Illinois Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Illinois Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Utilize US Legal Forms to obtain a printable Illinois Final Notice of Default for Outstanding Payments in relation to Contract for Deed.

Our court-admissible templates are created and periodically revised by experienced attorneys.

Ours is the most comprehensive Forms collection available online and offers affordable and precise samples for individuals and legal practitioners, as well as small and medium-sized businesses.

Tap Buy Now if it is the template you desire.

- The templates are organized into state-specific categories, and several of them may be previewed before downloading.

- To download templates, users must have a subscription and must Log In to their account.

- Click Download next to any form you require and access it in My documents.

- For those without a subscription, follow the guidelines below to quickly locate and download Illinois Final Notice of Default for Outstanding Payments in relation to Contract for Deed.

- Ensure you acquire the appropriate template pertaining to the required state.

- Examine the document by reading the description and using the Preview feature.

Form popularity

FAQ

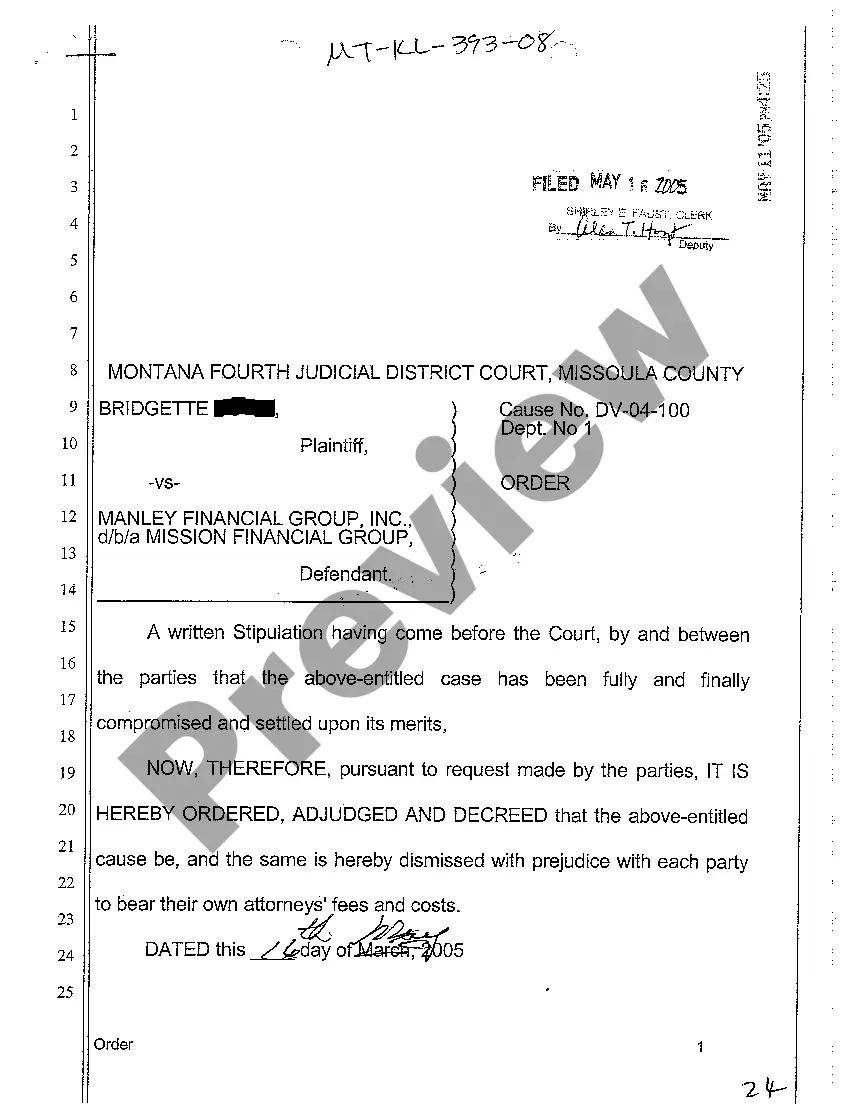

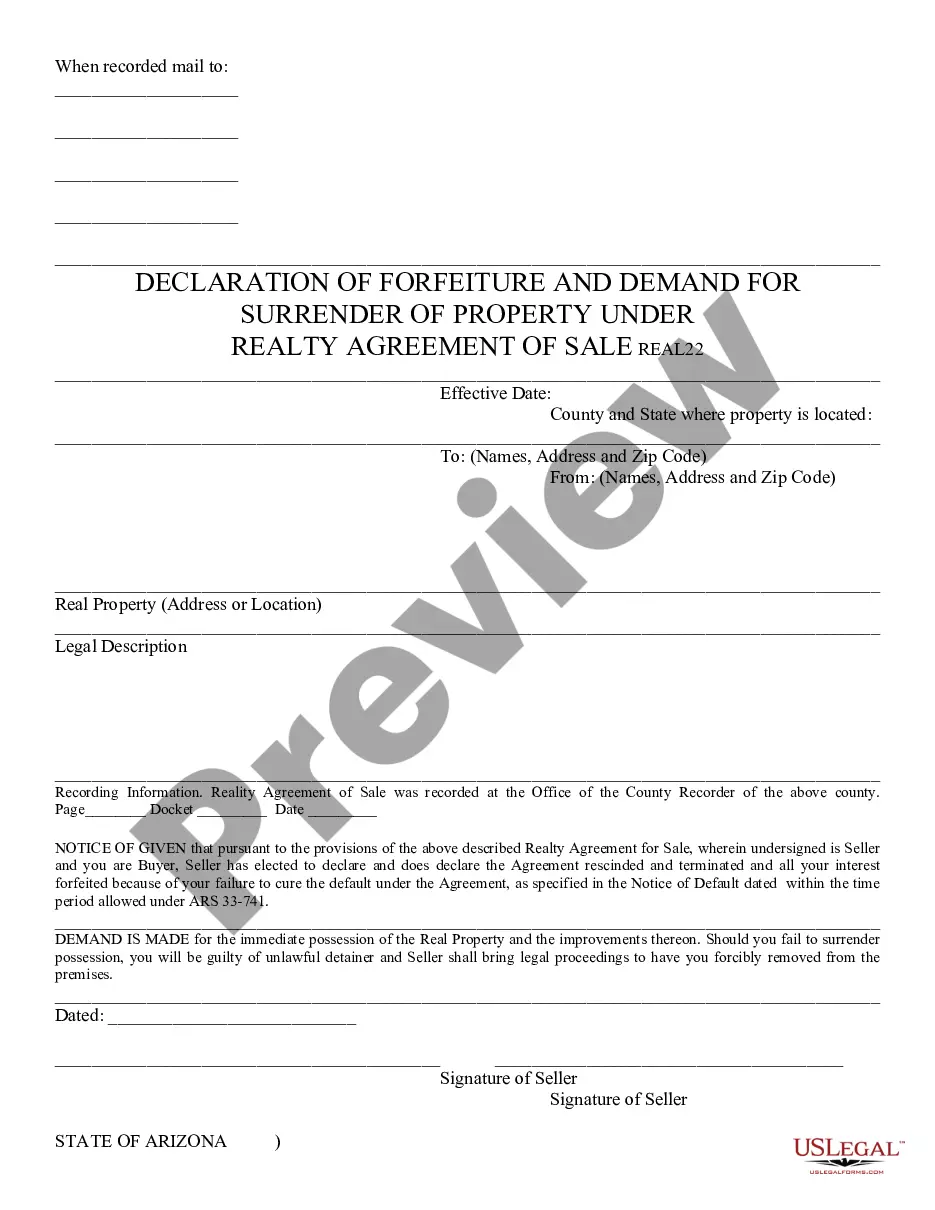

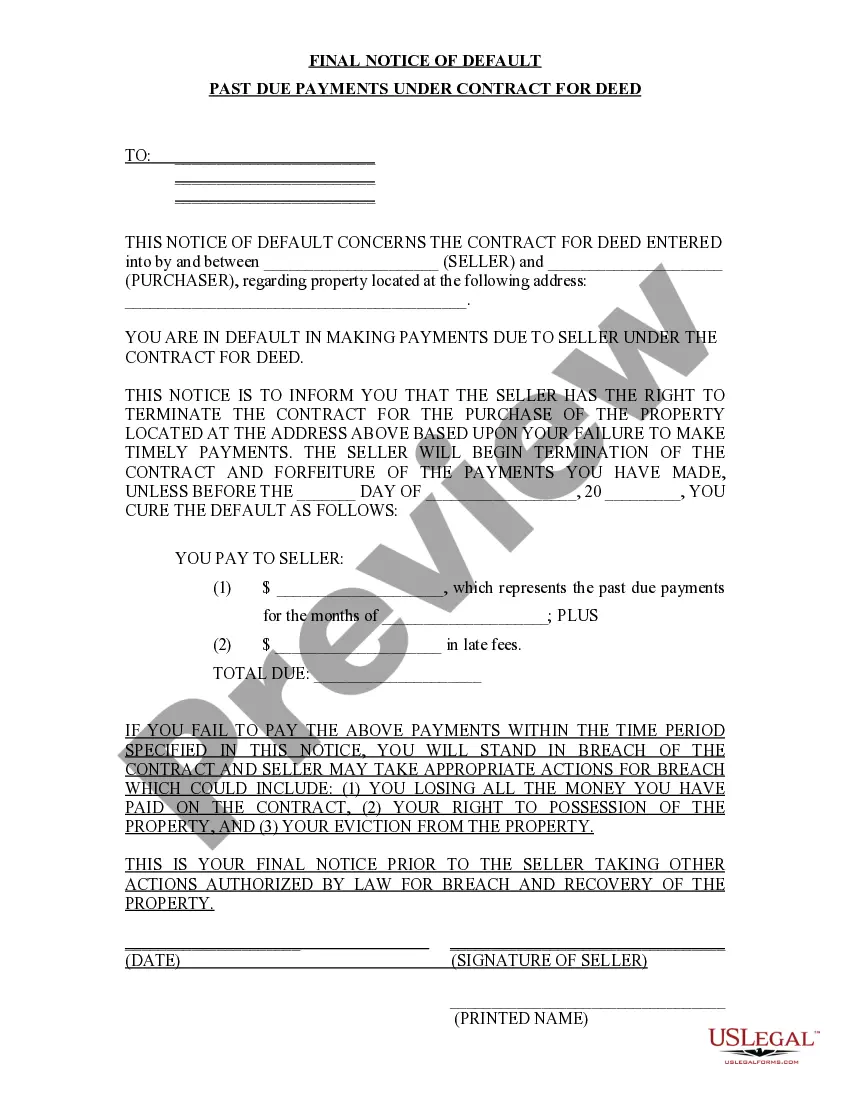

When a contract for deed is in default, the seller must provide the buyer with an Illinois Final Notice of Default for Past Due Payments. This notice gives the buyer an opportunity to remedy the default within a specified period. If the buyer fails to comply, the seller can initiate legal proceedings to regain possession and equitable title. It's essential for sellers to follow the correct legal processes to protect their rights.

A: Yes you can, but you will need a good real estate attorney to do this for you, one that can structure this type of transaction.Ask someone who has recently sold a home or property, if they would recommend an attorney to get started.

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.

This means that if you default and can?t make your payments, you lose the property and all of the money you have already paid into it (often including repairs and improvements). Unlike a traditional mortgage, a defaulting buyer in a contact for deed may only have 30-60 days to cure the default or move out.

Contact the other party and ask whether they are willing to negotiate the cancellation of the contract. Offer the other party an incentive to cancel the contract for deed.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.