Kentucky Lease of Recreation or Athletic Equipment

Description

Article 2A of the UCC governs any transaction, regardless of its form, that creates a lease of personal property. Article 2A has been adopted, in different forms, by the majority of states, but it does not apply retroactively to transactions that occurred prior to the effective date of its adoption in a particular jurisdiction.

How to fill out Lease Of Recreation Or Athletic Equipment?

Selecting the most suitable authorized document template can be challenging.

Certainly, there are numerous templates accessible online, but how can you find the legal document you require.

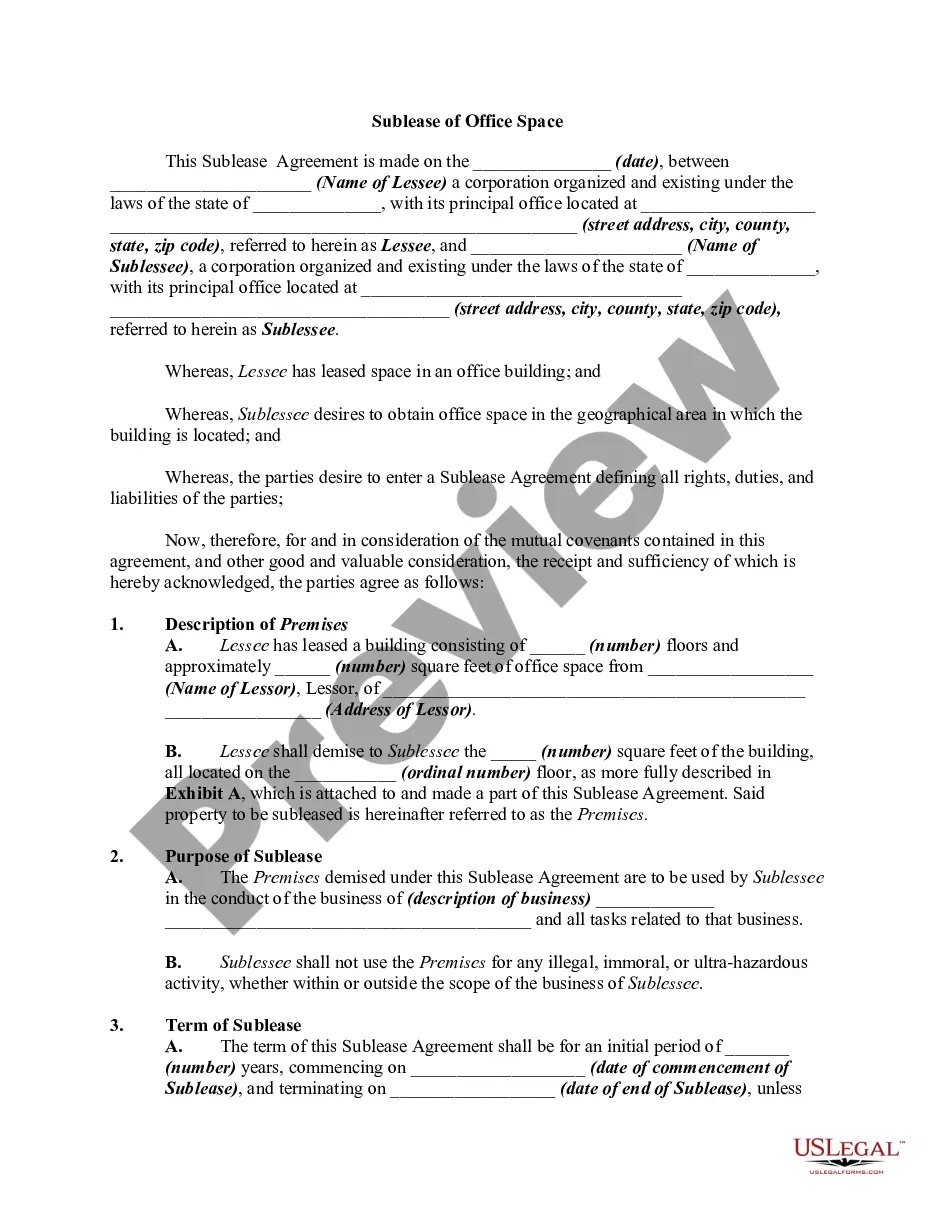

Use the US Legal Forms platform. The service offers thousands of templates, including the Kentucky Lease of Recreation or Athletic Equipment, that you can utilize for both business and personal purposes.

