Kentucky General Form of Storage Order and Agreement

Description

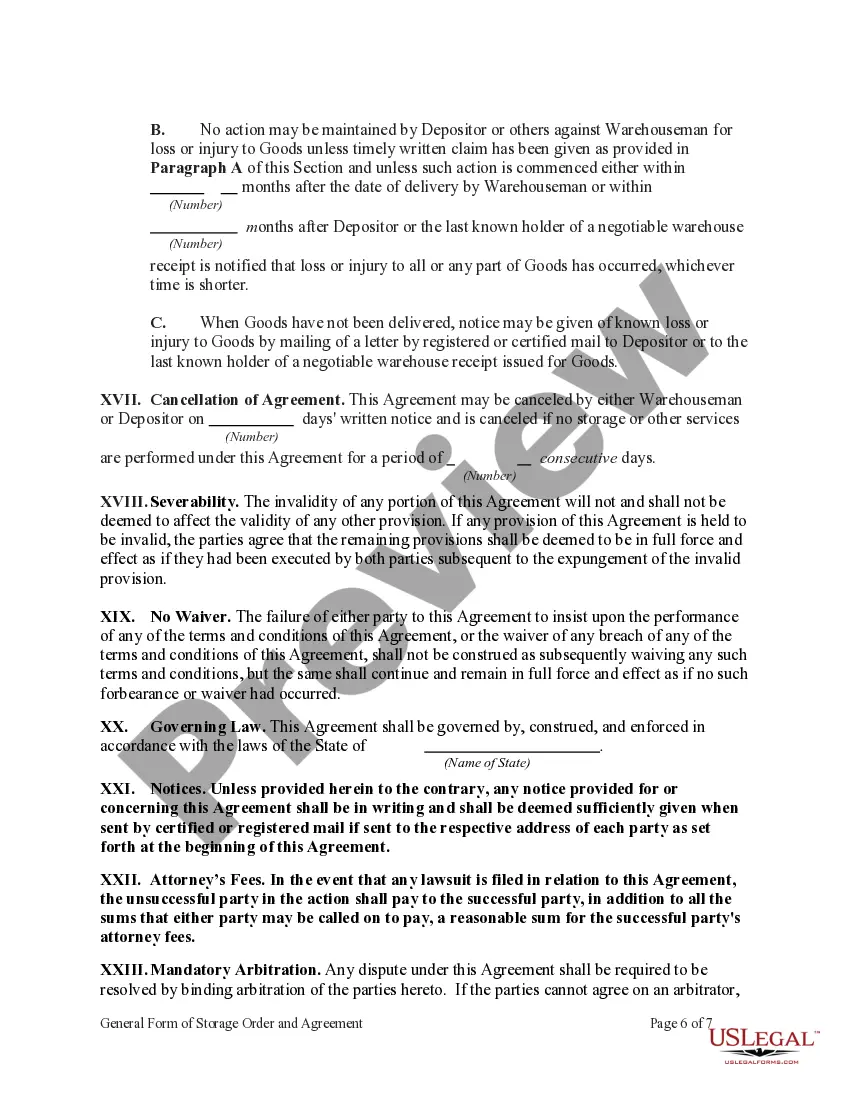

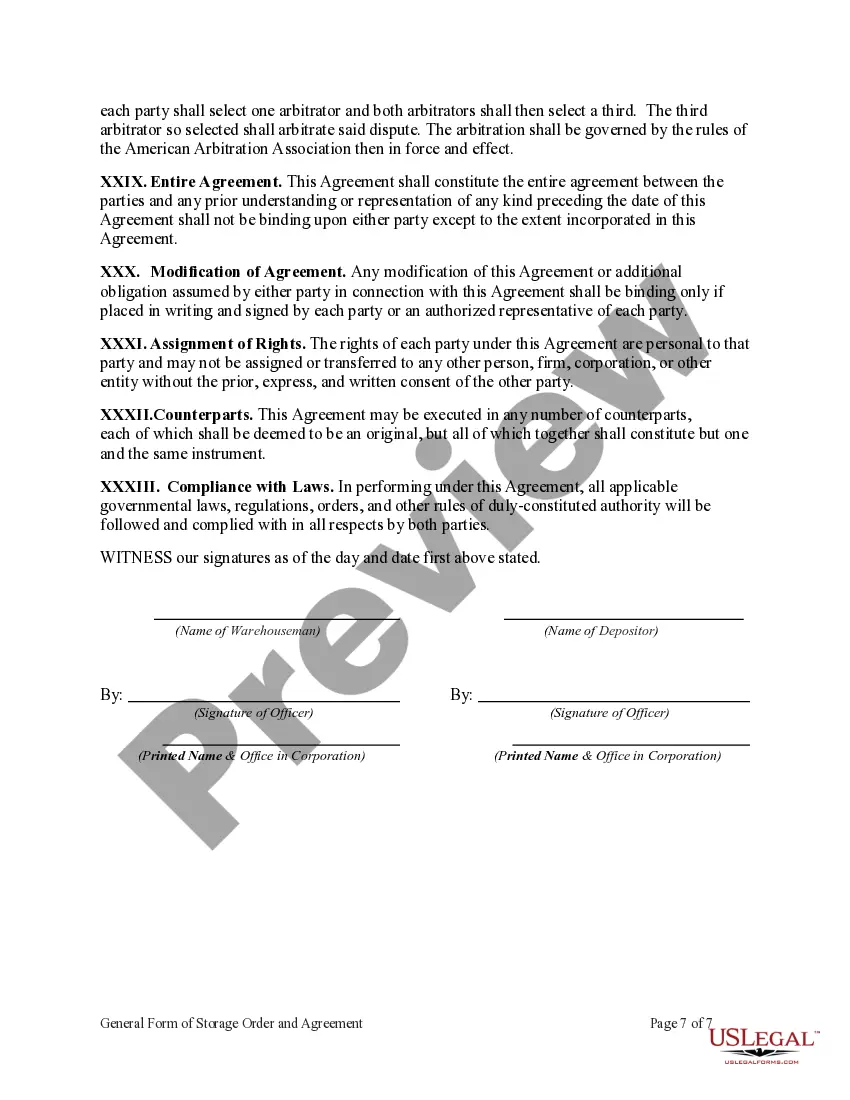

How to fill out General Form Of Storage Order And Agreement?

Are you currently in a position where you require documents for either business or personal needs on almost a daily basis.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Kentucky General Form of Storage Order and Agreement, designed to comply with state and federal regulations.

Once you find the right form, click Purchase now.

Select the pricing plan you want, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kentucky General Form of Storage Order and Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Review option to evaluate the form.

- Check the description to confirm that you have chosen the right form.

- If the form is not what you’re looking for, use the Lookup field to find the form that meets your needs.

Form popularity

FAQ

Filing for an LLC in Kentucky requires submitting the Articles of Organization with the Kentucky Secretary of State's office. It is a straightforward process where you need to provide key information such as your LLC’s name and address. Additionally, you may want to consider the implications of the Kentucky General Form of Storage Order and Agreement for your business operations.

Getting a seller permit in Kentucky involves registering your business with the state. You will need to complete an application that may include details about your business structure and expected sales. Once approved, your seller permit will facilitate compliance with sales tax laws and other regulations tied to the Kentucky General Form of Storage Order and Agreement.

The Kentucky General Form of Storage Order and Agreement, known as KY form 725, must be filed by any individual or business seeking to claim a storage exemption. If you operate a business that requires goods stored for resale, this form is essential for your tax compliance. It helps ensure that the storage of those goods is recognized under Kentucky law, allowing for appropriate tax treatment.

The 740 tax form is the Kentucky individual income tax return form. It is used to report your income and calculate the amount of tax owed or the refund due. Completing this form accurately is crucial for compliance with state tax laws. To streamline your document handling, including forms like the 740, consider the Kentucky General Form of Storage Order and Agreement.

