Kentucky Agreement to Partners to Incorporate Partnership

Description

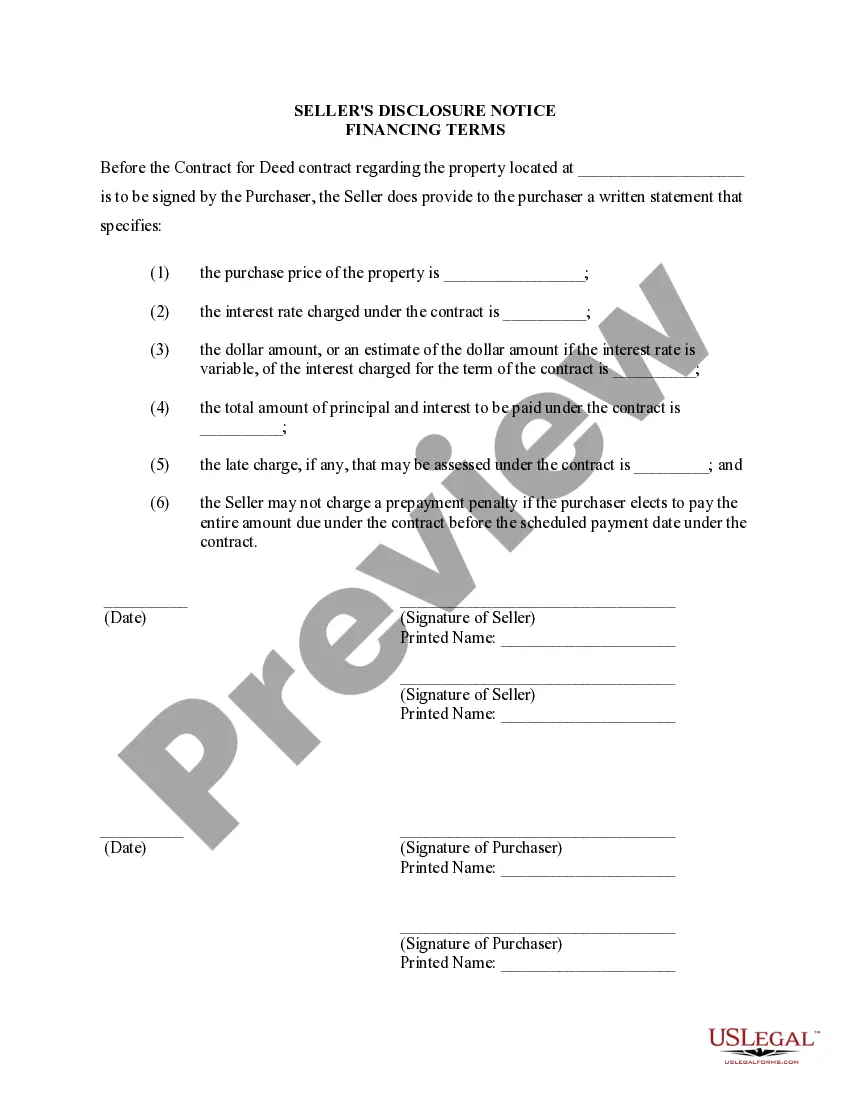

The articles of incorporation is a document that must be filed with a state in order to incorporate. Information typically required to be included are the name and address of the corporation, its general purpose and the number and type of shares of stock to be issued.

How to fill out Agreement To Partners To Incorporate Partnership?

It is feasible to spend hours online trying to locate the legal document template that meets the state and federal criteria you need.

US Legal Forms offers thousands of legal forms that can be evaluated by professionals.

You can download or print the Kentucky Agreement to Partners to Form Partnership from the service.

If you want to find another version of the form, use the Search field to locate the template that fits your needs and specifications.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- Subsequently, you can fill out, modify, print, or sign the Kentucky Agreement to Partners to Form Partnership.

- Each legal document template you purchase is yours forever.

- To retrieve another copy of the purchased form, visit the My documents section and select the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the appropriate document.

Form popularity

FAQ

The 4 types of partnerships are general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type varies in terms of liability and management structure. General partnerships involve shared liability among all partners, while limited partnerships include both general and limited partners with varying levels of responsibility. Limited liability partnerships provide protection from personal liability, whereas joint ventures are temporary collaborations focused on specific projects or goals.

The four main types of partnerships include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. In a general partnership, all partners share liability and management responsibilities. Limited partnerships allow for partners with limited liability, while limited liability partnerships offer protection for all partners from individual debts. Joint ventures are temporary partnerships formed for a specific purpose, pooling resources for that shared goal.

The four types of key partnerships are strategic alliances, joint ventures, equity partnerships, and business collaborations. Strategic alliances arise when companies share resources to achieve mutual goals while retaining their independence. Joint ventures involve creating a new entity, pooling resources for a specific project. Equity partnerships, on the other hand, see one partner acquiring an ownership stake in another business, while collaborations focus on achieving specific objectives without forming a new entity.

Kentucky Form 765 is a tax form used by partnerships to report income, deductions, and credits to the state of Kentucky. This form is essential for partnerships operating within the state, ensuring compliance with state tax laws. Completing Form 765 accurately is crucial for fulfilling legal obligations and can facilitate smoother processing of returns, helping partners maintain good standing.

