Kentucky Notice of Charging Lien on a Judgment - Attorney's Notice of Intent to File Lien

Description

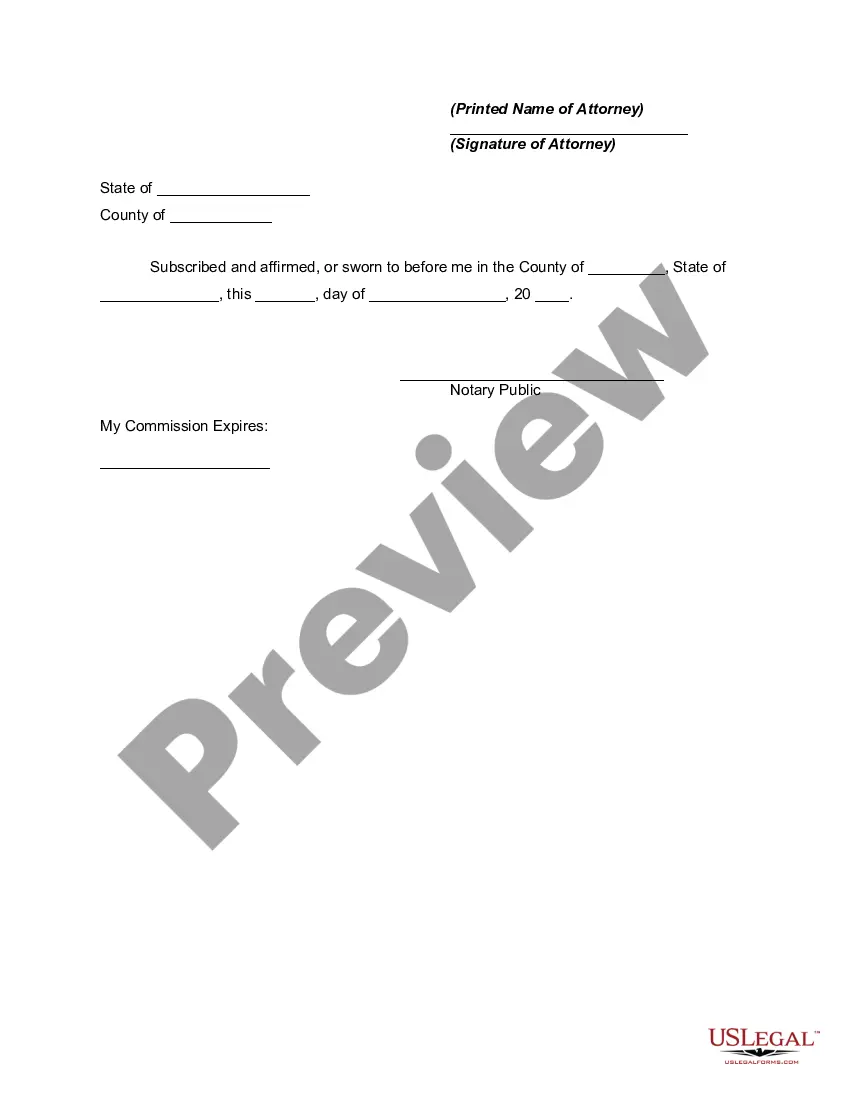

How to fill out Notice Of Charging Lien On A Judgment - Attorney's Notice Of Intent To File Lien?

Are you currently inside a placement where you will need documents for either business or specific purposes nearly every time? There are a lot of legal document web templates available on the Internet, but discovering types you can rely isn`t effortless. US Legal Forms offers a large number of develop web templates, such as the Kentucky Notice of Charging Lien on a Judgment - Attorney's Notice of Intent to File Lien, which can be written to meet state and federal demands.

If you are previously familiar with US Legal Forms website and possess a merchant account, simply log in. Afterward, it is possible to download the Kentucky Notice of Charging Lien on a Judgment - Attorney's Notice of Intent to File Lien template.

Should you not have an accounts and need to begin to use US Legal Forms, follow these steps:

- Discover the develop you require and make sure it is for your proper city/county.

- Make use of the Review key to analyze the form.

- See the outline to actually have selected the proper develop.

- In case the develop isn`t what you`re looking for, make use of the Lookup field to find the develop that meets your needs and demands.

- When you find the proper develop, click Buy now.

- Select the prices plan you would like, complete the specified information and facts to make your account, and pay money for the transaction making use of your PayPal or Visa or Mastercard.

- Decide on a handy data file structure and download your copy.

Get each of the document web templates you might have purchased in the My Forms food selection. You may get a additional copy of Kentucky Notice of Charging Lien on a Judgment - Attorney's Notice of Intent to File Lien at any time, if possible. Just click the necessary develop to download or printing the document template.

Use US Legal Forms, the most considerable selection of legal kinds, to conserve some time and steer clear of blunders. The support offers appropriately manufactured legal document web templates which you can use for a range of purposes. Produce a merchant account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

Liens generally follow the "first in time, first in right" rule, which says that whichever lien is recorded first in the land records has higher priority than later recorded liens. For example, a mortgage has priority over a judgment lien if the lender records it before the judgment creditor records its lien.

About Kentucky Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

376.160 Priority of liens -- Persons not deemed employees. Any lien provided for in KRS 376.150 and 376.180 shall be superior to the lien of any mortgage or other encumbrance thereafter created, and shall be for the whole amount due the employees as such, or due for such materials or supplies.

Tax liens are involuntary and occur when a homeowner does not pay their federal, state, or local taxes. If this happens, a tax lien is placed against your property. This lien takes priority over all other liens and stays there until the debt is completely paid.

To attach a lien, the creditor records the judgment with the county clerk for the Kentucky county where the debtor has property now or may have any property in the future.

And some states also allow judgment liens on the debtor's personal property -- things like jewelry, art, antiques, and other valuables. In Kentucky, a judgment lien can be attached to real estate only (i.e., a house or similar property interest).

Each attorney shall have a lien upon all claims, except those of the state, put into his hands for suit or collection or upon which suit has been instituted, for the amount of any fee agreed upon by the parties or, in the absence of such agreement, for a reasonable fee.

Tax Lien. A tax lien is an involuntary lien placed on your property if you fail to pay state or federal taxes. Tax liens are given priority over all other liens, which means they must be paid first.