Kentucky Invoice Template for Baker

Description

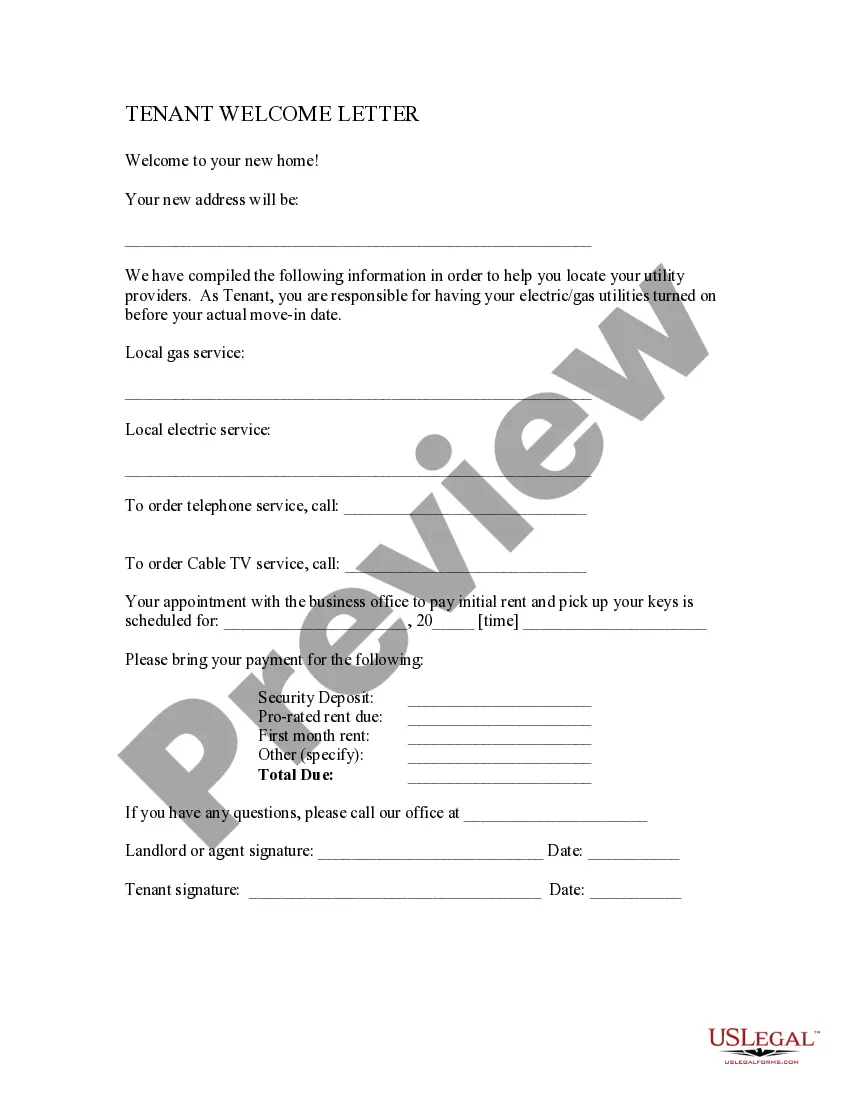

How to fill out Invoice Template For Baker?

Are you currently in a situation where you need documents for either business or personal use almost every day.

There are many official document templates available online, but finding forms you can trust is not easy.

US Legal Forms offers thousands of form templates, including the Kentucky Invoice Template for Baker, designed to comply with federal and state regulations.

Once you find the right form, simply click Acquire now.

Choose the pricing plan you prefer, provide the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard. Select a convenient file format and download your copy. You can access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Kentucky Invoice Template for Baker anytime by selecting the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. This service provides professionally crafted legal document templates for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Kentucky Invoice Template for Baker template.

- If you do not have an account yet and want to begin using US Legal Forms, follow these steps.

- Locate the form you need and verify it is for your specific city/area.

- Use the Review button to examine the form.

- Review the description to ensure you have selected the correct form.

- If the form is not what you are looking for, utilize the Lookup section to find the form that matches your needs and requirements.

Form popularity

FAQ

Baked goods in Kentucky may be taxable, depending on how they are sold. For instance, sales of prepared foods consumed on-site typically incur sales tax, while cakes and cookies sold as takeout may have different obligations. Utilizing a Kentucky Invoice Template for Baker can simplify tax tracking, allowing you to differentiate between taxable and exempt sales seamlessly.

Restaurant food in Kentucky is generally taxed at the state sales tax rate of 6%. This applies to meals consumed on the premises or takeout options. Bakers offering food services should keep this tax in mind, and a Kentucky Invoice Template for Baker can help you manage these transactions effectively, ensuring taxes are calculated and displayed correctly.

In Kentucky, several products do not face sales tax, including prescription medication, some groceries, and certain agricultural items. Such distinctions matter, especially for bakers who want to offer a mix of taxable and non-taxable items. By utilizing a Kentucky Invoice Template for Baker, you can easily categorize your products to reflect tax obligations accurately.

Yes, candy is generally subject to sales tax in Kentucky. However, if the candy is sold in a way that qualifies for food sales tax exemptions, such as being bundled with other food items, there may be exceptions. To navigate the complexities of tax classifications and ensure compliance, a Kentucky Invoice Template for Baker can provide clarity and organization in tracking taxable and non-taxable sales.

In Kentucky, certain items are exempt from sales tax, including food for human consumption prepared for immediate use, certain agricultural products, and specific medical supplies. Bakers should be aware of these exemptions when creating their sales documentation. Using a Kentucky Invoice Template for Baker can help ensure that these exempt items are accurately recorded, minimizing tax liabilities.

Making a bakery invoice involves a few straightforward steps. Start by listing your bakery’s name and address, followed by the customer's details. Next, detail the goods provided, including quantities and prices, and use a Kentucky Invoice Template for Baker to format your document correctly. This template helps ensure clarity and organization, leading to smoother transactions and professional interactions.

Yes, it is legal to create your own invoice as long as it meets specific requirements. To ensure compliance, include details like your business name, address, items sold, and prices. Using a Kentucky Invoice Template for Baker can simplify this process, making sure you do not miss any critical components. A well-structured invoice helps maintain professionalism and supports your record-keeping.

To write an invoice correctly, include your contact information, the customer's details, and a clear invoice number. Make sure to provide a detailed list of the services or goods rendered, with corresponding prices and quantities. Additionally, include payment terms and the total amount due. A Kentucky Invoice Template for Baker can help make writing invoices straightforward and efficient.

The correct format for an invoice includes essential elements such as your business name, logo, and contact information at the top. Following that, you should provide the client's details, invoicing date, and a unique invoice number. An itemized list of products or services should follow, concluding with the total amount due and payment information. A Kentucky Invoice Template for Baker adheres to this structure, making it easy to create compliant and effective invoices.

Filling out a construction invoice involves detailing the specific work performed, along with the materials used and their costs. Include labor hours, hourly rates, and any subcontractor costs as necessary. It's also helpful to itemize any change orders or additional work that affects the total bill. A Kentucky Invoice Template for Baker can offer guidance and structure for this specialized invoice format.