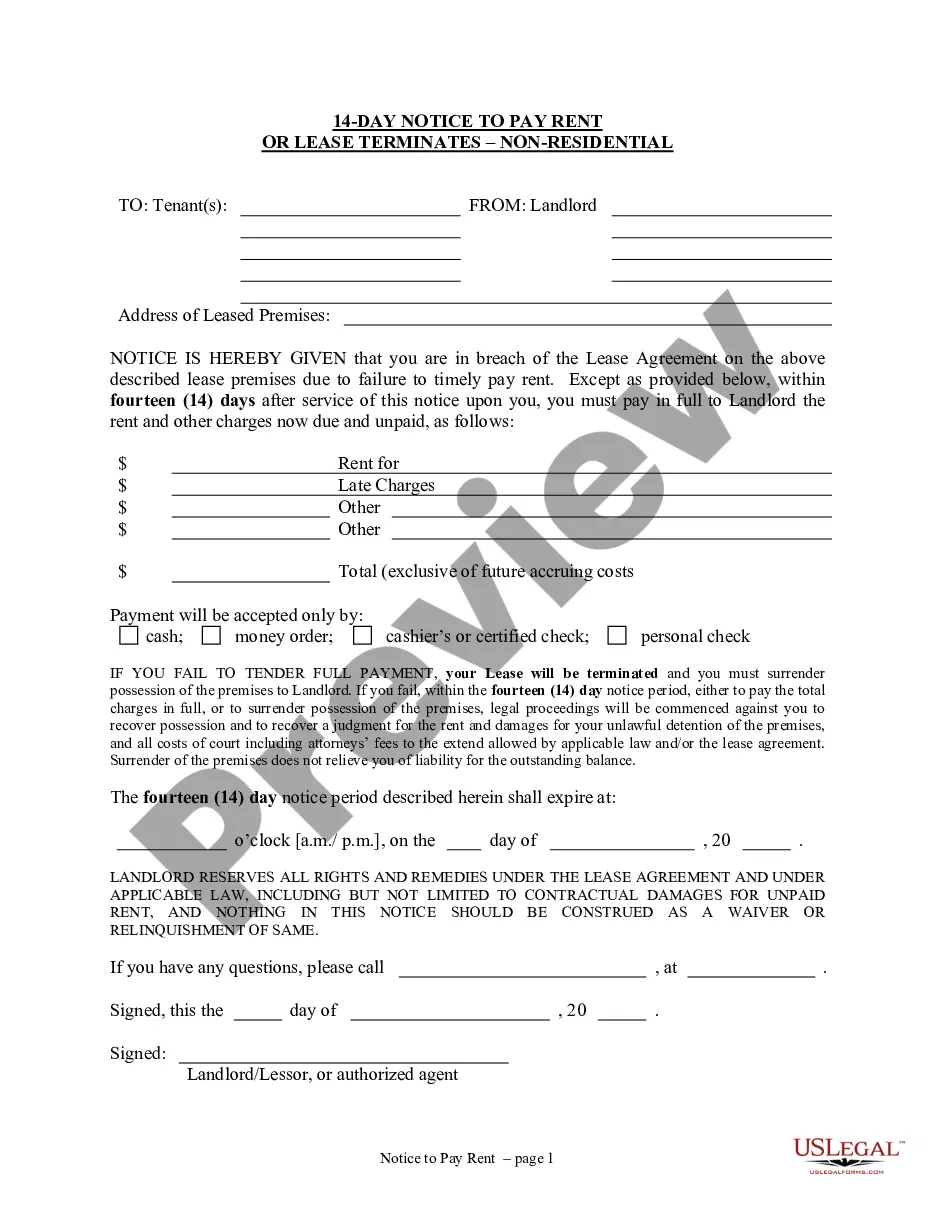

A partnership agreement is a crucial document that outlines the roles, responsibilities, and expectations of each partner in a business venture. This agreement, often referred to as a Kentucky Agreement to Partners to Incorporate Partnership, can specify profit sharing, decision-making processes, and dispute resolution mechanisms. Clear agreements help prevent misunderstandings and provide a roadmap for the partnership’s operation.

The 4 D's of partnership encompass discovery, development, delivery, and determination. In the discovery phase, partners explore mutual interests, aligning their visions. The development stage involves creating a solid framework for cooperation, often formalized in a Kentucky Agreement to Partners to Incorporate Partnership. Delivery focuses on executing plans effectively, while determination ensures that partners remain committed to their shared objectives, evaluating their progress regularly.

The 4 stages of partnership include forming, storming, norming, and performing. During the forming stage, partners initiate collaboration and establish expectations. As the partnership develops, partners may experience conflict in the storming stage, where differing ideas emerge. Moving on to the norming stage, partners work towards resolving their differences and create an effective collaboration, ultimately leading to the performing stage, where they achieve their shared goals.

Yes, a limited partnership can enter into contracts, just like general partnerships. The general partners typically manage the business and sign contracts, while limited partners usually provide capital and have limited liability. Utilizing a Kentucky Agreement to Partners to Incorporate Partnership can help define the roles of each partner clearly in the contracting process.

Absolutely, a partnership can legally enter into contracts. This allows the partnership to engage in transactions, lease property, or hire employees on behalf of the business. When drafting these contracts, having a Kentucky Agreement to Partners to Incorporate Partnership can add structure and clarity to your partnership's legal commitments.

Yes, a partnership can enter into various agreements to outline its operations or obligations. These agreements can cover aspects such as financial arrangements, business operations, and partner responsibilities. It’s essential to draft these carefully, often utilizing a Kentucky Agreement to Partners to Incorporate Partnership to ensure all parties are aligned.