Kentucky Sample Letter for Explanation of Insurance Rate Increase

Description

How to fill out Sample Letter For Explanation Of Insurance Rate Increase?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a range of legal templates that you can download or print.

By using the website, you can access thousands of documents for business and personal purposes, categorized by types, states, or keywords.

You can find the most recent versions of documents like the Kentucky Sample Letter for Explanation of Insurance Rate Increase in just seconds.

Review the details of the document to ensure you've chosen the right one.

If the document does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you have a subscription, Log In and download the Kentucky Sample Letter for Explanation of Insurance Rate Increase from the US Legal Forms library.

- The Download button will appear on every document you view.

- You can find all previously acquired documents in the My documents section of your account.

- If you're new to US Legal Forms, here are simple steps to get started.

- Ensure you have selected the correct document for your location/state.

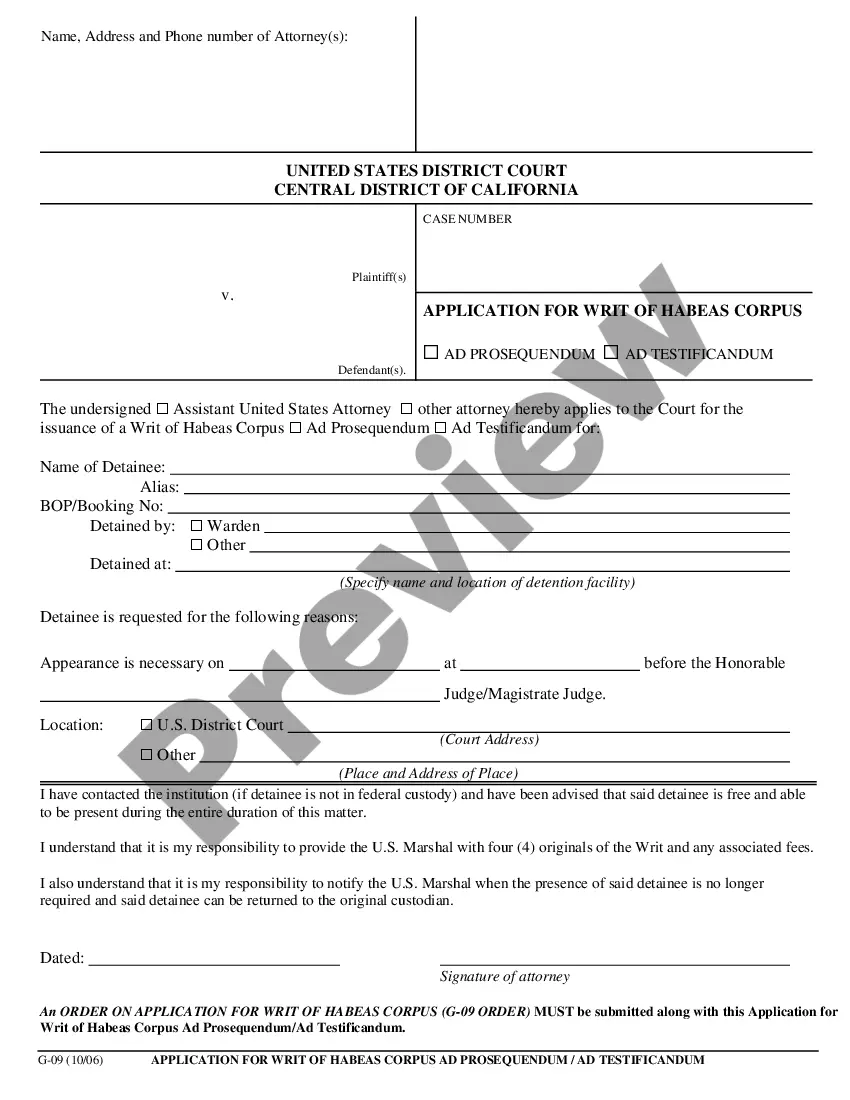

- Click the Preview button to examine the content of the form.

Form popularity

FAQ

As of now, Michigan holds the title for the highest car insurance rates in the United States. The state's no-fault insurance system and unlimited medical benefits for injured drivers contribute to these elevated costs. However, rates vary significantly from one state to another, and Kentucky also faces challenges. If you receive an unexpected rate hike, a Kentucky Sample Letter for Explanation of Insurance Rate Increase can help you request a detailed review of your rates.

Insurance in Kentucky tends to be expensive due to a combination of factors, including the state's unique insurance laws and a higher frequency of claims. Many drivers encounter higher premiums because of the specific risks associated with driving in the area. Moreover, weather conditions can also influence rates. Using a Kentucky Sample Letter for Explanation of Insurance Rate Increase can help you understand your premium and explore potential options for adjustments.

Several factors contribute to high car insurance rates in Kentucky. The state has a higher rate of accidents and a limited number of insurance companies competing for business, leading to increased costs. Additionally, insurance providers often cite higher repair costs and environmental factors. To address these challenges, consider using a Kentucky Sample Letter for Explanation of Insurance Rate Increase to seek clarity from your insurer.

In Kentucky, $200 a month can be considered on the higher end for car insurance. Factors like your driving history, type of vehicle, and coverage level all play significant roles in determining your rates. If you face an increase in your premium, a Kentucky Sample Letter for Explanation of Insurance Rate Increase can help clarify the reasons behind it. Understanding the specifics can empower you to make informed decisions about your insurance.

As stated earlier, the commissioner of the Kentucky Department of Insurance is appointed by the Governor with the intention of ensuring qualified leadership. This role requires a deep understanding of insurance laws and practices that affect consumers. Part of their job involves clarifying issues like the Kentucky Sample Letter for Explanation of Insurance Rate Increase.

The commissioner of insurance is responsible for overseeing the insurance industry within Kentucky. This includes enforcing compliance with state laws, addressing consumer complaints, and providing education on insurance practices. They also play a significant role in situations regarding the Kentucky Sample Letter for Explanation of Insurance Rate Increase.

The insurance commissioner of Kentucky is Nancy Atkins, as mentioned previously. Her role is crucial for maintaining the integrity of insurance operations and protecting consumer rights. For assistance related to insurance rate explanations, including the Kentucky Sample Letter for Explanation of Insurance Rate Increase, she represents the enforcement of state regulations.

The current commissioner of the Kentucky Department of Insurance is Nancy Atkins. She oversees the regulation of the insurance industry in the state, ensuring consumer protection. If you seek to understand policies regarding rate increases, including the Kentucky Sample Letter for Explanation of Insurance Rate Increase, she serves as a key resource.

You can reach the Commonwealth of Kentucky Insurance Department at (502) 564-6034. They provide assistance regarding various insurance inquiries, including explanations of rate increases. If you need specific guidance on a Kentucky Sample Letter for Explanation of Insurance Rate Increase, their staff can offer valuable insights.

Yes, in Kentucky, you can show proof of insurance on your phone. Many insurance providers offer digital proof that displays on your mobile device. This is a convenient option for drivers to keep up with their insurance documents. If you need guidance on how to navigate this process, our Kentucky Sample Letter for Explanation of Insurance Rate Increase may offer practical insights.