Kentucky Owner Financing Contract for Moblie Home

Description

How to fill out Owner Financing Contract For Moblie Home?

If you wish to be thorough, acquire, or create legal document templates, utilize US Legal Forms, the leading assortment of legal documents, which are accessible online.

Employ the website's straightforward and user-friendly search feature to locate the forms you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment option you prefer and provide your details to register for the account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Kentucky Owner Financing Agreement for Mobile Home. Every legal document template you acquire is yours indefinitely. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again. Stay proactive and download, and print the Kentucky Owner Financing Agreement for Mobile Home with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to find the Kentucky Owner Financing Agreement for Mobile Home in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and then click the Download button to obtain the Kentucky Owner Financing Agreement for Mobile Home.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Verify that you have selected the form for the correct city/state.

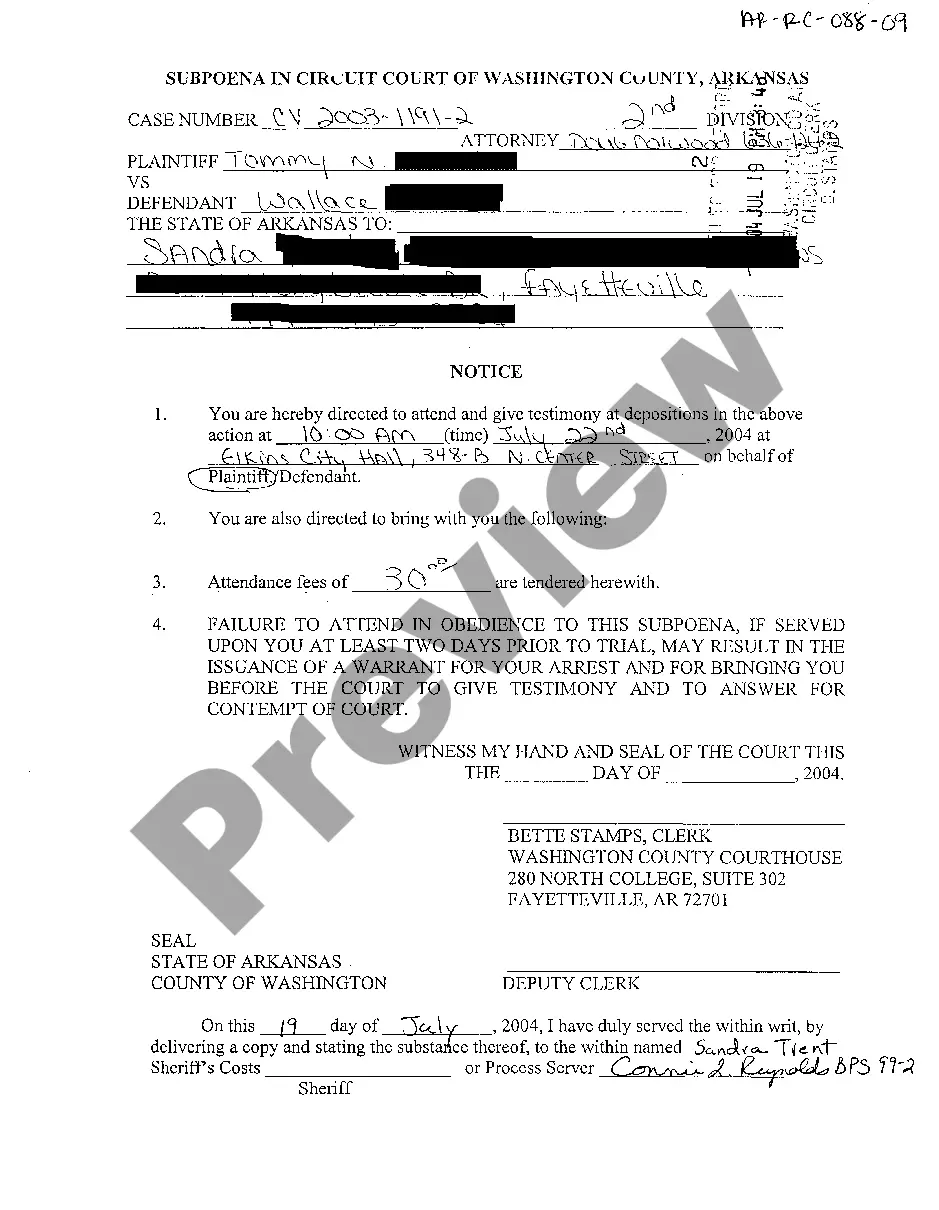

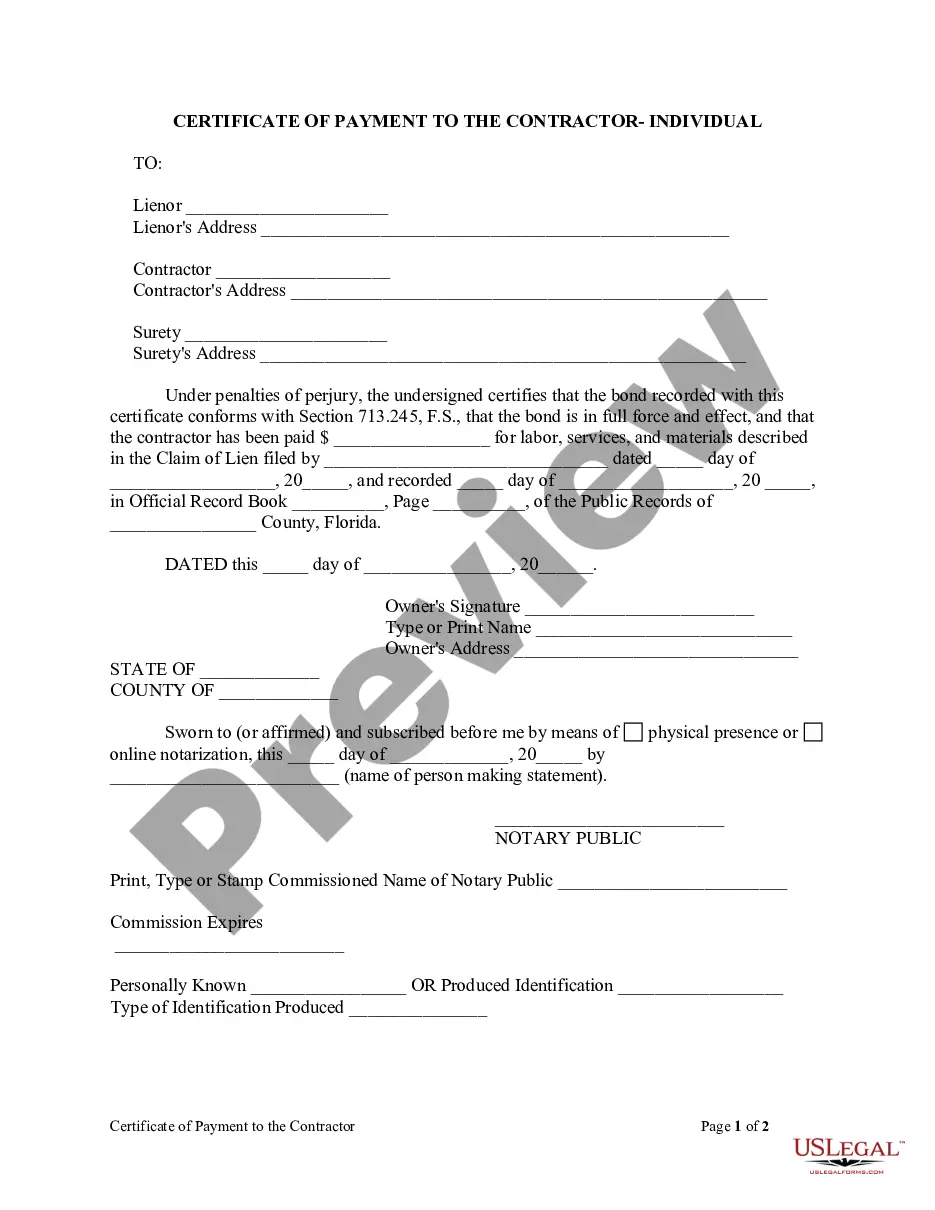

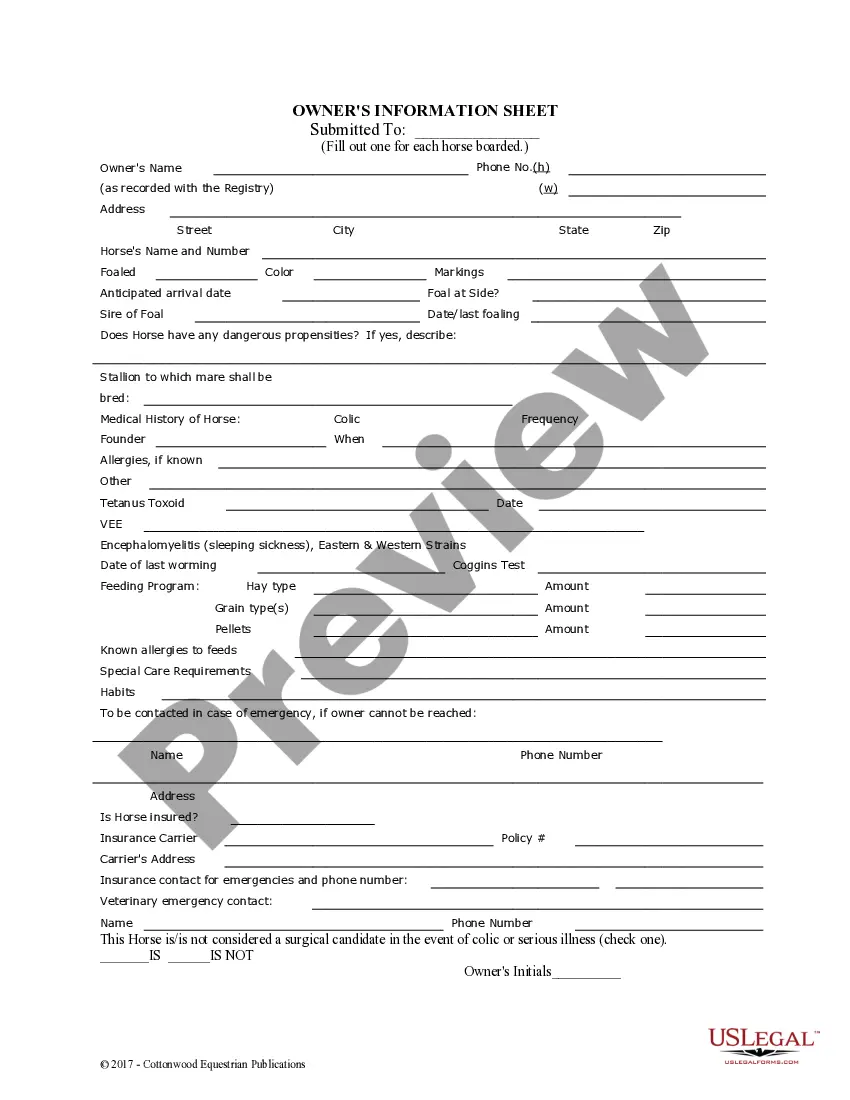

- Step 2. Use the Preview feature to review the form's content. Be sure to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In a Kentucky Owner Financing Contract for Mobile Home, the seller typically retains the deed until the buyer fulfills all payment obligations. This arrangement helps protect the seller's interests, as they can reclaim the property if the buyer defaults. Meanwhile, the buyer gains possession and rights to the home while making payments. This process offers a straightforward alternative for those seeking ownership without traditional financing.

Credit score requirements for financing a mobile home typically start around 580 for some lenders. Higher scores can improve your chances of obtaining favorable terms. However, when using a Kentucky Owner Financing Contract for Mobile Home, credit score considerations may be more flexible. Many sellers may be willing to work with you based on other factors, providing another pathway to ownership.

Banks often hesitate to finance mobile homes due to concerns about depreciation and resale value. Unlike traditional homes, manufactured homes may not appreciate or maintain their value in the same way. However, with a Kentucky Owner Financing Contract for Mobile Home, you can bypass traditional bank financing and work directly with sellers. This approach provides an excellent alternative for buyers seeking to secure their dream home.

Financing a manufactured home can be more challenging compared to traditional homes. Many lenders may view manufactured homes as less secure investments. However, a Kentucky Owner Financing Contract for Mobile Home can simplify this process. It offers flexible terms and allows buyers to negotiate directly with sellers, often eliminating some of the hurdles posed by conventional lending.

To write up an owner finance contract, first gather all essential information regarding the sale, including buyer and seller details, property specifics, and financing terms. Clearly state the responsibilities of each party, focusing on payment schedules and interest. Use a Kentucky Owner Financing Contract for Mobile Home as a template to ensure all elements are covered, making the process efficient.

Owner financing a mobile home starts with finding a buyer. Agree on terms such as down payment, monthly payments, and interest rate. Document these terms in a Kentucky Owner Financing Contract for Mobile Home to ensure legal protection and clarity. This method provides a great opportunity for sellers to reach a larger audience while offering financing flexibility.

Step 2: Multiply Loan Amount By The Interest Rate And Divide By 12. For example, if a seller-financed loan is for $100,000 at an interest rate of 8%, you would calculate that $100,000 x 0.08, which means $8,000 in interest for the year.

The seller's financing typically runs only for a fairly short term, such as five years, with a balloon payment coming due at the end of that period.

The seller's financing typically runs only for a fairly short term, such as five years, with a balloon payment coming due at the end of that period.

Here are three main ways to structure a seller-financed deal:Use a Promissory Note and Mortgage or Deed of Trust. If you're familiar with traditional mortgages, this model will sound familiar.Draft a Contract for Deed.Create a Lease-purchase Agreement.