Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms

Description

How to fill out Sample Letter For Letter Requesting Extension To File Business Tax Forms?

If you desire to be thorough, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms, that are accessible online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you require. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to acquire the Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms in just a few clicks.

Each legal document template you purchase is yours forever. You will have access to every form you acquired within your account. Click on the My documents section and choose a form to print or download again.

Complete and obtain, and print the Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/county.

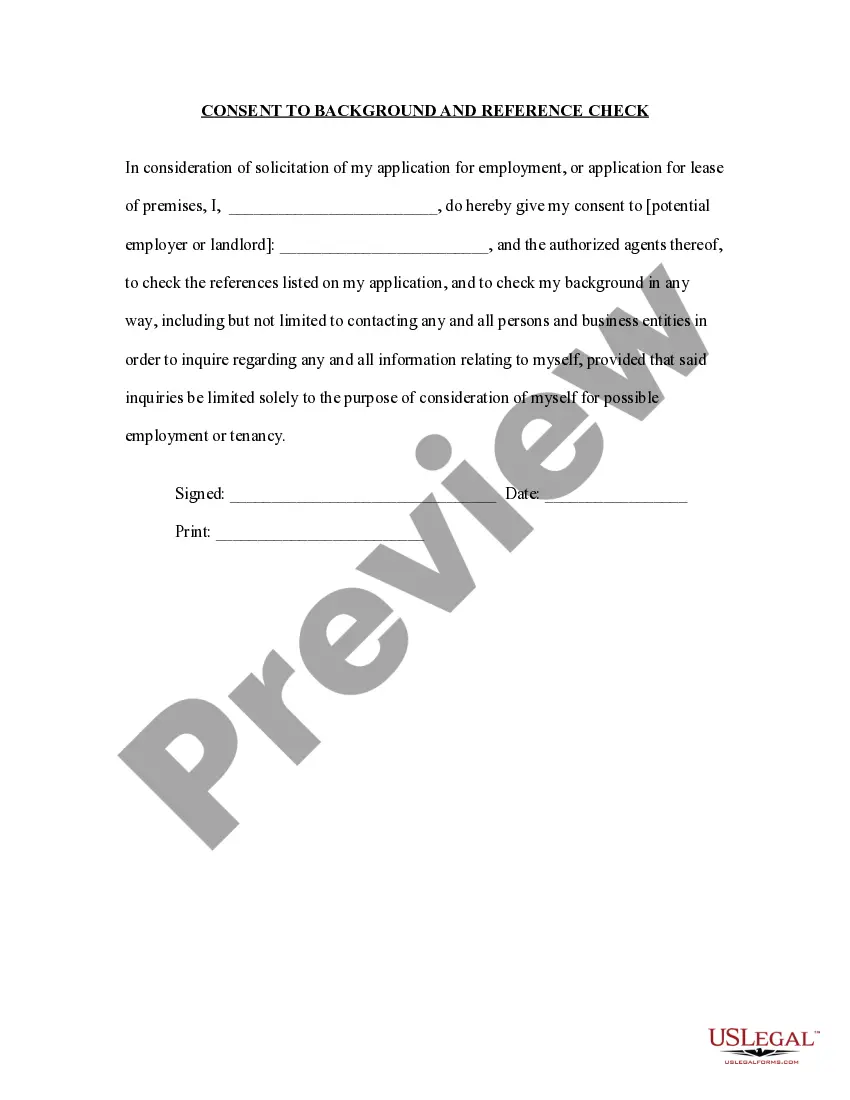

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find other versions of the legal form design.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms.

Form popularity

FAQ

Kentucky does not grant an automatic extension for state taxes. Taxpayers must actively request an extension by submitting a Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms before the deadline. Using USLegalForms can help you create this letter easily, ensuring you fulfill all necessary requirements to avoid penalties.

To file for a tax extension online, visit the Kentucky Department of Revenue's website where you can find the necessary forms. Some online services also offer easy-to-use tools that include a Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms as part of their filing process. Filing online provides a quick way to submit your request and ensures your tax extension is processed efficiently.

Filing an extension for Kentucky state taxes involves completing the appropriate forms and potentially submitting a Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms. You can download the necessary forms from the Kentucky Department of Revenue website or use platforms like USLegalForms that simplify the process. Remember to check the specific deadlines to avoid any late penalties.

To obtain a tax extension letter, you can use a reliable template or generator that provides a Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms. Make sure the letter includes your business details, the reason for requesting an extension, and any relevant deadlines. USLegalForms offers templates that can simplify this process and ensure you meet all requirements.

Yes, Kentucky does recognize federal tax extensions. If you file for a federal extension, it typically applies to your state taxes as well. However, you still need to submit a Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms to ensure compliance with state laws. This letter helps clarify your situation and avoids any potential penalties.

Yes, you can ask for an extension on your business taxes, and it is a common practice among many businesses. In Kentucky, you need to submit a formal request with the appropriate forms to get this extension. A Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms can be a useful tool to help you write your request professionally.

Requesting a business tax extension involves completing the necessary forms specific to your state and submitting them before the deadline. In Kentucky, you can utilize online resources or standard mail to send your request. Using a Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms can assist in ensuring your request is clear and well-articulated.

To file a business tax extension for an LLC in Kentucky, you will need to complete the relevant extension form, which is generally the same as that for corporations. Submit this form along with any preliminary payment to the state before your return's due date. For a smoother process, you might use a Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms as a guide for your submission.

Filing an extension for Kentucky state taxes involves filling out the appropriate extension form and submitting it to the Kentucky Department of Revenue. This can often be done online or by mail, depending on your preference. Make sure to check the requirements for your specific business type and consider using a Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms to ensure clarity in your request.

In Kentucky, the corporate tax extension form is typically Form 625, which allows businesses to request an extension to file their tax returns. This form must be filled out and submitted to the state before the original due date of the tax return. Additionally, using a Kentucky Sample Letter for Letter Requesting Extension to File Business Tax Forms can help you communicate your needs effectively.