The mailing address for Kentucky tax forms largely depends on the type of tax form you are submitting. Most forms are mailed to the Department of Revenue in Frankfort, while others may have specific addresses based on their categories. It is essential to verify the correct routing to ensure efficient processing. For help with document management, our Kentucky General Form of Storage Order and Agreement is an excellent resource.

Mail your KY 720EXT form to the Kentucky Department of Revenue in Frankfort. It is important to ensure your forms are sent well ahead of any deadlines to avoid penalties. Properly addressing your submission can lead to smoother processing from the state. The Kentucky General Form of Storage Order and Agreement from uslegalforms can assist during various stages of document management.

The TTB form must be mailed to the address specified on the form. Usually, it is directed to the Alcohol and Tobacco Tax and Trade Bureau in Washington, D.C. Double-check that you are sending it to the correct address to avoid complications. For comprehensive resources like managing storage agreements, explore the Kentucky General Form of Storage Order and Agreement.

You should mail your Kentucky form 720 to the Division of Sales and Use Tax in Frankfort, Kentucky. Make sure you are using the latest version of the form to avoid any delays. Proper mailing directly influences the timely processing of your returns. If you need additional guidance, our Kentucky General Form of Storage Order and Agreement can assist you.

Yes, KY form 725 can be filed electronically. This option simplifies the submission process, allowing you to file from the comfort of your home. By utilizing e-filing, you receive a confirmation upon submission which aids in tracking your document. For efficient handling of other forms, refer to our Kentucky General Form of Storage Order and Agreement.

You should mail your W7 application to the address indicated in the form instructions. Typically, it is sent to the Internal Revenue Service in Austin, Texas. Remember, ensuring you complete all required details helps in processing your application timely. For comprehensive support related to tax forms, consider using the Kentucky General Form of Storage Order and Agreement through uslegalforms.