Kentucky Articles of Association of a Professional Association

Description

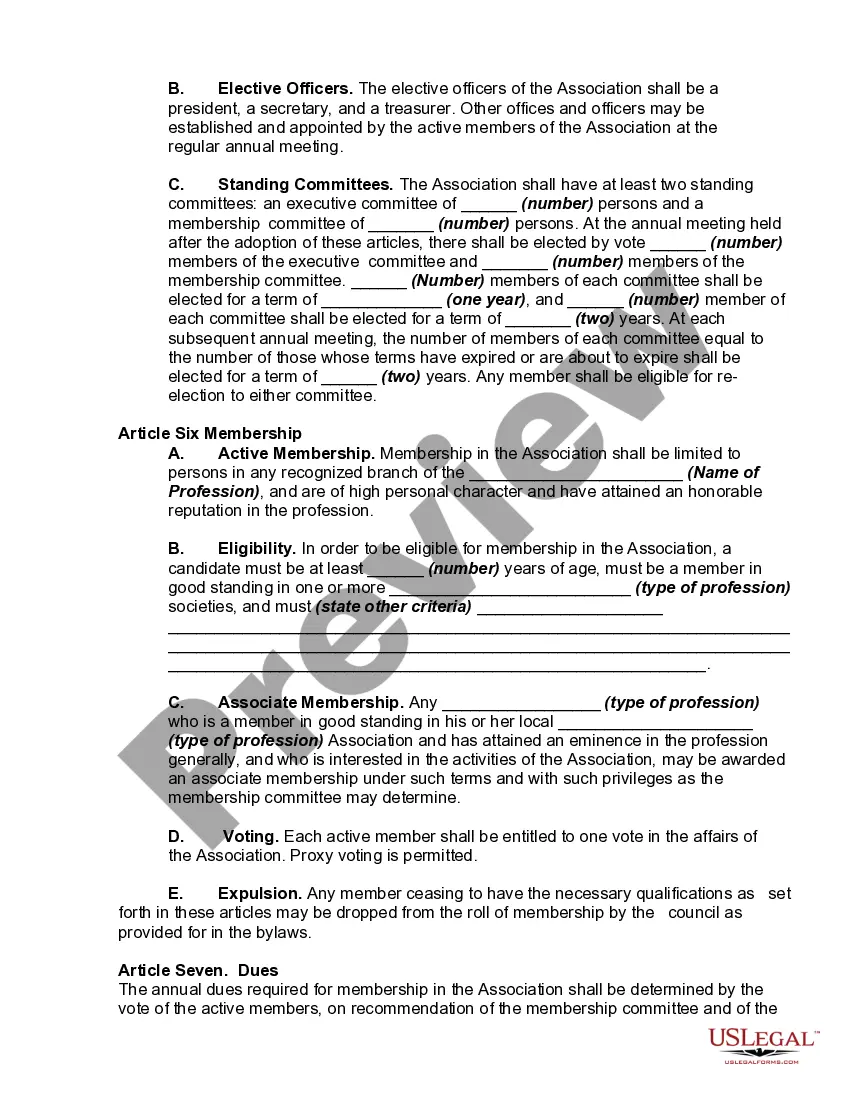

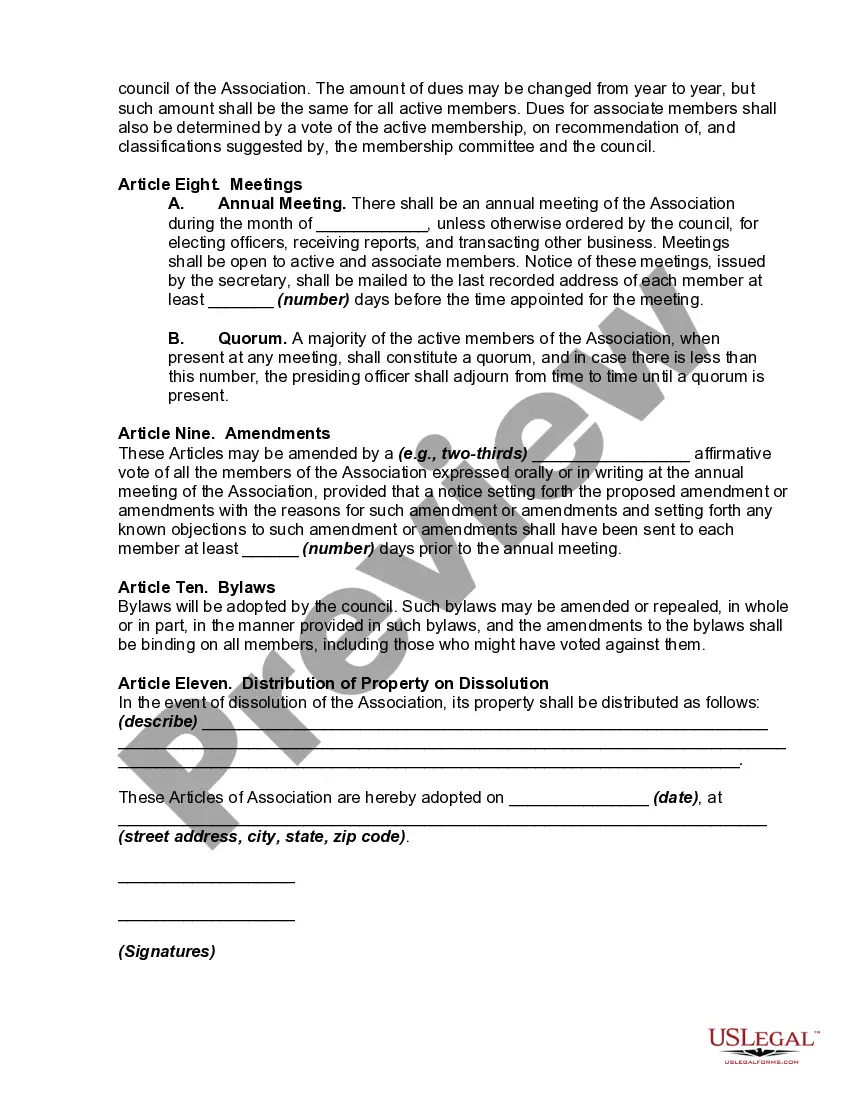

Statutes in some jurisdictions require that the constitution or articles of association, and the bylaws, be acknowledged or verified. In some jurisdictions, it is required by statute that the constitution or articles of association be recorded, particularly where the association or club owns real property or any interest in real property.

How to fill out Articles Of Association Of A Professional Association?

US Legal Forms - one of many largest libraries of lawful varieties in the United States - gives a wide range of lawful file layouts it is possible to down load or printing. Utilizing the site, you can get 1000s of varieties for organization and person purposes, categorized by classes, suggests, or keywords.You can find the most up-to-date models of varieties just like the Kentucky Articles of Association of a Professional Association in seconds.

If you have a monthly subscription, log in and down load Kentucky Articles of Association of a Professional Association through the US Legal Forms catalogue. The Obtain key will appear on every develop you look at. You have access to all in the past saved varieties in the My Forms tab of the profile.

If you would like use US Legal Forms the very first time, listed here are straightforward instructions to help you began:

- Make sure you have selected the correct develop for your personal town/state. Click the Review key to examine the form`s content. Read the develop outline to ensure that you have selected the right develop.

- When the develop does not fit your needs, use the Research area towards the top of the display to obtain the one that does.

- In case you are content with the form, verify your selection by visiting the Acquire now key. Then, select the costs prepare you favor and provide your credentials to register on an profile.

- Method the purchase. Utilize your bank card or PayPal profile to complete the purchase.

- Select the formatting and down load the form on the device.

- Make alterations. Load, modify and printing and indication the saved Kentucky Articles of Association of a Professional Association.

