Kentucky Triple Net Lease for Sale

Description

How to fill out Triple Net Lease For Sale?

Selecting the appropriate legal document template can be challenging.

Undoubtedly, there is a multitude of templates available online, but how can you locate the legal document you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Kentucky Triple Net Lease for Sale, suitable for both business and personal purposes.

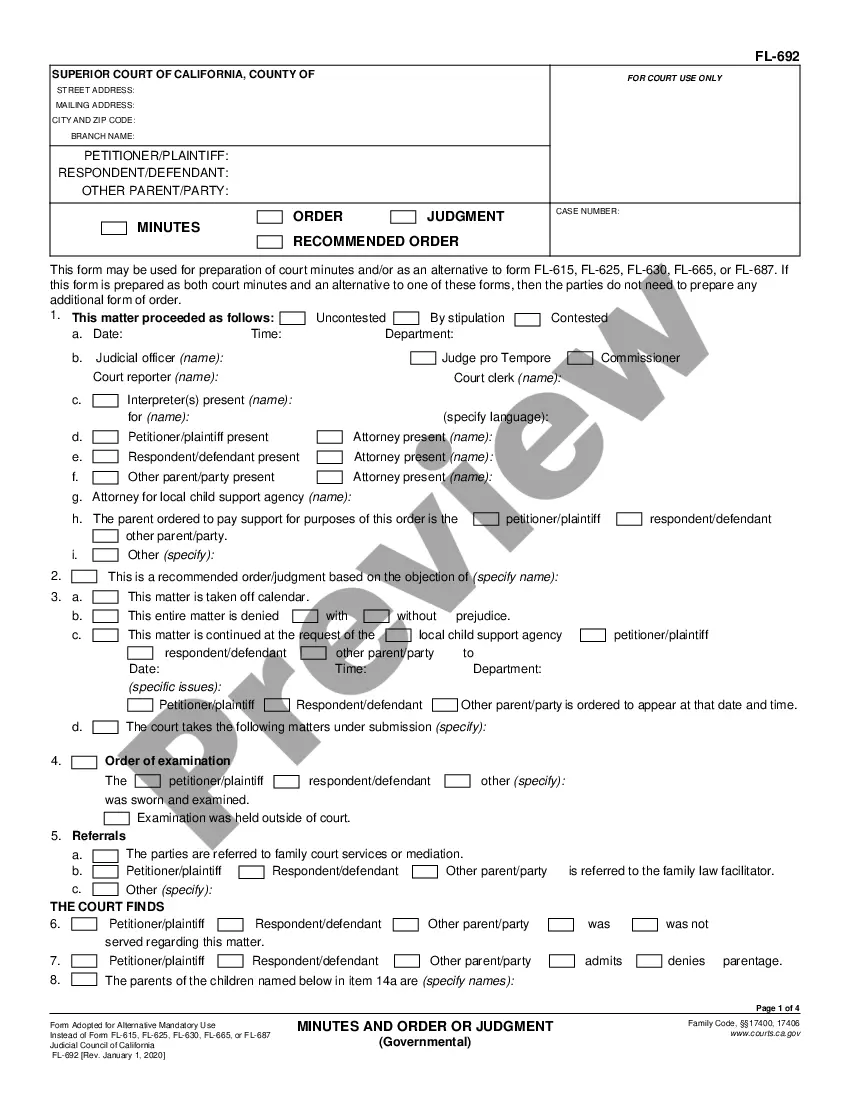

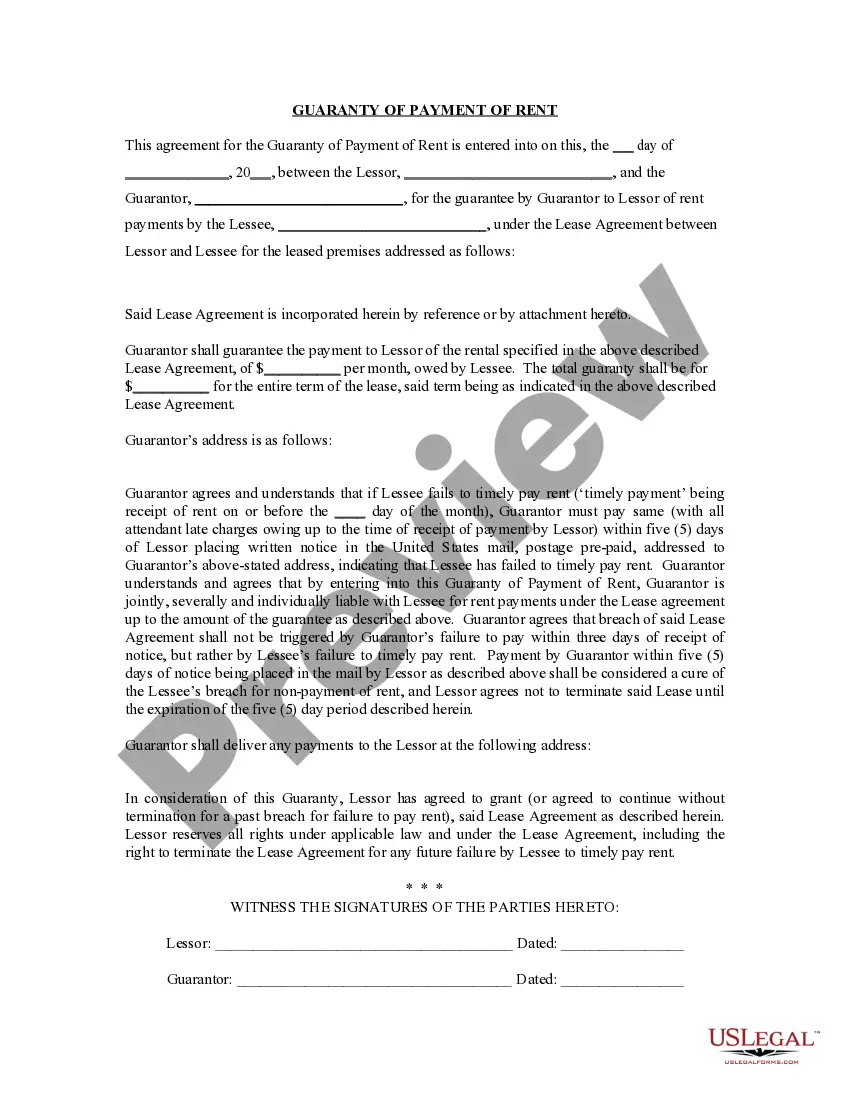

You can review the form using the Review button and check the form details to confirm it is suitable for your needs.

- All the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Kentucky Triple Net Lease for Sale.

- Use your account to search for the legal documents you have purchased previously.

- Visit the My documents tab in your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct document for your location/region.

Form popularity

FAQ

Structuring an NNN lease requires clear communication of terms between the landlord and tenant. Start by detailing the rent amount and specifying the additional expenses the tenant will cover. In a Kentucky Triple Net Lease for Sale, precise terms save both parties headaches in the future. Utilizing platforms like uslegalforms can provide templates and resources tailored to your needs.

A typical triple net lease includes the base rent plus the tenant’s responsibility for property taxes, insurance, and maintenance costs. This arrangement allows the property owner to benefit from a lower management burden. For a Kentucky Triple Net Lease for Sale, knowing these inclusions will help you assess potential returns and investment viability. Always read the lease documents carefully to understand all obligations.

To structure a triple net lease, you first outline the responsibilities of both the landlord and tenant. Specify who pays for property taxes, insurance, and maintenance costs in the lease agreement. A well-structured Kentucky Triple Net Lease for Sale ensures clarity and prevents future disputes. Consider consulting with a legal expert to draft a balanced lease.

To calculate a triple net lease, you need to determine the property's total rent and add the operating expenses. The expenses typically include property taxes, insurance, and maintenance costs. In the case of a Kentucky Triple Net Lease for Sale, understanding these components helps make informed investment decisions. You can also refer to comprehensive resources to guide you through this process.

