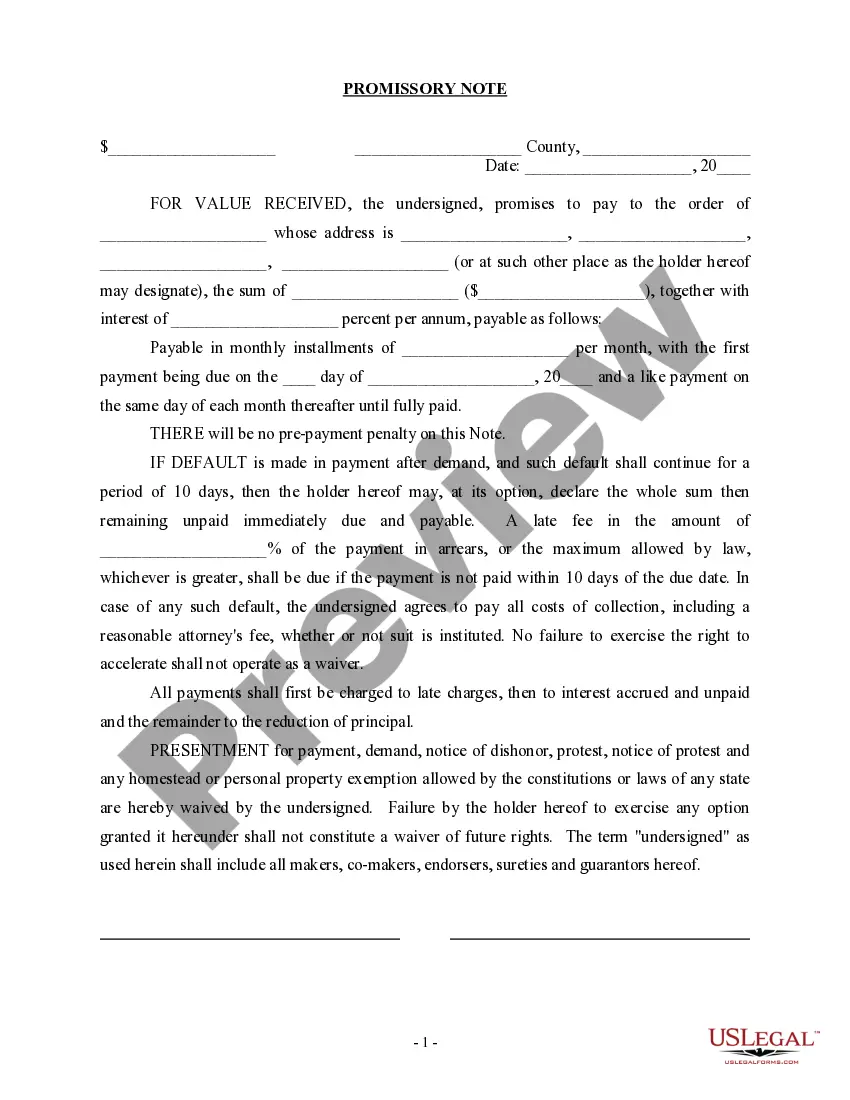

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

Kentucky Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business

Description

How to fill out Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

Are you currently in a circumstance where you require documents for both organizational or particular intents on a daily basis.

There are many legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the Kentucky Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Relation to a Business Purchase, which are designed to comply with state and federal regulations.

Choose the payment plan you want, enter the required information to create your account, and pay for your order using your PayPal or credit card.

Select a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Kentucky Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Relation to a Business Purchase anytime if needed. Just select the required form to download or print the document template.

- If you're already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kentucky Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Relation to a Business Purchase template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Review option to examine the form.

- Read the summary to make sure you have selected the correct form.

- If the form isn't what you're seeking, use the Search field to find the form that meets your requirements.

- Once you locate the right form, click Purchase now.

Form popularity

FAQ

The format of a promissory note generally includes a header that identifies the document, followed by sections detailing the parties involved, the amount borrowed, the interest rate, and payment terms. You may also want to include sections for default and acceleration clauses, as well as a signature area. This format ensures clarity and legal standing for a Kentucky Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments.

To fill out a promissory note sample, you should start by providing the names and addresses of both the lender and the borrower. Next, clearly state the amount being borrowed and detail the repayment terms, such as the fixed interest rate and the schedule for installment payments. Finally, include any relevant information about the secured property, and have both parties sign the document to make it legally binding.

