Kentucky Contract for Part-Time Assistance from Independent Contractor

Description

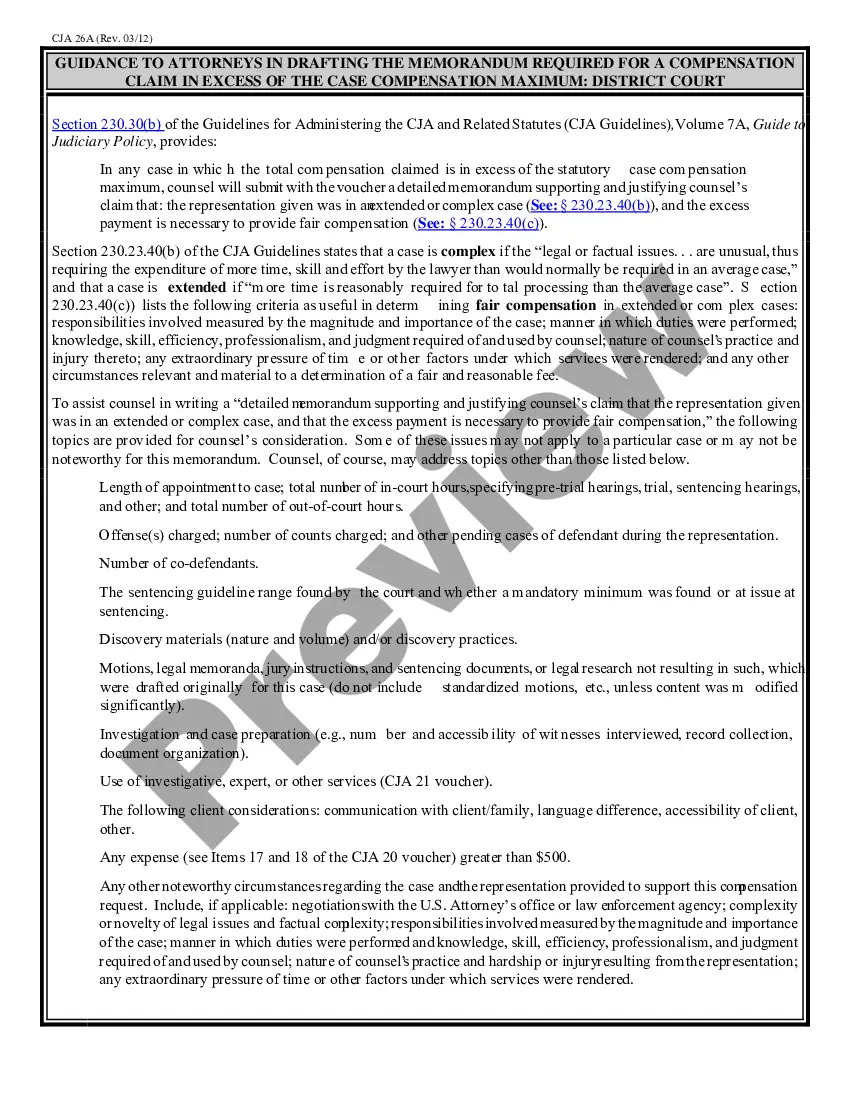

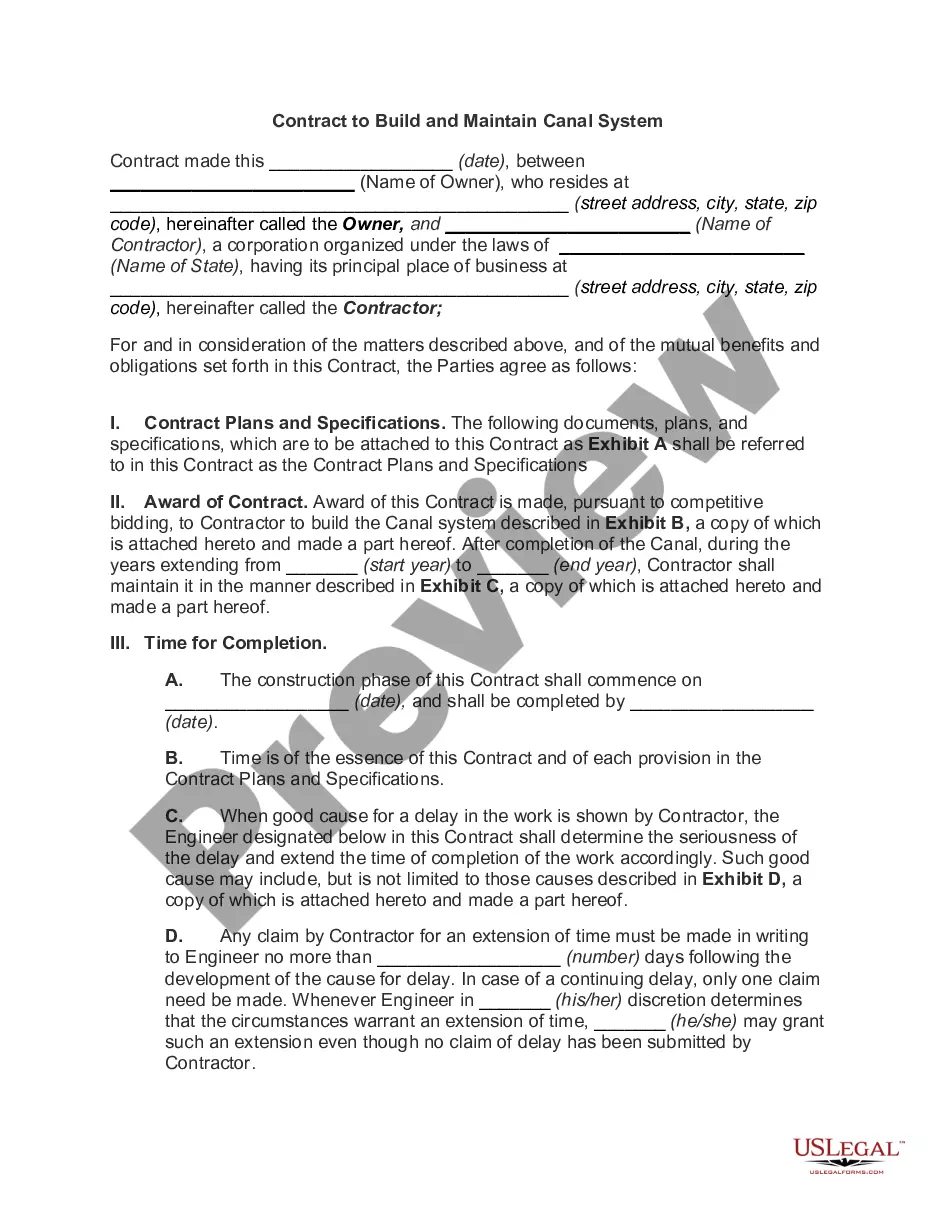

How to fill out Contract For Part-Time Assistance From Independent Contractor?

If you wish to obtain, download, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you’ve located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to get the Kentucky Contract for Part-Time Assistance from Independent Contractor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to receive the Kentucky Contract for Part-Time Assistance from Independent Contractor.

- You can also access forms you’ve previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the template for the appropriate city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the outline.

- Step 3. If you are not satisfied with the form, employ the Search field at the top of the screen to find other templates within the legal form repository.

Form popularity

FAQ

Yes, a 1099 employee, also known as an independent contractor, should have a clear contract in place. A Kentucky Contract for Part-Time Assistance from Independent Contractor outlines the scope of work, payment terms, and responsibilities of both parties. Having this contract protects your interests and ensures that both you and the contractor understand expectations. Consider using US Legal Forms to create a tailored contract that meets your specific needs.

Writing your own contract starts with a clear understanding of the agreement terms. Include sections for services, payment structure, and timelines. Be precise to avoid ambiguity and ensure both parties agree on all matters. For efficiency, a Kentucky Contract for Part-Time Assistance from Independent Contractor can serve as an excellent starting point.

Yes, a 1099 employee can have a contract that outlines the terms of their engagement. This contract clarifies responsibilities, deliverables, and payment arrangements. Having a well-defined agreement protects both the worker and the employer. You can create a Kentucky Contract for Part-Time Assistance from Independent Contractor to ensure all necessary details are included.

Creating a contract for a contractor requires outlining all responsibilities, timelines, and payment terms. Start with a template that covers essential aspects like termination clauses and services provided. Make sure to keep the language straightforward, so both parties understand their obligations. Utilizing a Kentucky Contract for Part-Time Assistance from Independent Contractor can simplify this process and ensure completeness.

