A Legacy is a gift of property or money under the terms of the will of a person who has died. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kentucky Assignment of Legacy in Order to Pay Indebtedness

Description

How to fill out Assignment Of Legacy In Order To Pay Indebtedness?

Are you within a place that you require paperwork for both organization or personal functions nearly every day? There are a variety of lawful file templates available online, but getting types you can rely is not straightforward. US Legal Forms offers a large number of type templates, just like the Kentucky Assignment of Legacy in Order to Pay Indebtedness, which can be created to meet state and federal requirements.

If you are already acquainted with US Legal Forms website and have your account, basically log in. Next, it is possible to download the Kentucky Assignment of Legacy in Order to Pay Indebtedness web template.

If you do not come with an bank account and want to begin using US Legal Forms, adopt these measures:

- Get the type you want and ensure it is for your appropriate area/county.

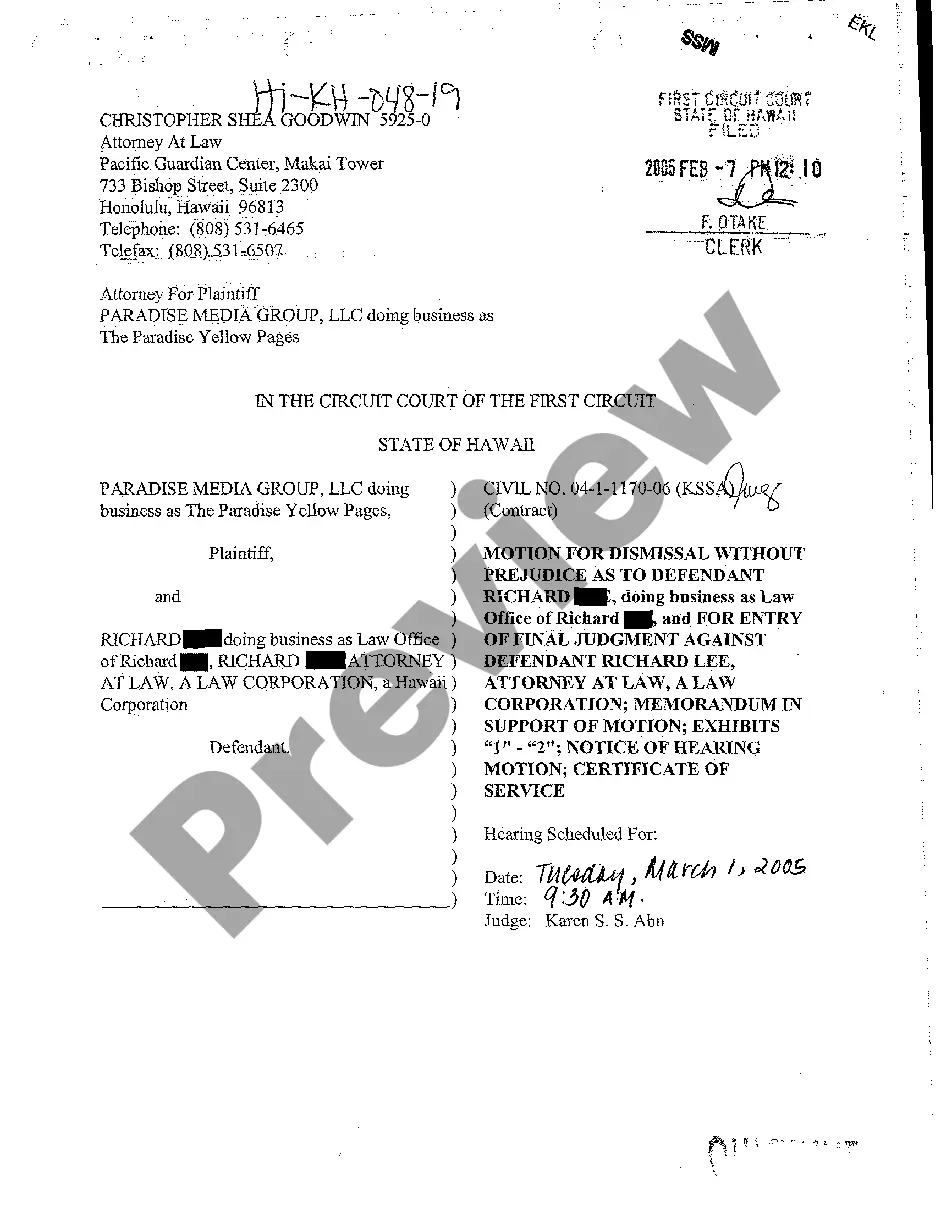

- Utilize the Review option to analyze the form.

- Read the description to actually have chosen the right type.

- When the type is not what you are searching for, make use of the Lookup field to get the type that meets your requirements and requirements.

- Once you discover the appropriate type, click on Get now.

- Select the pricing strategy you desire, fill in the desired information and facts to make your bank account, and buy your order making use of your PayPal or Visa or Mastercard.

- Select a hassle-free paper structure and download your duplicate.

Locate all of the file templates you have purchased in the My Forms menu. You can get a more duplicate of Kentucky Assignment of Legacy in Order to Pay Indebtedness any time, if required. Just select the essential type to download or print the file web template.

Use US Legal Forms, probably the most substantial variety of lawful types, in order to save efforts and steer clear of errors. The support offers appropriately manufactured lawful file templates that can be used for a range of functions. Generate your account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

If a decedent is survived solely by children, those children are afforded the entirety of the intestate estate, ing to Kentucky inheritance laws. Other than that, the children are given half of the estate if their deceased parent was married at the time of his or her death, ing to dower and curtesy laws.

Generally, and in the past, the most important factor in determining whether a joint account is with rights of survivorship is whether the bank signature card establishing the account identifies the interests of the parties as being with rights of survivorship.

All creditors that wish to be paid from the estate are required to file a claims against the estate within 180 days (6 months) from the date the personal representative is appointed. Valid debts can be paid after the six months are up.

A Kentucky survivorship deed transfers title to two owners as joint tenants with right of survivorship or?if they are spouses?as tenants by the entirety with right of survivorship. The right of survivorship gives a surviving co-owner complete title to the property when the other co-owner dies.

Ing to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023). If the estate passes to the spouse of the deceased person, no estate tax is assessed.318 Taxes for 2022 are paid in 2023.

The right of survivorship gives a surviving co-owner complete title to the property when the other co-owner dies. A Kentucky property owner can keep property out of probate by creating a survivorship deed in favor of the owner and the owner's child, spouse, or other potential heir.

The surviving spouse is entitled to the 50% dower share. The other remaining 50 percent goes to the deceased spouse's relatives based on succession laws ? children, followed by grandchildren, then parents, siblings, or nieces and nephews.

Class B: If you were the decedent's aunt, uncle, niece, nephew, daughter-in-law, son-in-law, or great-grandchild, your first $1,000 of inheritance is exempt from inheritance tax. Then you will pay rates ranging from 4% on inheritances worth up to $10,000 and 16% on anything worth $200,000 or more.