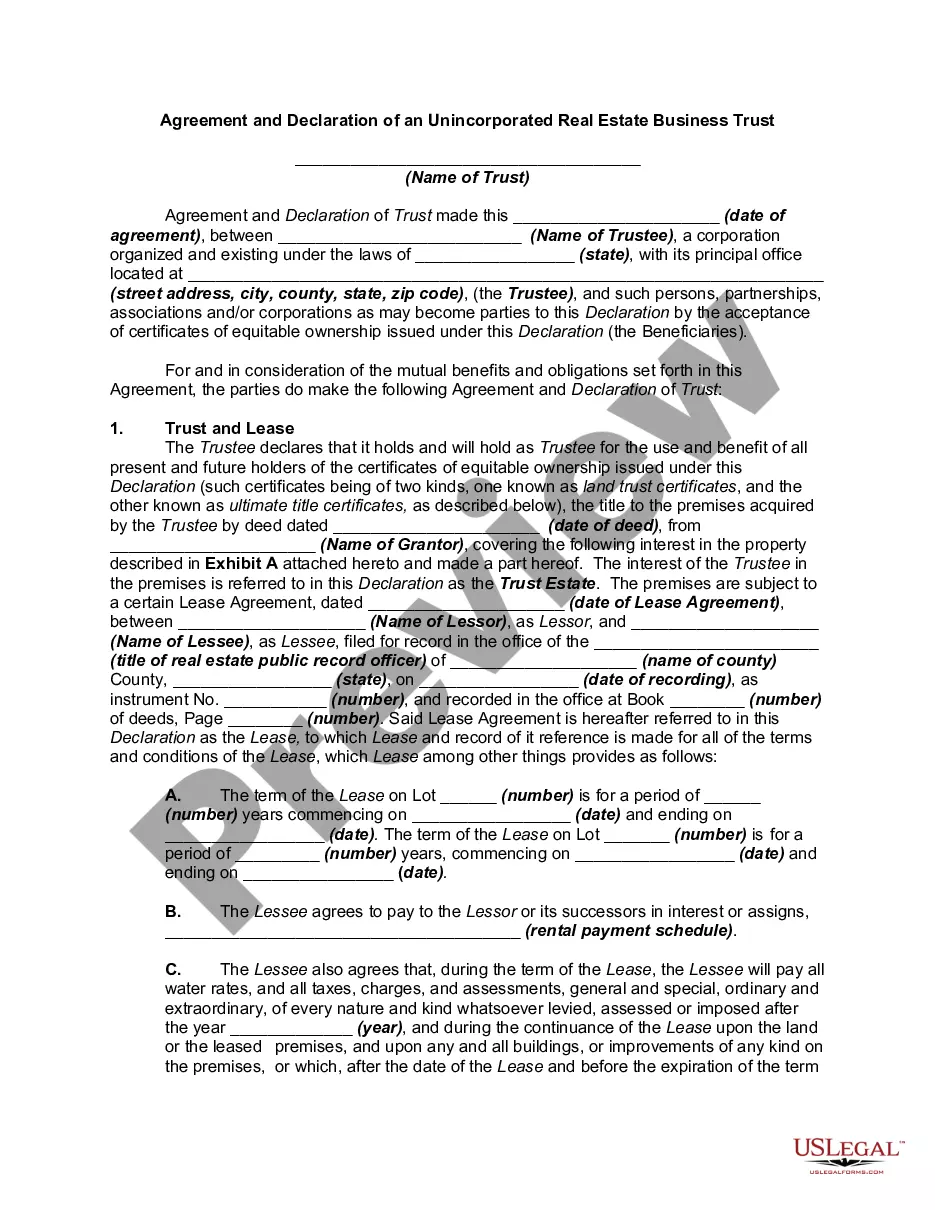

What is a Secured Promissory Note? A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

The buyer doesn't want to have to pay interest, and the seller feels funny asking for it, so they agree, no interest. Unfortunately, the IRS may impute interest received to the seller, even if the parties agreed to zero interest or a rate below the IRS' published rates.

A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

A real estate note is simply an IOU secured by property. In a conventional real estate transaction, a buyer makes a down payment, obtains a loan, and signs a note promising to pay a certain amount each month to the lender until the loan, plus interest, is paid.

A. As used in this section, "loan secured by real estate" means an obligation executed or assumed by the borrower that is secured by mortgage, deed of trust, or similar instrument, encumbering real estate that is owned by the borrower and upon which the bank relies as the principal security for the loan.