If the form does not satisfy your requirements, utilize the Search field to find the correct form.

- Each of the forms is verified by professionals and meets federal and state standards.

- If you are already registered, sign in to your account and click the Download button to retrieve the Kentucky Lease of Recreation or Athletic Equipment.

- Utilize your account to browse the legal forms you have purchased previously.

- Navigate to the My documents tab in your account and obtain an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

- First, ensure that you have selected the correct form for your city/state. You can preview the form using the Review button and read the form description to confirm it is the appropriate one for you.

Form popularity

FAQ

To obtain a Kentucky resale certificate, you first need to register your business with the state. Once registered, you can complete the resale certificate application, which is typically available online through the Kentucky Department of Revenue's website. It's important to provide the necessary details about your business, including the nature of your operations related to the Kentucky Lease of Recreation or Athletic Equipment. After submitting the application, keep in mind that approval may take some time, so planning ahead is essential to ensure a smooth process.

Certain items are exempt from sales tax in Kentucky, including some healthcare items and specific educational materials. However, most rental transactions, including the Kentucky Lease of Recreation or Athletic Equipment, fall under taxable categories. Understanding these exemptions is essential for compliance. For tailored advice on your rentals, consider leveraging the tools available on uslegalforms.

In Kentucky, equipment rentals are generally taxable unless specifically exempted by law. This includes the Kentucky Lease of Recreation or Athletic Equipment. It’s crucial to understand the regulations to ensure you collect and remit the appropriate sales tax. Using a platform like uslegalforms can help clarify these tax responsibilities for you.

Kentucky llet must be filed by individuals and entities that own and rent recreational or athletic equipment in the state. If you generate income from a Kentucky Lease of Recreation or Athletic Equipment, you need to report this activity appropriately. This ensures that you meet state tax obligations. Consider utilizing resources like uslegalforms to get all necessary forms and guidance.

Individuals and businesses engaged in leasing equipment in Kentucky must file KY form 725. Specifically, if you are involved in the Kentucky Lease of Recreation or Athletic Equipment and earn rental income, you are required to report that income. This form ensures proper reporting for tax purposes. Use it to stay compliant with Kentucky tax regulations.

In Kentucky, rental income is generally taxed as regular income, thus subject to the state’s income tax rates. If you earn rental income from a Kentucky Lease of Recreation or Athletic Equipment, you must report this as part of your overall income during tax filings. Staying informed about tax implications can enhance your financial strategy.

Equipment rentals may be tax-exempt under certain conditions, primarily for specific organizations like non-profits or institutions using a Kentucky Lease of Recreation or Athletic Equipment. To determine if your rental qualifies for tax exemption, a thorough review of applicable criteria and documentation is necessary.

Rental equipment is indeed subject to sales tax in Kentucky, typically calculated at the standard rate. This applies to various types of rentals, including a Kentucky Lease of Recreation or Athletic Equipment. Being aware of tax obligations can help you avoid any unexpected financial liabilities.

Yes, equipment rental is taxable in Kentucky according to current tax laws. This taxation applies to rentals, including those involving a Kentucky Lease of Recreation or Athletic Equipment. It is advisable to assess your rental agreements to maintain compliance.

In Kentucky, gym memberships are generally subject to sales tax. However, there are specific exemptions, especially if the membership involves a Kentucky Lease of Recreation or Athletic Equipment. It is crucial to check local guidelines to ensure compliance and optimize your offerings.