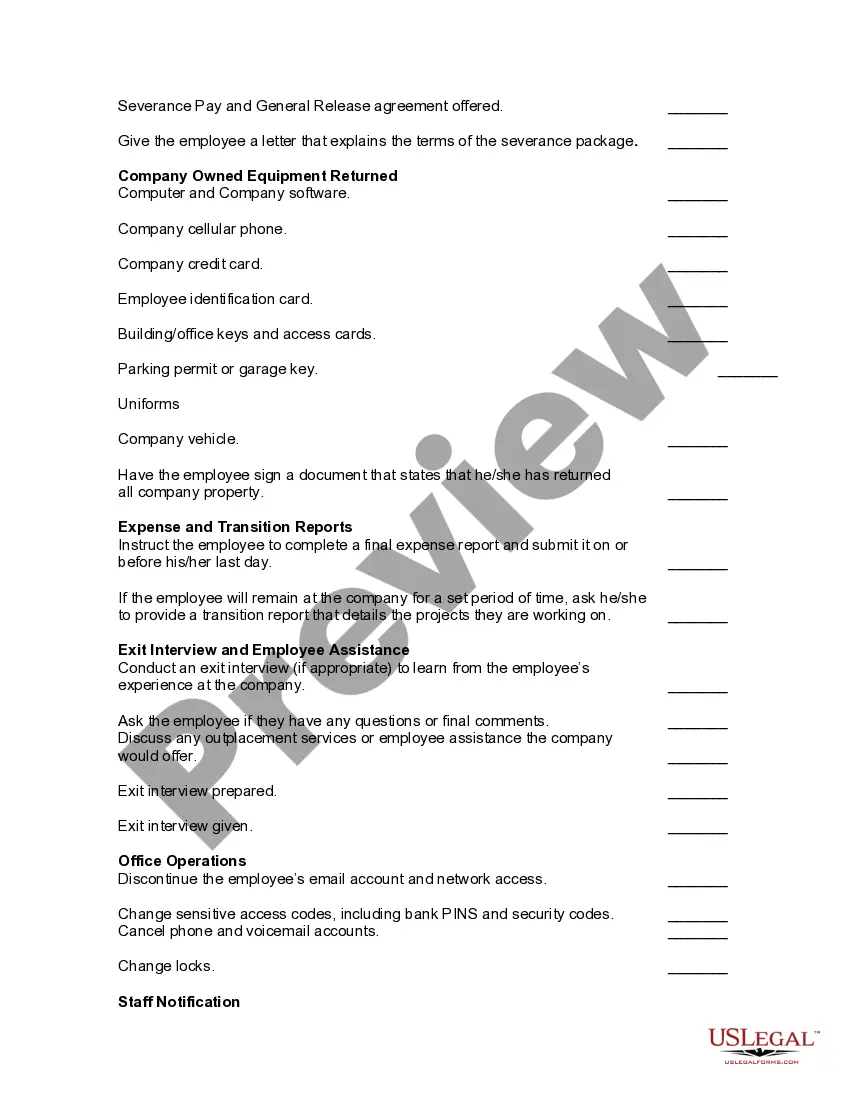

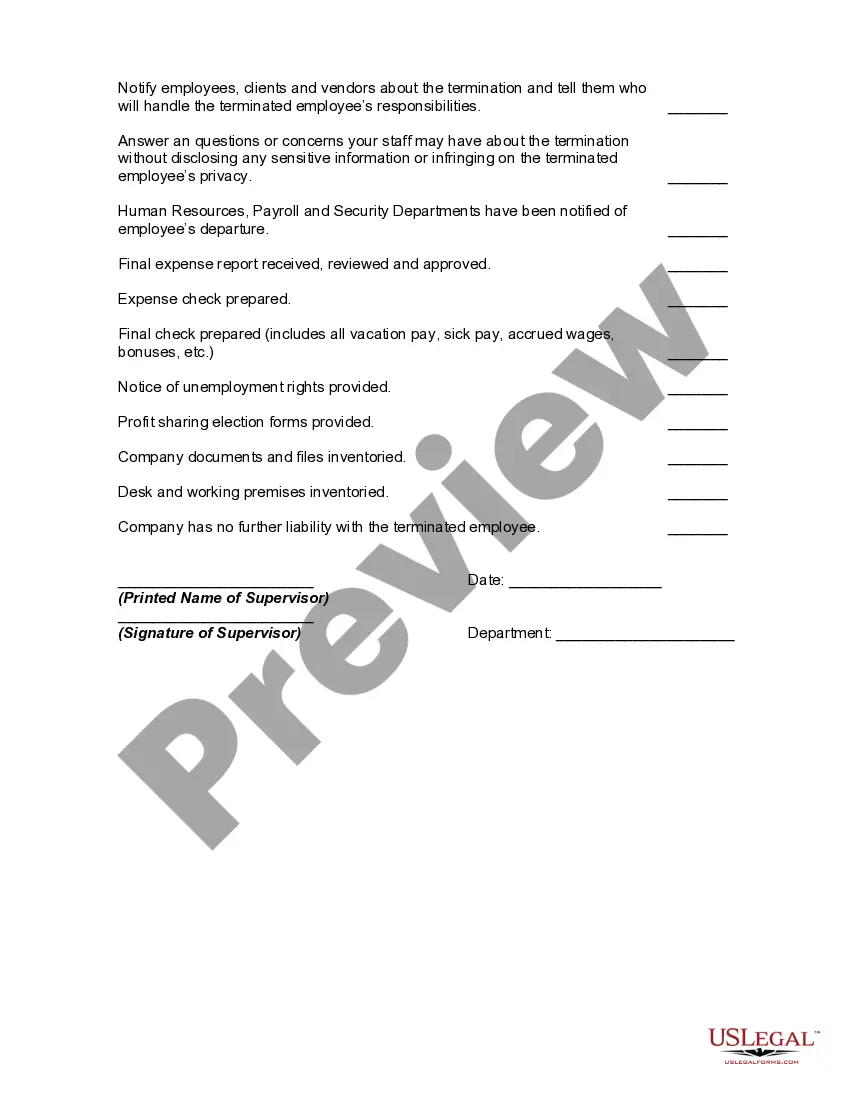

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

Kentucky Worksheet - Termination of Employment

Description

How to fill out Worksheet - Termination Of Employment?

Are you currently in a position where you need paperwork for potential business or personal reasons almost every day.

There are many legal document templates accessible online, but locating ones you can rely on is not straightforward.

US Legal Forms offers numerous template options, such as the Kentucky Worksheet - Termination of Employment, which are created to meet federal and state regulations.

Once you find the appropriate form, click Purchase now.

Select the pricing plan you prefer, complete the required information to create your account, and process the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Kentucky Worksheet - Termination of Employment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Search for the form you need and ensure it is for your specific city/state.

- Utilize the Review option to examine the document.

- Check the description to confirm you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Revenue Form K-4. 42A804 (11-13) KENTUCKY DEPARTMENT OF REVENUE. EMPLOYEE'S WITHHOLDING EXEMPTION CERTIFICATE.

Taxes on Severance PayKentucky taxes money a worker receives as severance pay. Although severance pay does not count as wages when an individual is reporting income for Kentucky unemployment insurance, it counts as net income under Kentucky's statutes relating to revenue and taxation.

A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee's paycheck. The Internal Revenue Service (IRS) Form W-4 is used to calculate and claim withholding allowances.

The withholding rate is at the maximum rate provided in KRS 141.020 or KRS 141.040. A partner, member, or shareholder may be exempt from withholding if an appropriate tax return was filed for the prior year.

200b200b200b200b200bKentucky Revised Statute Chapter 141 requires employers to withhold income tax for both residents and nonresidents employees (unless exempted by law). Employers must withhold the income tax of the employees receiving "wages" as defined in Section 3401(a) of the Internal Revenue Code.

An employee who claims exemption from taxes for a particular tax is claiming they should not have withholding because they will not have to pay that tax at all. Their employer should not report their wages.

You may be exempt from withholding for 2021 if both the following apply: 20, you had a right to a refund of all Kentucky income tax withheld because you had no Kentucky income tax. liability, and. 20, you expect a refund of all your Kentucky income tax withheld.

Employers withholding less than $400 Kentucky income tax a year will be required to file a return and remit the tax annually. The employer will be notified by DOR when the account is placed on an annual filing basis. The annual return (Form K-3) is filed with DOR by January 31, following the close of the calendar year.