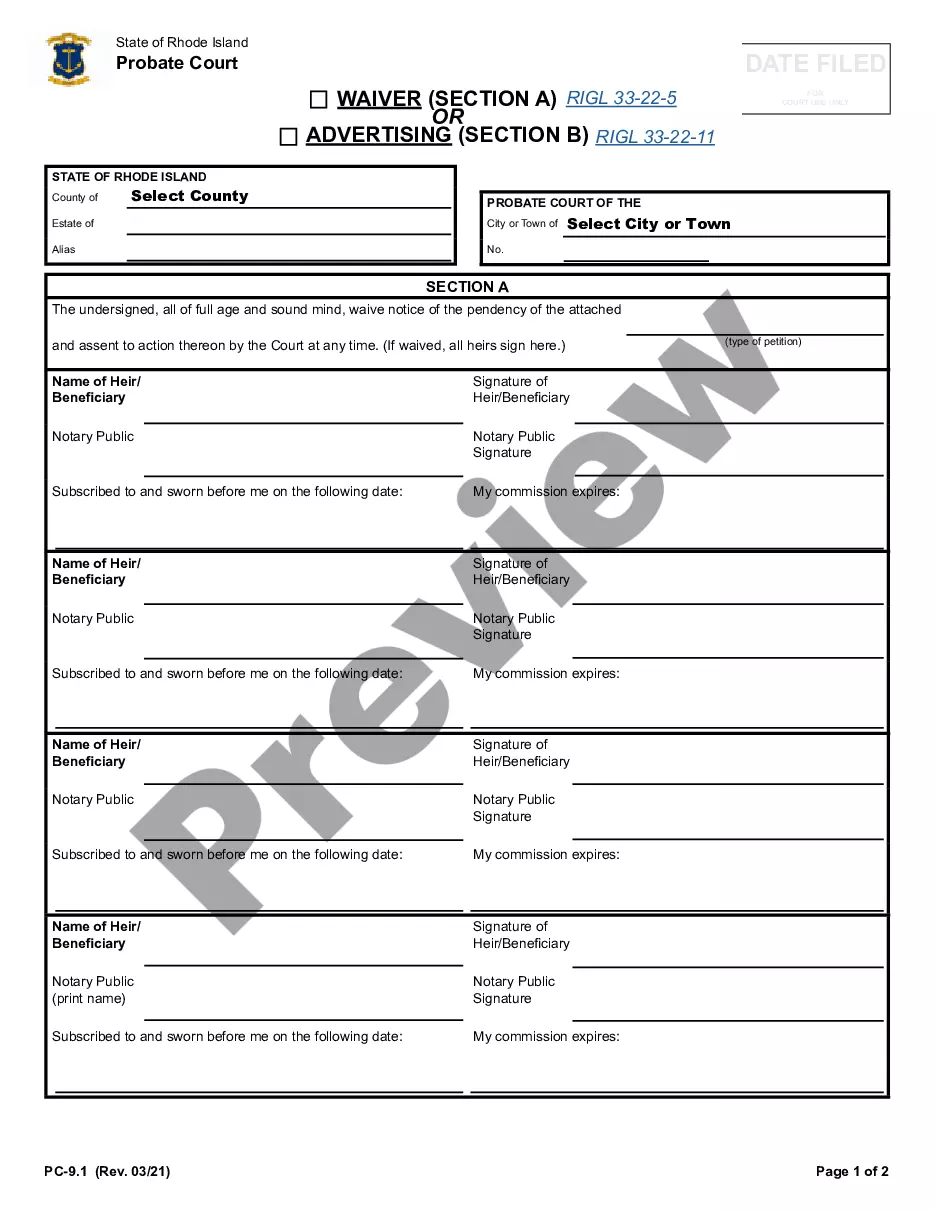

- Click the Preview button to review the document's content.

- Check the document details to confirm you've chosen the right one.

- If the document doesn't meet your needs, utilize the Search box at the top of the screen to find a suitable one.

- If you are satisfied with the document, affirm your choice by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Yes, as a non-resident, you must file taxes if you have income sourced from Kentucky, including businesses operating in the state. It is important to stay informed about the Kentucky Rules and Regulations for Shopping Center to ensure compliance and avoid potential penalties.

Kentucky is often seen as a business-friendly state due to its supportive environment for small and medium-sized enterprises. The state offers various incentives, grants, and resources to encourage business growth. Understanding the Kentucky Rules and Regulations for Shopping Center can further enhance your strategy, ensuring compliance while maximizing your potential.