Writing a contract as an independent contractor involves defining the scope of work, payment details, and deadlines. You should also specify terms regarding confidentiality and dispute resolution. Using a clear and organized format can make the agreement easy to understand. For more streamlined options, explore a Kentucky Contract for Part-Time Assistance from Independent Contractor.

An independent contractor agreement can be created by either the hiring party or the contractor themselves. It is essential to outline roles, responsibilities, and payment terms. You can use templates or legal services to ensure all critical elements are included. For the best results, consider a Kentucky Contract for Part-Time Assistance from Independent Contractor.

Independent contractors in Kentucky are responsible for paying self-employment taxes, which include Social Security and Medicare taxes. They must also report their income through a 1099 form and can deduct certain business expenses. To navigate these tax obligations effectively, consider using a Kentucky Contract for Part-Time Assistance from Independent Contractor, which can help clarify the business relationship and potential deductions.

Not having a contract can leave you vulnerable in a working relationship. In the context of a Kentucky Contract for Part-Time Assistance from Independent Contractor, the absence of a formal agreement can result in a lack of clarity about expectations. This situation can lead to disputes, unsatisfied parties, and potential legal complications, so it's best to secure a contract to safeguard your interests.

While you can operate as a 1099 employee without a contract, it is not advisable. A Kentucky Contract for Part-Time Assistance from Independent Contractor offers essential legal coverage and ensures both parties understand their obligations. Without a contract, you may face challenges in case of disputes or disagreements regarding the services provided.

Yes, independent contractors should always have a contract, like a Kentucky Contract for Part-Time Assistance from Independent Contractor. A contract clearly defines roles, responsibilities, and payment terms, reducing the risk of misunderstandings. Having this legal document protects both parties and provides clarity on what is expected throughout the working relationship.