Kentucky Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association

Description

How to fill out Notice Of Meeting To Pass On Resolution To Incorporate Non-Profit Association?

Are you currently facing a circumstance where you require documents for potential business or personal activities almost every day.

There are numerous legal document templates available online, but finding reliable ones is challenging.

US Legal Forms provides a vast array of form templates, including the Kentucky Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association, designed to meet both state and federal regulations.

Upon locating the appropriate form, simply click Purchase now.

Select a convenient pricing plan, input the required information to create your account, and complete the payment through PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Kentucky Notice of Meeting to Pass on Resolution to Incorporate Non-Profit Association template.

- If you do not have an account and want to utilize US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is tailored to the correct city/state.

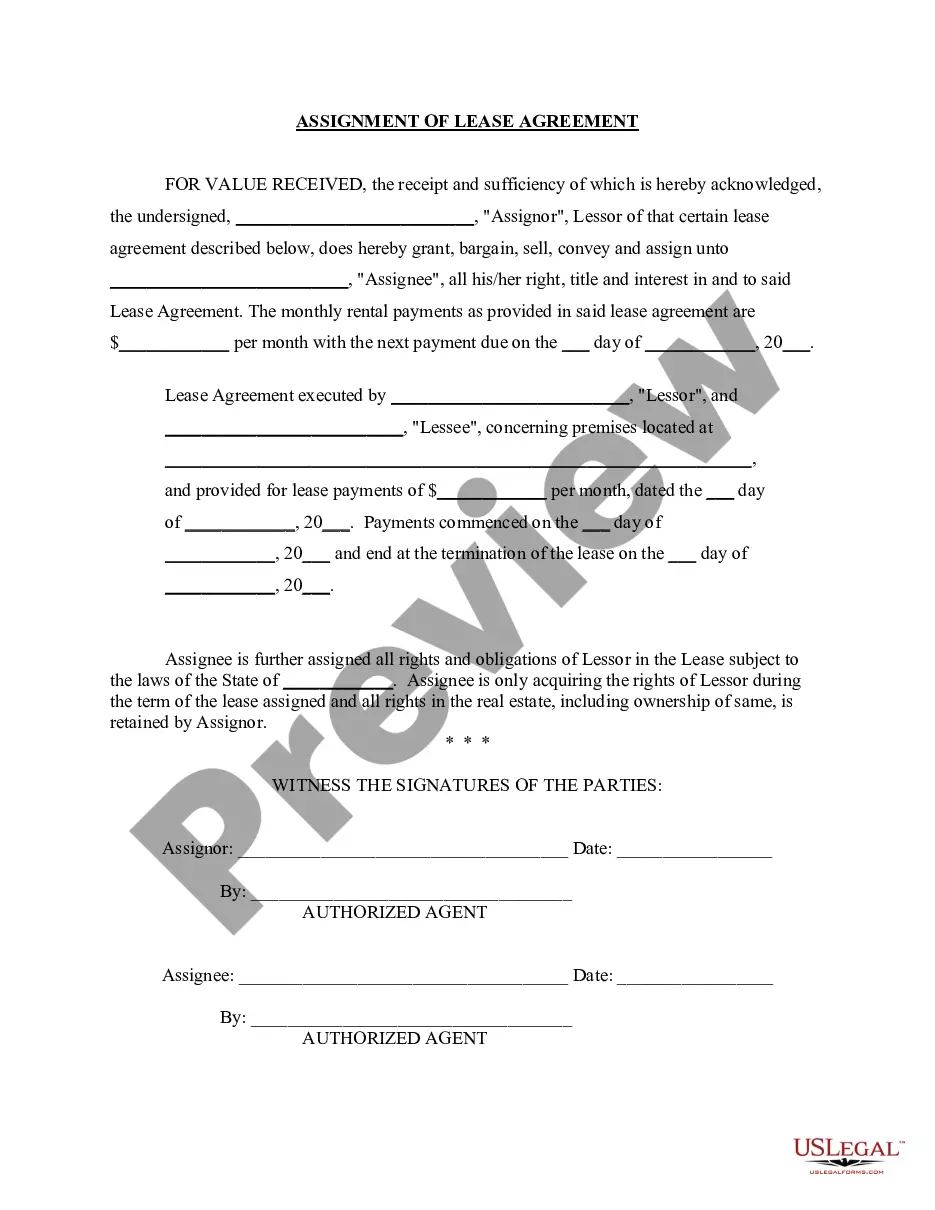

- Use the Preview feature to review the form.

- Examine the details to confirm you have selected the right form.

- If the form does not meet your expectations, utilize the Search box to find the form that suits your needs.

Form popularity

FAQ

Nonprofit corporations often deal with government agencies on issues of public concern, which may involve applying for grants, loans or other governmental approvals. In many situations, the government agency requires a corporate resolution to verify the board's approval for making the government application.

Meeting minutes are typically taken by the organization's secretary. If the Secretary is not present, another officer or director should be chosen to record the minutes. Meeting minutes also need to be signed by the individual who took the minutes at the conclusion of the board meeting.

The first step in the voluntary dissolution process is the approval by the majority of the board of directors or members, or both, to elect to wind up and dissolve the nonprofit corporation. (Corporations Code, sections 5033, 5034, 6610, 6610.5, 8610, 8610.5, 9680.)

How to Start a Nonprofit in KentuckyName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

Labeling a vote a resolution means that the board believed the issue was important enough to separate it from standard voting issues. A resolution is considered an official board action and it requires a quorum. Board directors must document all official board actions, including resolutions, in their meeting minutes.

In general, the SEC guidelines permit resolutions only from shareholders who have continuously held at least $2,000 of the company's stock for a year or longer. If a shareholder meets these requirements, then the board can choose to bring up the resolution for a vote at the next shareholder meeting.

Nonprofit organizations can even operate with a deficit from one year to the next, although this is not an ideal way to go about financing a nonprofit venture. Instead, a steady balance of income and spending is needed to keep the nonprofit operating in the black most of the time.

Nonprofit Financial ReportingNot only can a charity sell its assets, but it also must put into place adequate procedures to record the sales and publish accurate financial reports. This publication must conform to generally accepted government accounting standards.

If the nonprofit's board fails to perform its fiduciary duties and places the nonprofit in a position where it cannot pay its taxes, the Internal Revenue Service has the authority to hold nonprofit board -- along with the employee responsible for the nonprofit not having the funds -- responsible for paying back taxes.

Legal Actions. If the closure is voluntary, it can be done through a vote by the board of directors, or, by the board and a vote by the membership if it is a membership-based nonprofit. The nonprofit corporation files articles of dissolution with the secretary of state, where it is incorporated.