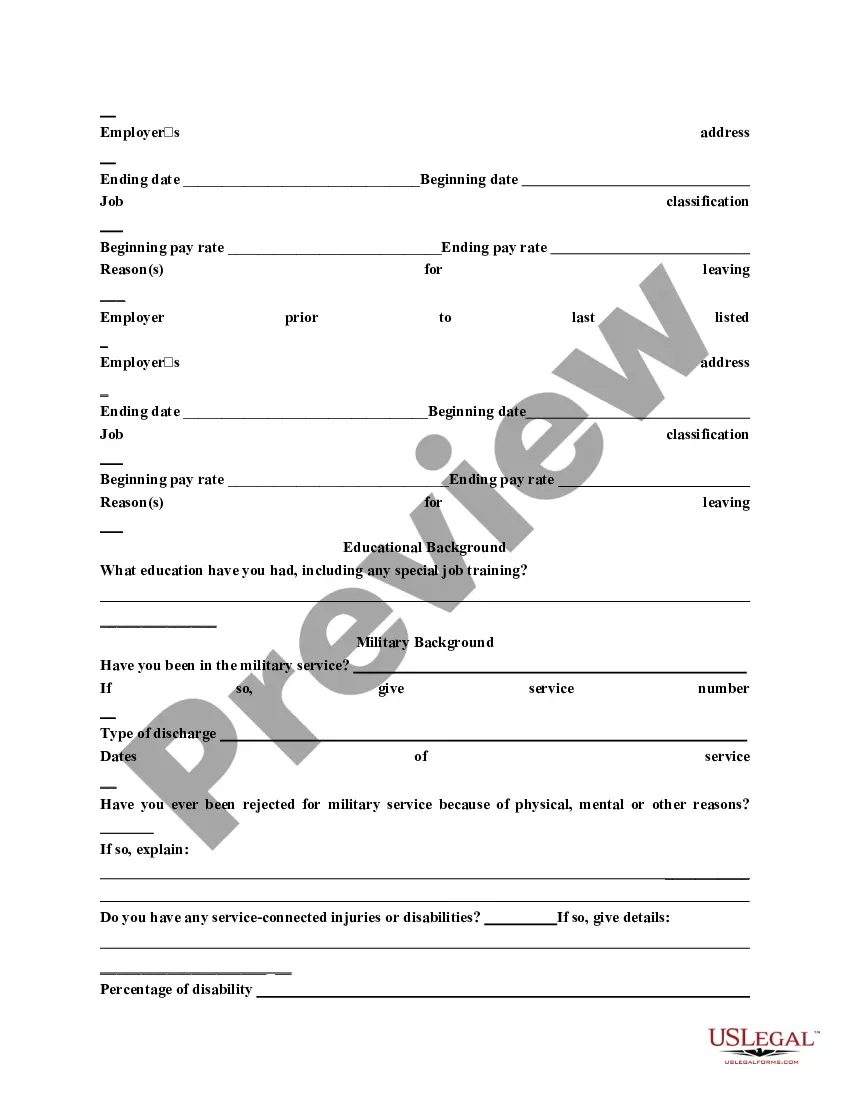

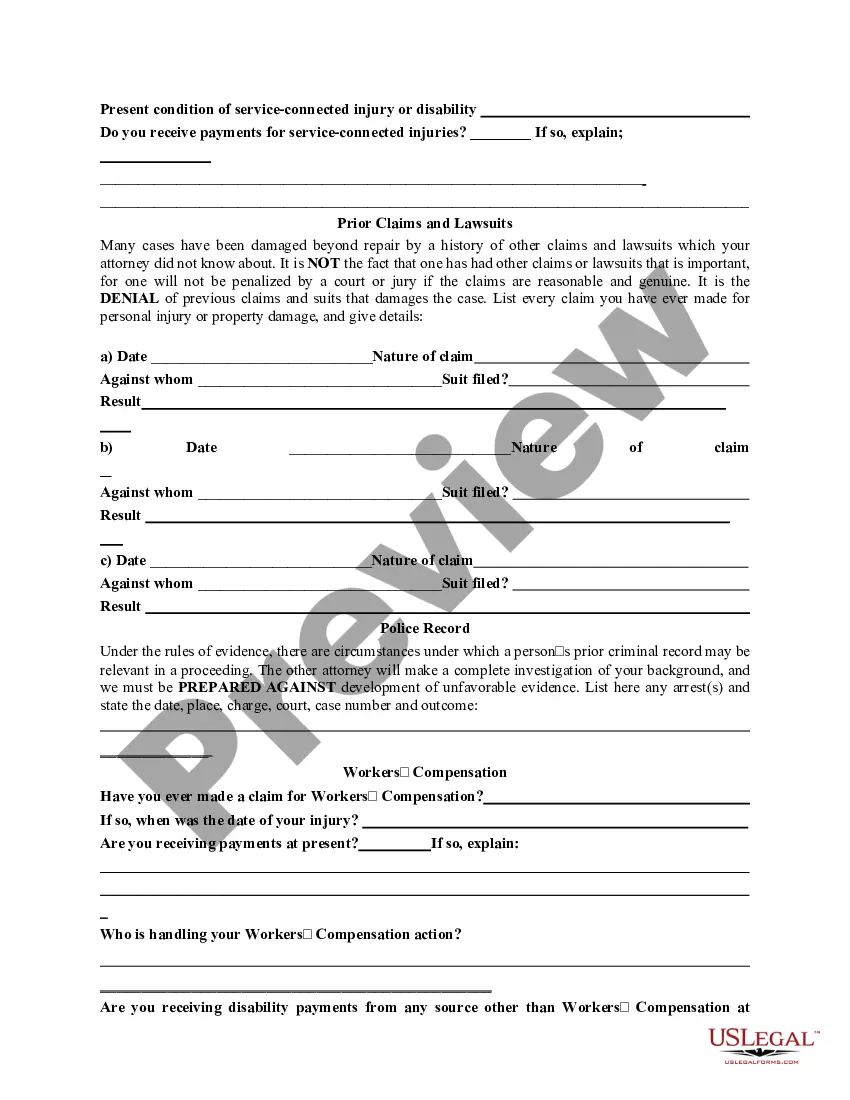

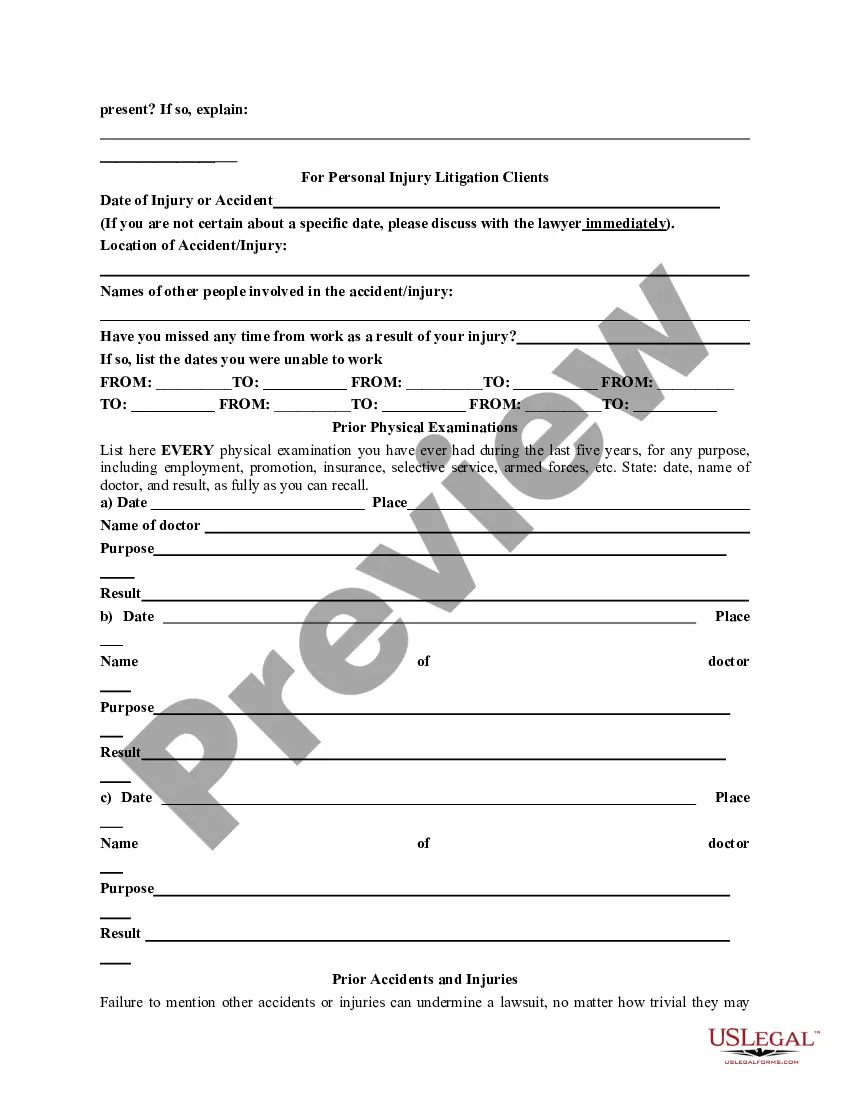

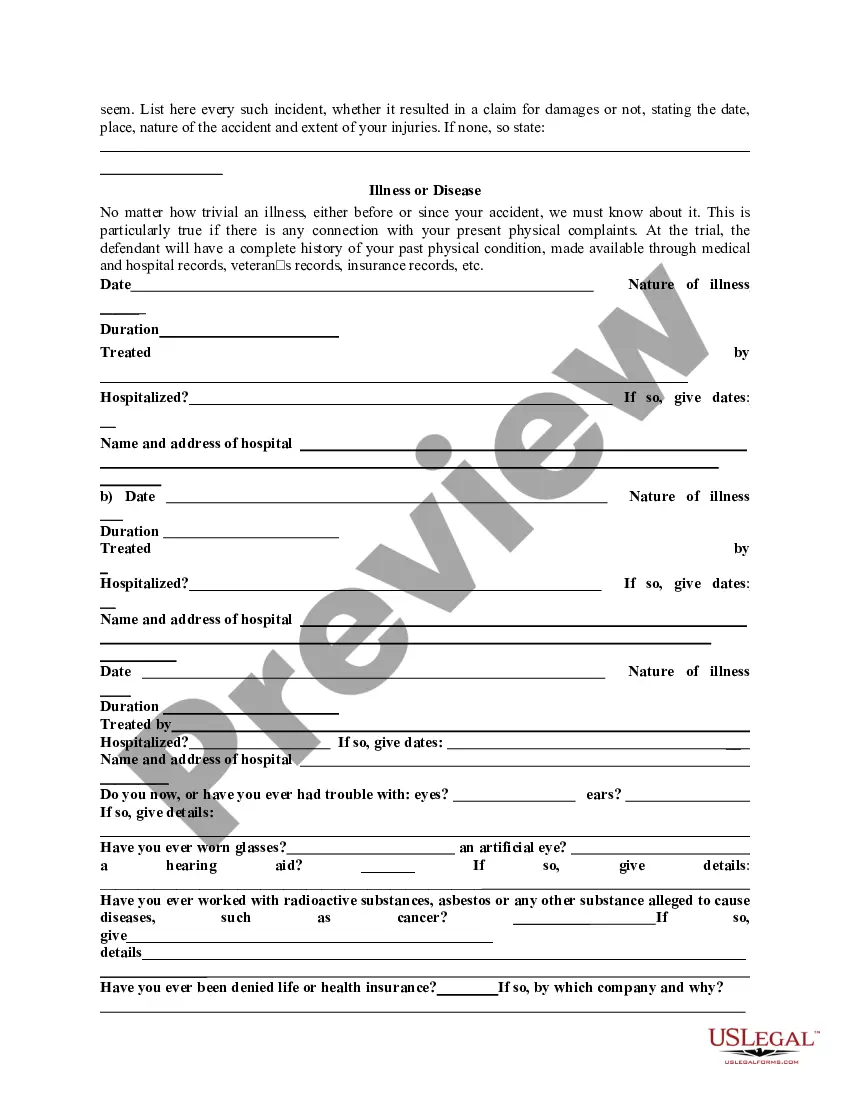

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Kentucky General Information Questionnaire

Description

How to fill out General Information Questionnaire?

Selecting the appropriate legal document design may be a challenge. Of course, there are numerous layouts available online, but how can you find the legal template you need? Utilize the US Legal Forms website. The service offers a vast array of layouts, including the Kentucky General Information Questionnaire, which can be utilized for both business and personal purposes. All of the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to download the Kentucky General Information Questionnaire. Use your account to review the legal forms you have previously acquired. Visit the My documents section of your account to get another copy of the documents you need.