Kentucky Sample Letter for Authorized Signatories for Partnerships or Corporations

Description

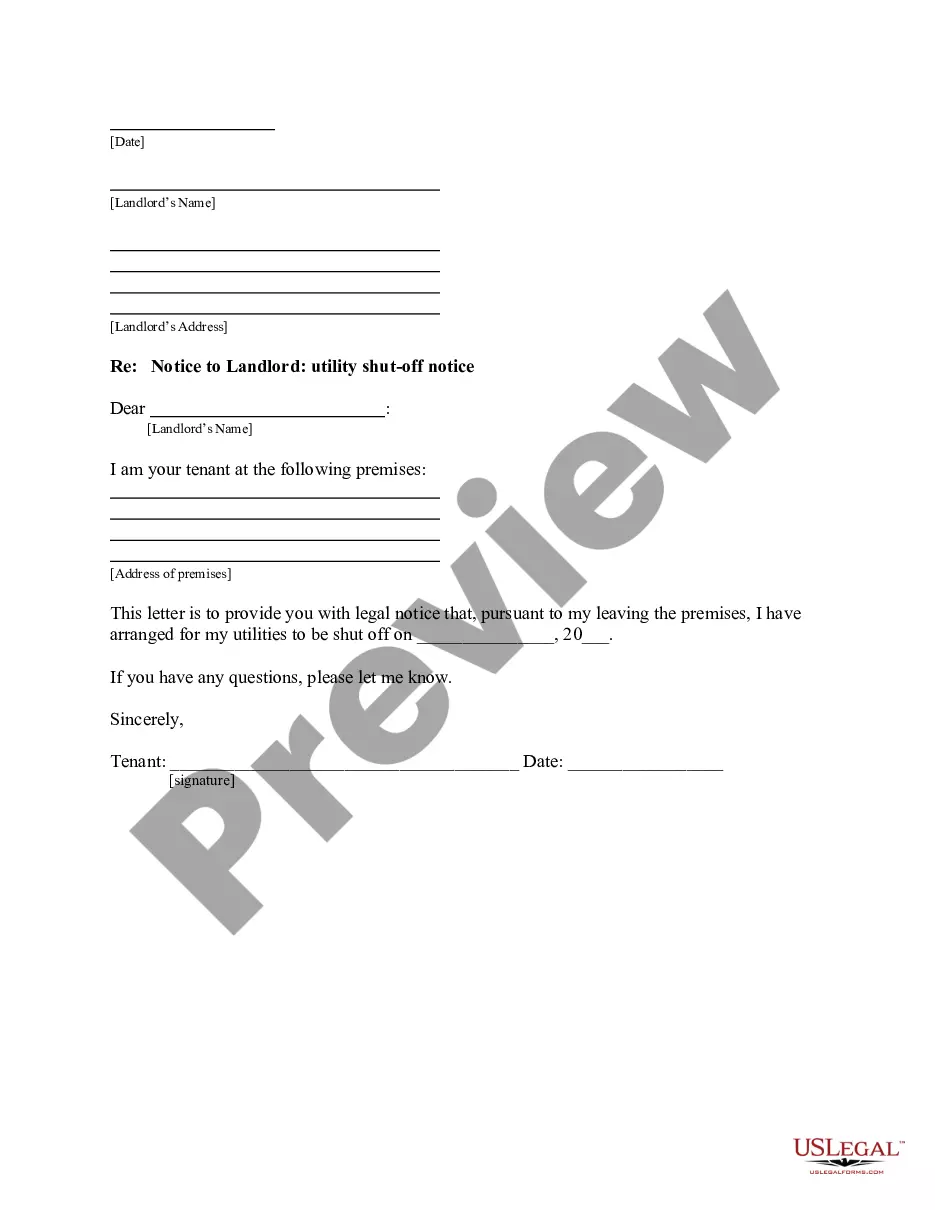

How to fill out Sample Letter For Authorized Signatories For Partnerships Or Corporations?

US Legal Forms - one of the greatest libraries of authorized kinds in the United States - delivers an array of authorized document templates you can acquire or print. While using internet site, you may get thousands of kinds for company and individual uses, sorted by groups, claims, or keywords and phrases.You will discover the most recent types of kinds just like the Kentucky Sample Letter for Authorized Signatories for Partnerships or Corporations within minutes.

If you already possess a membership, log in and acquire Kentucky Sample Letter for Authorized Signatories for Partnerships or Corporations from the US Legal Forms local library. The Download switch will show up on every develop you look at. You have access to all previously delivered electronically kinds from the My Forms tab of your own accounts.

If you want to use US Legal Forms for the first time, listed below are easy instructions to help you started off:

- Be sure you have picked the proper develop for your personal city/state. Select the Review switch to examine the form`s content material. Look at the develop outline to ensure that you have chosen the correct develop.

- In case the develop does not satisfy your requirements, use the Research area on top of the screen to find the one who does.

- In case you are content with the form, confirm your selection by simply clicking the Get now switch. Then, pick the rates plan you like and give your credentials to register for the accounts.

- Procedure the transaction. Use your Visa or Mastercard or PayPal accounts to complete the transaction.

- Find the structure and acquire the form on the device.

- Make modifications. Load, revise and print and indicator the delivered electronically Kentucky Sample Letter for Authorized Signatories for Partnerships or Corporations.

Each format you included with your account lacks an expiry time and is also the one you have forever. So, if you wish to acquire or print another duplicate, just check out the My Forms section and click around the develop you need.

Get access to the Kentucky Sample Letter for Authorized Signatories for Partnerships or Corporations with US Legal Forms, by far the most comprehensive local library of authorized document templates. Use thousands of specialist and condition-specific templates that meet up with your business or individual needs and requirements.

Form popularity

FAQ

The partnership must attach the Kentucky Form 4562 to Form 765, and the amount from Kentucky Form 4562, Line 22 less the IRC §179 deduction on Line 12 must be included on Form 765, Part I, Line 8. The IRC §179 deduction from the Kentucky Form 4562, Line 12 must be included on Form 765, Schedule K, Section A, Line 9.

These instructions have been designed for pass-through entities: S-corporations, partnerships, and general partnerships , which are required by law to file a Kentucky income tax and LLET return. Form PTE is complementary to the federal forms 1120S and 1065. .revenue.ky.gov.

The partnership may state the authority, or limitations on the authority, of some or all of the partners to enter into other transactions on behalf of the partnership and any other matter. The statement must be executed by two partners.

Kentucky does not require LLCs to include member information with their Articles of Organization, so chances are you won't have to contact the Kentucky Division of Business Filings to change your filing with the state. Instead, you'll include your new LLC member information when you file your Kentucky Annual Report.

Steps to Create a Kentucky General Partnership Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN) Get Kentucky state tax identification numbers.

CONSENT OF REGISTERED AGENT The registered agent must give written consent to act as agent on behalf of the business entity. If the registered agent is a corporation an officer or the chairman of the board of directors must sign on behalf of the corporation.

Who needs to register their business? In most cases, all businesses in Kentucky are required by law to register with the Office of the Secretary of the State, the Department of Revenue, the Office of Employment Training, the Internal Revenue Service and with local municipalities to obtain business licenses and permits.

Entities that are "inactive" are either in "good standing" or "bad standing." If an entity has "inactive status and bad standing," either the entity did not file an annual report for the year, or the registered agent has resigned and a new agent has not been appointed.