Kentucky Checklist - Key Record Keeping

Description

How to fill out Checklist - Key Record Keeping?

It is feasible to spend time online looking for the legal document template that meets your state and federal requirements.

US Legal Forms offers a vast array of legal documents that have been assessed by experts.

It is straightforward to obtain or print the Kentucky Checklist - Key Record Keeping from the services.

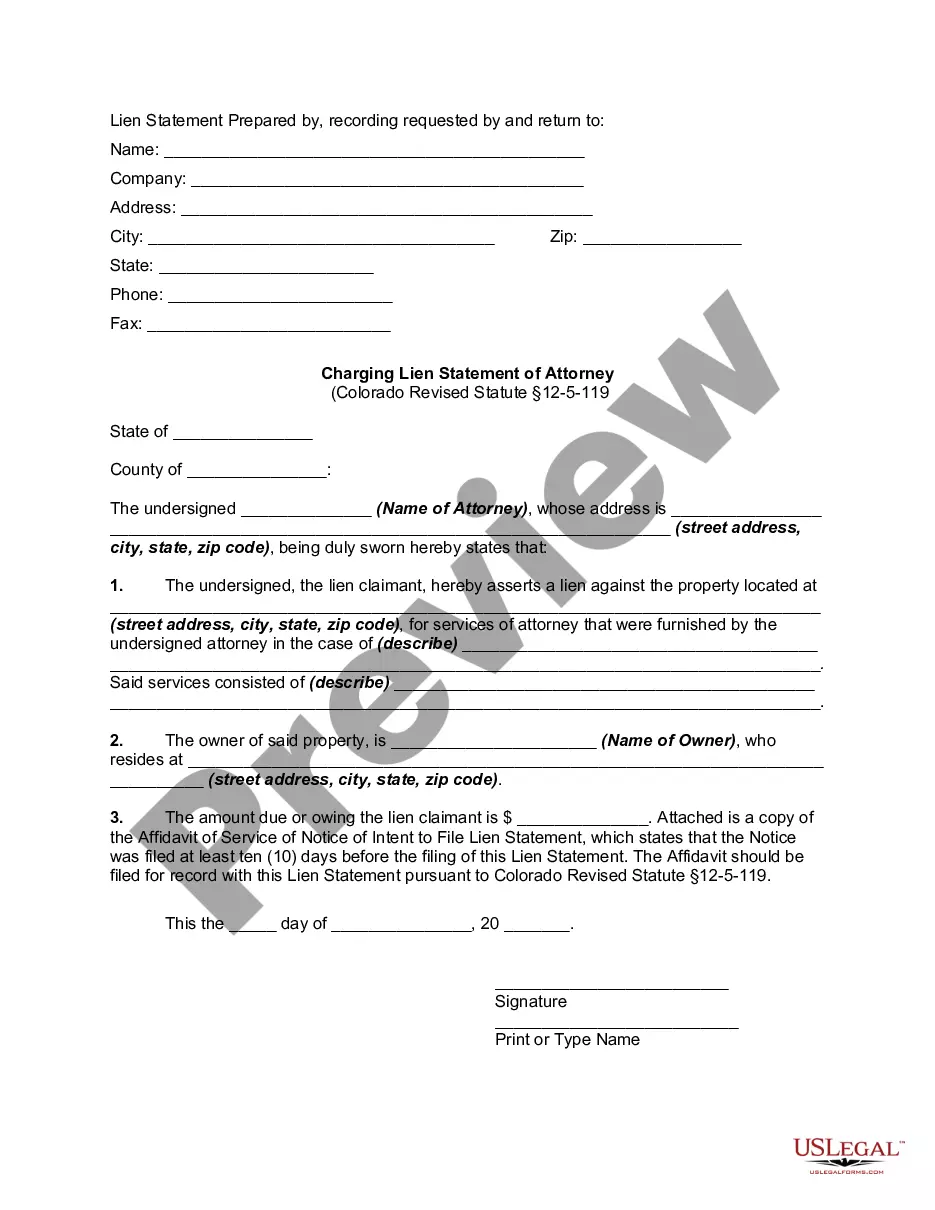

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, edit, print, or sign the Kentucky Checklist - Key Record Keeping.

- Each legal document template you acquire remains yours indefinitely.

- To get another copy of any purchased form, visit the My documents tab and click the related button.

- If visiting the US Legal Forms site for the first time, follow the straightforward instructions outlined below.

- Firstly, ensure you have selected the correct document template for the state/city of your preference.

- Check the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

According to the Kentucky Checklist - Key Record Keeping, you should retain a variety of financial records for seven years. These include tax returns, bank statements, payroll records, and any supporting documents related to expenses and revenue. Keeping these records organized not only supports compliance but also aids in financial planning and decision-making. USLegalForms offers resources to help you systematize your record management efficiently.

The 7 year retention rule is a guideline indicating that businesses should keep financial records for a period of seven years. This rule is crucial in the Kentucky Checklist - Key Record Keeping, as it aligns with the IRS recommendations for tax purposes. Following this rule can protect your company from potential audits and legal issues, while also helping to maintain clear and accurate financial histories. To facilitate this process, consider utilizing platforms like USLegalForms, which can guide you in managing your records.

In the context of the Kentucky Checklist - Key Record Keeping, a company typically must retain financial records for at least seven years. This timeframe ensures that you comply with legal requirements, such as audits and tax filings. Additionally, keeping records for this duration helps safeguard your business against unexpected inquiries or disputes. Remember, having an organized documentation process will streamline your business operations.

For employee records in Kentucky, you should retain them for at least three years after termination. Additionally, specific records related to payroll and taxes must be kept longer due to federal requirements. Following the Kentucky Checklist - Key Record Keeping can help you manage these timelines appropriately. To simplify compliance, consider using uslegalforms for your record-keeping solutions.

In Kentucky, the law requires that medical records be retained for at least five years after the last patient visit. This ensures that critical information remains accessible when needed. The Kentucky Checklist - Key Record Keeping will help you navigate these timelines effectively. Utilize platforms like uslegalforms to streamline your record-keeping processes.

Legally, medical records must generally be kept for six to ten years, depending on the state and the specific type of record. For instance, in Kentucky, the law outlines specific retention periods to ensure compliance. Following the Kentucky Checklist - Key Record Keeping can help you stay organized and meet these legal requirements. Consider uslegalforms to simplify the management and maintenance of your records.

Yes, under federal law, HIPAA records must be kept for at least six years from the date of their creation or the date when they were last in effect. This retention is crucial for compliance and protects patient rights. The Kentucky Checklist - Key Record Keeping suggests maintaining these records securely during this period. By leveraging platforms like uslegalforms, you can ensure your business fully understands its record-keeping obligations.

Yes, Kentucky is a public record state, meaning many records are accessible to the public. This includes documents like real estate records, court records, and certain government documents. Knowing this is essential for your record-keeping, and the Kentucky Checklist - Key Record Keeping can help you navigate public records effectively.

Medical record retention laws in Kentucky mandate that records be retained for five years following the last patient visit. This rule is crucial for compliance with state regulations. The Kentucky Checklist - Key Record Keeping can provide you detailed guidelines on how to manage these records effectively.

Typically, financial records in Kentucky should be retained for seven years. This time frame allows for audits or disputes that may arise. The Kentucky Checklist - Key Record Keeping is an excellent tool to help you track what documents you need and for how long.