Every single template you added to your money lacks an expiry date and is your own property eternally. So, if you want to down load or printing another duplicate, just go to the My Forms portion and click around the develop you want.

Obtain access to the Kentucky Articles of Association of a Professional Association with US Legal Forms, by far the most considerable catalogue of lawful file layouts. Use 1000s of skilled and state-specific layouts that meet your organization or person requirements and needs.

Form popularity

FAQ

Frequently Asked Questions: Kentucky LLC Formation What are the requirements to form an LLC in Kentucky? You must file articles of organization, appoint a registered agent, and pay a filing fee of $40 (or $60 for expedited service).

Apply for federal tax-exempt status You may apply for federal 501(c)(3) status for your Kentucky nonprofit LLC the way most tax-exempt organizations do: by submitting Form 1023.

Delaware does NOT require an operating agreement. However, it is highly recommended to have a LLC operating agreement even if you are only a single member LLC. The state of Delaware recognizes operating agreements and governing documents.

Kentucky LLC Cost. To start an LLC in Kentucky, the state fee is $40 to file your LLC Articles of Organization online or in-person. Along with the fee you'll pay to the Secretary of State, you'll also have to pay $15 every year when you file your annual report.

Why Create a Kentucky LLC? A central location, strong shipping lanes and major infrastructure make forming an LLC in Kentucky an easy choice. The state's pro-business climate also provides a number of business incentives, tax credits and other financial benefits.

Kentucky Revised Statutes § 275.003: In Kentucky, an Operating Agreement is not a legal requirement to form an LLC. However, having one provides clarity to member responsibilities, business operations, and mitigates potential business disputes.

To amend your Kentucky LLC Articles of Organization you submit form Articles of Amendment to the Kentucky Secretary of State (SOS). The form is available in your online account once you sign up with Northwest. You can also find the amendment form on the SOS website.

Ing to KRS 141.010(25), ?doing business? in Kentucky includes but is not limited to: Being organized under the laws of Kentucky. Having a commercial domicile in Kentucky. Owning or leasing property in Kentucky.