Kentucky Cash Disbursements Journal

Description

How to fill out Cash Disbursements Journal?

You have the capability to spend multiple hours online trying to locate the legal document template that meets the state and federal standards you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can obtain or create the Kentucky Cash Disbursements Journal from the service.

Review the form description to confirm you have chosen the accurate form. If available, use the Preview option to review the document template as well.

- If you possess a US Legal Forms account, you can sign in and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the Kentucky Cash Disbursements Journal.

- Every legal document template you obtain is yours permanently.

- To receive an additional copy of any downloaded form, navigate to the My documents section and click the appropriate option.

- If you're visiting the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure you have selected the correct document template for your desired county/city.

Form popularity

FAQ

A disbursement is a payment. The word disbursement implies a payment that has been finalized. That is, it has been properly recorded as a debit on the payer's side and a credit on the payee's side.

A retailer's cash disbursement journal would include inventory, accounts receivables, accounts payables, salaries, and wages. A manufacturer may have all of these but also accounts for raw materials purchased and production costs.

In the cash disbursement journal, a company itemizes all the financial expenditures it makes with cash (or cash equivalents). The cash disbursement journal helps create the organization's general leger.

A cash disbursement can be made with bills or coins, a check, or an electronic funds transfer. If a payment is made with a check, there is typically a delay of a few days before the funds are withdrawn from the company's checking account, due to the impact of mail float and processing float.

A cash disbursement is a payment that a business makes with cash or a cash equivalent. Cash disbursement payments show how much money is flowing out of a business. You can compare your company's disbursements to the money coming into your business to determine whether you have a positive or negative cash flow.

A cash disbursements journal is summarized at the end of the period, usually a month. The total cash outflow is then posted to the general ledger, along with the total cash inflow (which can be derived from the cash receipts journal).

When it comes to recording cash disbursements, be as specific as possible. Don't just include the amount of money you spent on the transaction....Cash disbursement journals should include:Date.Payee name.Amount debited or credited.Accounts involved (e.g., payment method)Purpose of the transaction.22-Oct-2019

For example, cash disbursed to pay bills is credited to the Cash account (which goes down in value) and is debited to the account from which the bill or loan is paid, such as Accounts Payable.

The cash disbursements journal (or cash payments journal) is an accounting form used to record all cash outflows. Some examples of outflows are accounts payable, materials payable, and operating expenses, as well as all cash purchases and disbursements to a petty cash fund.

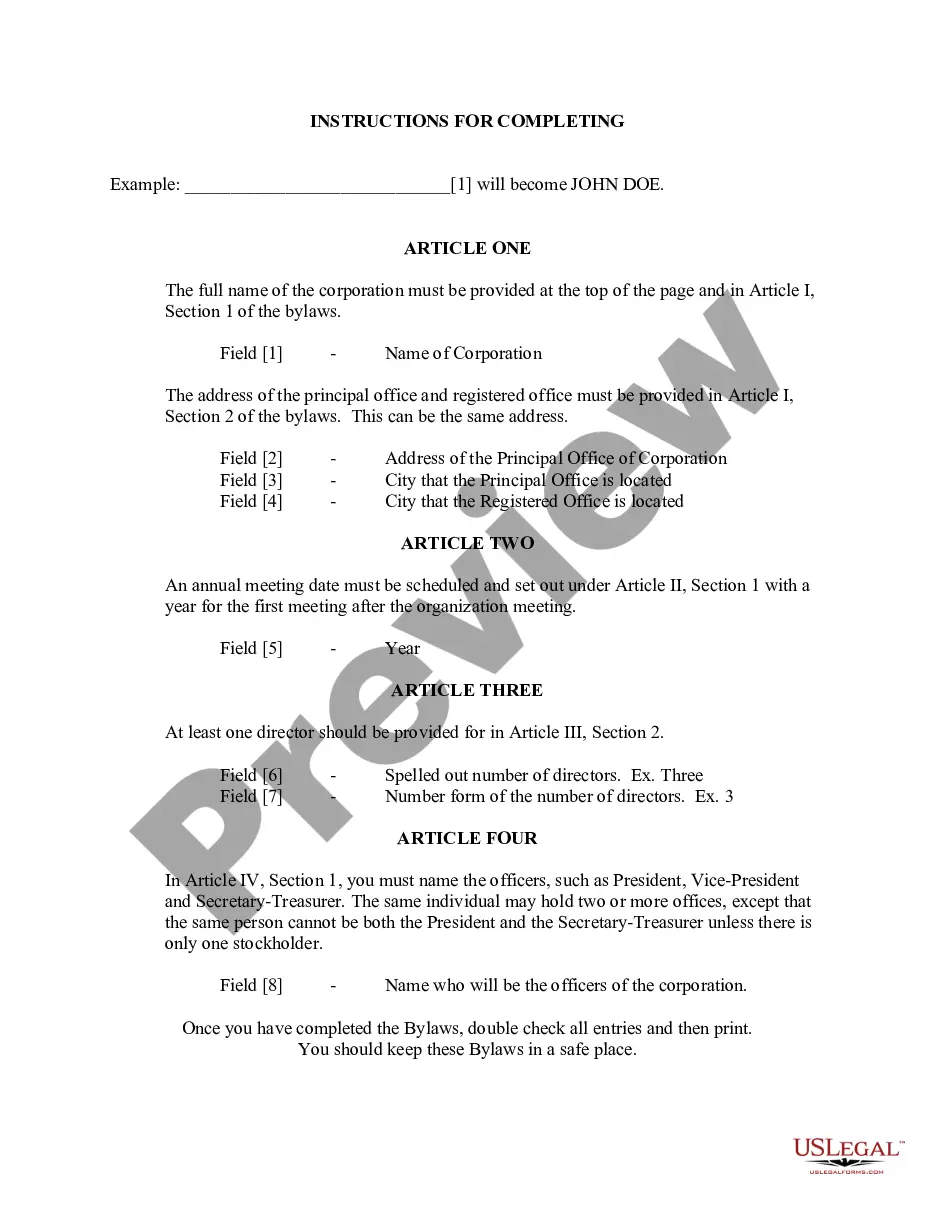

Posting from the Cash Payments JournalEnter the transaction date in the Date column of the subsidiary ledger account.Enter the journal letters and page number in the Posting Reference column.Enter the Accounts Payable Debit amount from the journal in the Debit column of the subsidiary ledger account.More items...