Are you currently in the situation that you need to have files for possibly business or personal functions almost every day time? There are a variety of legitimate file themes available on the Internet, but finding types you can rely isn`t simple. US Legal Forms gives 1000s of kind themes, like the Kentucky Agreement By Heirs to Substitute New Note for Note of Decedent, that are written in order to meet state and federal requirements.

In case you are previously acquainted with US Legal Forms site and get a free account, merely log in. Afterward, it is possible to down load the Kentucky Agreement By Heirs to Substitute New Note for Note of Decedent template.

Should you not have an profile and need to begin using US Legal Forms, abide by these steps:

- Get the kind you will need and make sure it is to the right metropolis/state.

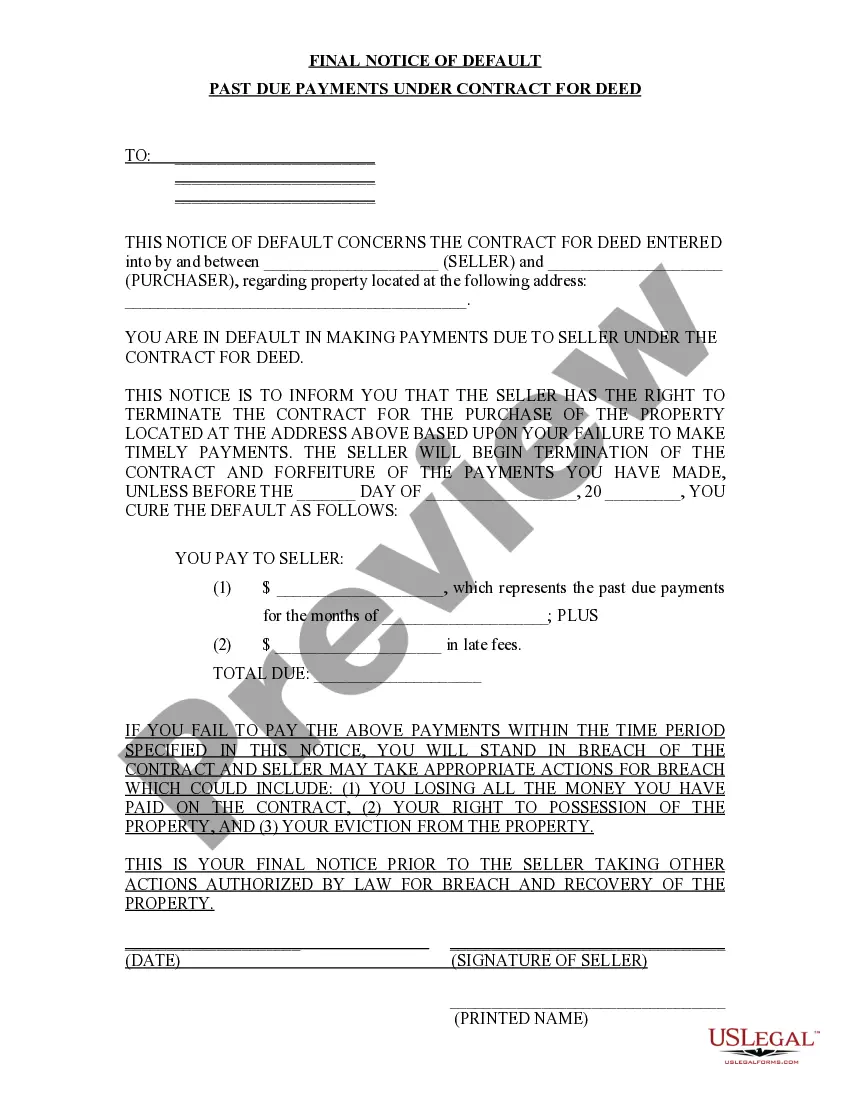

- Utilize the Preview key to check the shape.

- Browse the explanation to ensure that you have selected the correct kind.

- In the event the kind isn`t what you`re looking for, take advantage of the Lookup field to discover the kind that fits your needs and requirements.

- When you obtain the right kind, click on Purchase now.

- Choose the costs program you would like, submit the required information to generate your money, and pay for your order using your PayPal or Visa or Mastercard.

- Choose a hassle-free file file format and down load your version.

Discover all the file themes you possess purchased in the My Forms menu. You can aquire a further version of Kentucky Agreement By Heirs to Substitute New Note for Note of Decedent whenever, if needed. Just click the necessary kind to down load or printing the file template.

Use US Legal Forms, probably the most extensive collection of legitimate varieties, in order to save time and avoid faults. The services gives appropriately made legitimate file themes which you can use for an array of functions. Generate a free account on US Legal Forms and initiate generating your way of life a little easier.