To get approved for a NNN lease, ensure that you present detailed financial records and a solid business model. Landlords typically seek reliable tenants who can manage the additional costs of the property. Your approval chances improve with a good credit score and experience in managing similar leases. When searching for a Kentucky Triple Net Lease for Sale, consider using resources like US Legal Forms to aid in the process.

Qualifying for a triple net lease often involves demonstrating financial stability and a strong business plan. Lenders and landlords want to see that you can manage ongoing costs while maintaining your operations. This means clear documentation of your financial history will be helpful. Utilizing US Legal Forms can simplify the process of finding a Kentucky Triple Net Lease for Sale that fits your criteria.

Triple net lease criteria usually include the property's location, the tenant's financial stability, and the lease terms. Landlords look for tenants who can handle all property expenses—taxes, insurance, and maintenance. Additionally, you should assess the property market in Kentucky when considering a Kentucky Triple Net Lease for Sale to ensure it meets your business requirements.

To get approved for a triple net lease, you typically need to provide financial information about your business, including credit history and income statements. Landlords want assurance that you can cover the costs associated with the property, such as taxes, insurance, and maintenance. Additionally, demonstrating a stable income or business model can improve your chances. Exploring Kentucky Triple Net Lease for Sale options can lead to properties suited to your needs.

Tenants often choose a triple net lease, like those found in a Kentucky Triple Net Lease for Sale, because it offers greater control over maintenance decisions and operational management. This lease structure can sometimes result in lower base rent, allowing businesses to allocate funds toward personal investments or growth. Additionally, tenants may appreciate the transparency regarding property expenses. Carefully consider your long-term goals and needs before making a decision.

In a Kentucky Triple Net Lease for Sale, tenants take on substantial risks, such as fluctuating property costs and potential vacancies. If a tenant cannot meet their financial obligations, they risk losing their leased space and the invested capital. Furthermore, economic downturns may affect property values, impacting lease negotiations. It’s crucial to assess your financial stability and do proper due diligence before pursuing this type of lease.