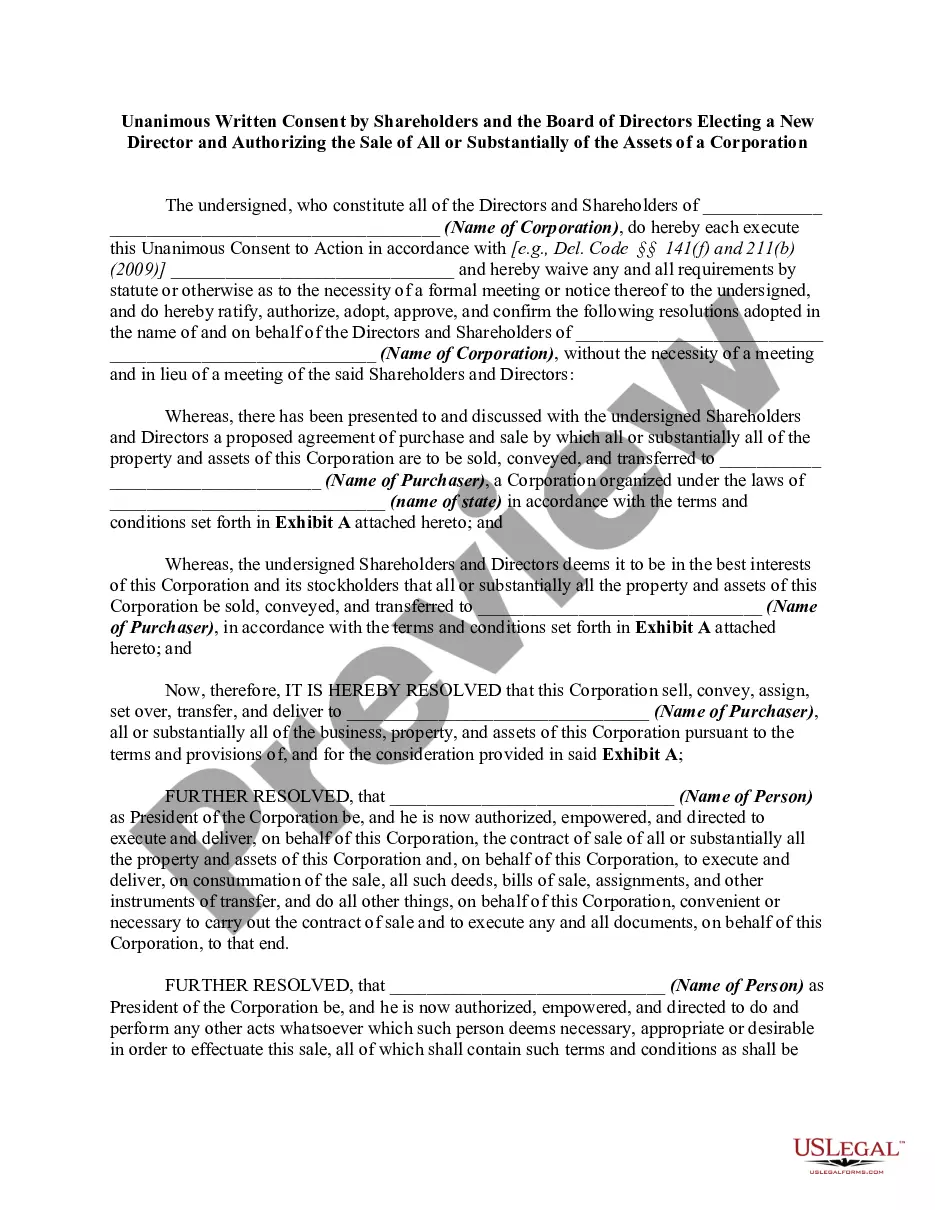

Kentucky Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

You might spend hours online searching for the legal document template that meets the federal and state criteria you need.

US Legal Forms provides thousands of legal forms that are reviewed by professionals.

You can easily download or print the Kentucky Agreement for Purchase of Business Assets from a Corporation from our platform.

If available, use the Review button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Kentucky Agreement for Purchase of Business Assets from a Corporation.

- Every legal document template you buy is yours for an extended period.

- To obtain an additional copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for the region/state you select.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

The acquired assets usually include all fixed assets (usually supported by a detailed list), all inventory, all supplies, tools, computers and related software, websites, all social media accounts used in connection with the Business, all permits, patents, trademarks, service marks, trade names (including but not

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

In an asset acquisition strategy a company chooses the assets, and sometimes liabilities, it wishes to obtain, as opposed to a traditional acquisition where it buys the entire company. Choosing the specific assets and liabilities reduces risk and potential losses.

Purchase acquisition accounting is now the standard way to record the purchase of a company on the balance sheet of the acquiring company. The assets of the acquired company are recorded as assets of the acquirer at fair market value. This method of accounting increases the fair market value of the acquiring company.

In an asset purchase or acquisition, the buyer only buys the specific assets and liabilities listed in the purchase agreement. So, it's possible for there to be a liability transfer from the seller to the buyer. Undocumented and contingent liabilities, however, are not included.

Here are several advantages of an asset purchase transaction: A major tax advantage is that the buyer can step up the basis of many assets over their current tax values and obtain tax deductions for depreciation and/or amortization.

Generally, stock purchases are more straightforward than asset purchases. The parties sign the Stock Purchase Agreement and related documents that outline the terms of the deal, and the seller(s) transfer the target company's stock to the purchaser. With this the purchaser assumes all the target company's liabilities.