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure that you have selected the correct form for your city/state. You can preview the form using the Review button and read the form description to confirm this is suitable for you. If the form does not meet your needs, use the Search field to find the right form. Once you are confident that the form is appropriate, click the Get now button to acquire the form. Choose the pricing plan you require and enter the necessary details. Create your account and complete the transaction using your PayPal account or credit card. Select the document format and download the legal document design to your device. Complete, edit, print, and sign the obtained Kentucky General Information Questionnaire.

This platform is an invaluable resource for those seeking legally compliant documents tailored to various requirements.

- US Legal Forms is the largest collection of legal templates where you can find numerous document layouts.

- Utilize the service to obtain professionally crafted documents that comply with state regulations.

- Ensure you have selected the correct form for your needs.

- Preview and review the document before acquiring.

- Download the document in your preferred format.

- Complete and sign the document once downloaded.

Form popularity

FAQ

Non-residents and part-year residents must file an income tax return (Form 740-NP, Kentucky Nonresident and Part-Year Resident Individual Income Tax Return) if any gross income from Kentucky sources or other sources exceeds the modified gross income limits for their family size.

Kentucky has implemented an identity confirmation quiz. If you are selected to take an identity quiz you will receive an identity verification letter asking you to complete the quiz within 30 days. The quiz consists of multiple choice questions with answers that help us verify your identity.

These instructions have been designed for pass-through entities: S-corporations, partnerships, and general partnerships , which are required by law to file a Kentucky income tax and LLET return. Form PTE is complementary to the federal forms 1120S and 1065. .revenue.ky.gov.

The Identity Confirmation Quiz is one of the tools the Department has implemented. You may also mail all requested information that is applicable to your return. Refer to your Quiz letter. Note: The quiz verifies your identity and confirms the return we received was filed by you or on your behalf.

A single member LLC whose single member is an individual, estate, trust, or general partnership must file a Kentucky Single Member LLC Individually Owned Income and LLET Return (Form 725) or a Kentucky Single Member LLC Individually Owned LLET Return (Form 725-EZ) to report and pay any LLET that is due.

A Limited Liability Entity Tax (LLET) applies to both C corporations and Limited Liability Pass-Through Entities (LLPTEs) and is not an alternative to another tax. However, corporations paying the LLET are allowed to apply that amount as a credit towards its regular corporate income tax.

The LLET is a tax on the Kentucky gross receipts or gross profits (i.e., gross receipts less cost of goods sold, as that term is statutorily defined) from the sale of tangible property of each non-exempt corporation and limited liability tax pass-through entity (?LLPTE?), such as a limited liability company (?LLC?), ...

??Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources.