Discrimination favoring management or highly paid employees is not permitted for deductible health and accident insurance plans. For self-insured medical reimbursement plans (i.e., direct payment or reimbursement by the employer of the medical bills of the employee or family), no discrimination, either in eligibility or benefits, is permitted if "highly compensated individuals" are to receive all plan benefits tax-free. The plan must benefit, in general, at least 70% of employees who are not highly compensated employees. However, there are exceptions. A "highly compensated employee" is one who has a significant ownership interest in the company, or who is one of the five highest paid officers or employees. An alternative designation is an income threshold, currently $80,000. If a self-insured plan is discriminatory, an employee who is considered a highly compensated employee must include the amount of discriminatory benefits received in gross income.

Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees

Description

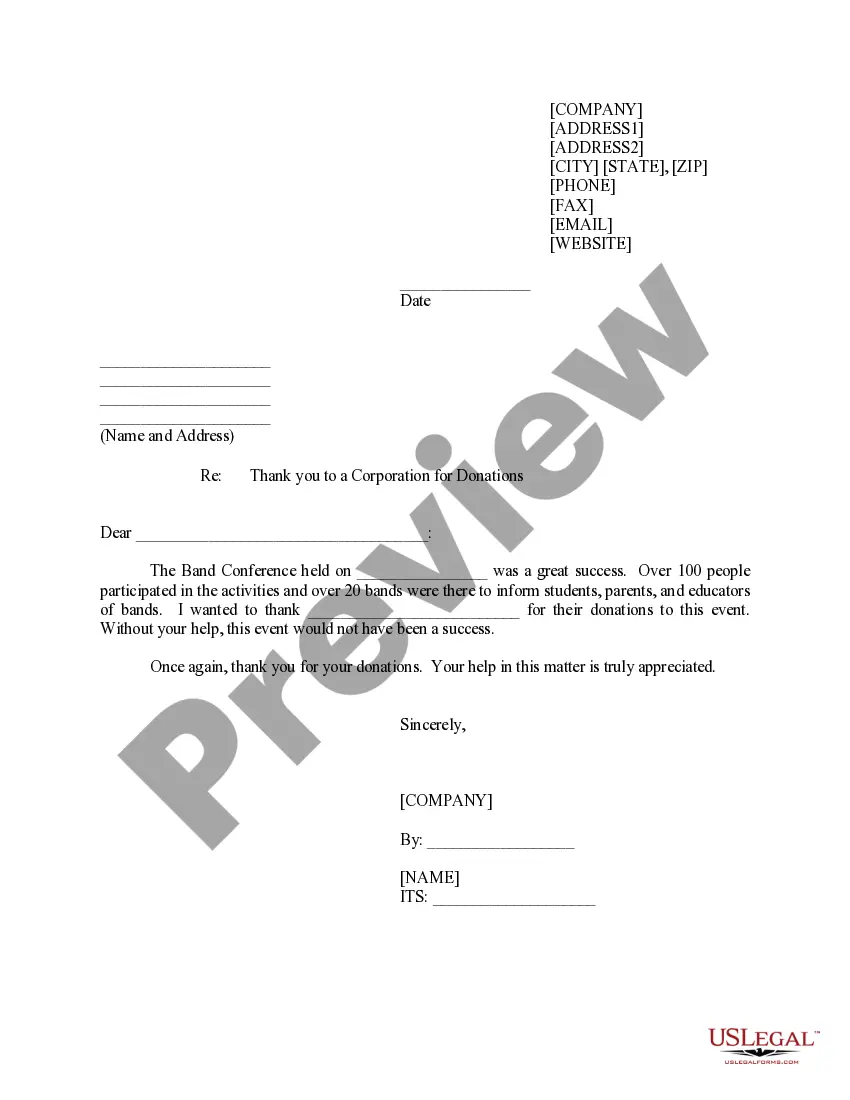

How to fill out Corporate Resolution Establishing A Self-insured Medical Payment Plan For Key Employees?

US Legal Forms - one of the largest compilations of legal documents in the USA - provides a range of legal template documents that you can download or print. By utilizing the website, you can find thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees in minutes. If you are already a member, Log In and download the Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees from the US Legal Forms collection. The Download button will appear on each document you view. You can access all previously downloaded forms from the My documents tab of your account.

If you are using US Legal Forms for the first time, here are some simple instructions to help you get started: Make sure you have selected the correct form for your state/region. Click the Review button to check the form’s details. Review the summary to ensure you have chosen the correct form.

Every document you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you need.

Access the Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees with US Legal Forms, one of the most extensive collections of legal document templates. Utilize an array of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your information to create an account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

- Edit. Fill out, modify, print, and sign the downloaded Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees.

Form popularity

FAQ

To get medical insurance outside of your employer, start by researching available individual plans. You can visit the health insurance marketplace to compare options or consult with a licensed insurance agent. Alternatively, for businesses, implementing a Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees can be a practical solution for creating a tailored insurance plan.

If your employer does not provide health insurance, you have several options. You can explore individual health insurance plans through private insurers or look into the health insurance marketplace, also known as healthcare. Another pathway is to consider a Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, which can provide tailored coverage for specific groups in your organization.

In the United States, state governments primarily regulate health insurance companies. State insurance departments monitor the operations of these companies, ensuring they follow the law and protect consumer interests. As you think about establishing a Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, it's important to be aware of these regulations to ensure that your plan aligns with both federal and state guidelines.

Self-funded plans are generally exempt from many state laws, thanks to ERISA. However, they still must comply with federal regulations and certain state laws regarding handling of medical data and consumer protections. Therefore, businesses considering a Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees should understand these nuances to navigate compliance successfully.

ERISA also governs the health benefit plans of self-insured, self-funded employers across America. This legislation sets standards to protect employee rights and outlines the responsibilities of employers regarding their health plans. Many businesses opt for a Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees under ERISA to ensure compliance while managing their health care costs effectively.

The Employee Retirement Income Security Act (ERISA) is the key legislation that allows large employers to self-insure health care benefits for their employees. This act provides the framework for employers to establish their own health plans, including a Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees. By doing so, businesses can gain more control over their health benefit offerings while potentially reducing costs.

insured medical plan works by allowing employers to directly cover employee healthcare claims using their own funds. Instead of paying fixed premiums to an insurance provider, businesses assess their medical spending and reimburse claims as they arise. By implementing a Kentucky Corporate Resolution Establishing a Selfinsured Medical Payment Plan for Key Employees, organizations gain flexibility in their benefits strategy, enabling them to align healthcare options with their workforce's diverse needs.

insured medical expense reimbursement plan is a system where employers reimburse their employees for medical expenses instead of providing traditional health insurance. This framework promotes financial efficiency, allowing companies to tailor benefits to their employees' specific needs. With proper management, a Kentucky Corporate Resolution Establishing a Selfinsured Medical Payment Plan for Key Employees creates a sustainable solution for healthcare spending and enhances employee satisfaction.

MERP plans, or Medical Expense Reimbursement Plans, offer significant benefits for businesses and employees alike, making them a worthwhile investment. These plans can provide tax advantages, reduce overall healthcare costs, and offer customizability based on employee needs. By implementing a Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees, businesses can maximize these benefits while maintaining a competitive edge in attracting top talent. The value of such plans often outweighs initial costs.

Parent Plus insurance in Kentucky typically refers to a type of policy that allows parents to cover their dependent children's medical expenses. This insurance ensures that young adults, often transitioning to independence, still have access to healthcare. Understanding these policies is crucial, especially when considering a Kentucky Corporate Resolution Establishing a Self-insured Medical Payment Plan for Key Employees. It helps employers design comprehensive benefit packages that align with both family needs and business goals.