Kentucky Officers Bonus in form of Stock Issuance - Resolution Form

Description

How to fill out Officers Bonus In Form Of Stock Issuance - Resolution Form?

Are you currently in a situation where you require documentation for an organization or individual that is used nearly all the time.

There are numerous official document templates accessible online, but locating ones that you can trust is not easy.

US Legal Forms provides a vast array of template documents, such as the Kentucky Officers Bonus in the form of Stock Issuance - Resolution Form, which are crafted to meet state and federal regulations.

Utilize US Legal Forms, the most comprehensive collection of legal templates, to save time and avoid errors.

The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Kentucky Officers Bonus in the form of Stock Issuance - Resolution Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

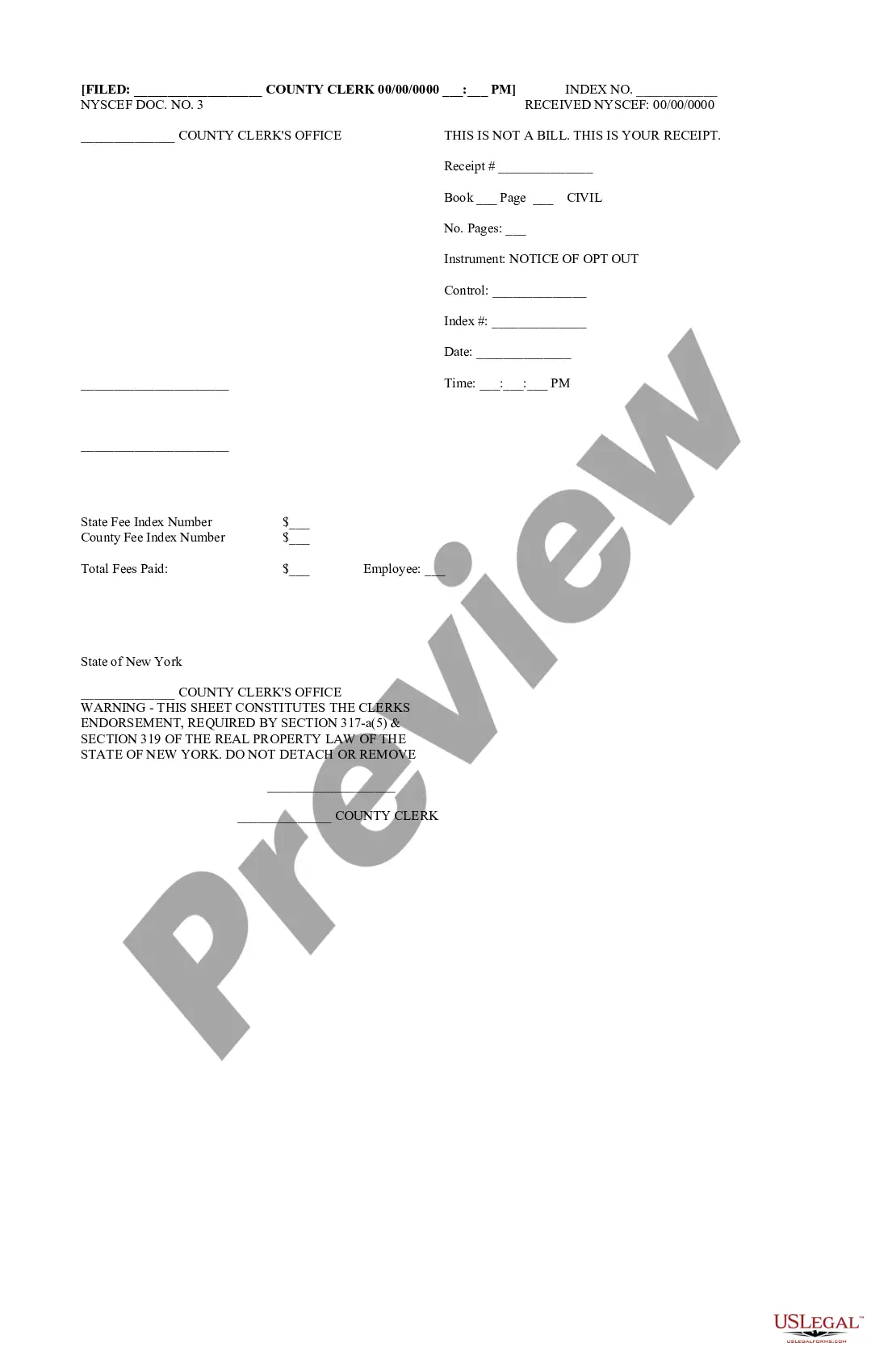

- Utilize the Review button to examine the form.

- Check the summary to confirm that you have selected the correct document.

- If the form is not what you are looking for, use the Search field to find the document that meets your requirements.

- Upon finding the appropriate form, click Buy now.

- Select the pricing plan you wish to choose, complete the required information to set up your account, and pay for your order using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can retrieve another copy of the Kentucky Officers Bonus in the form of Stock Issuance - Resolution Form anytime if needed. Just go through the necessary form to obtain or print the document template.

Form popularity

FAQ

Yes, Kentucky does offer automatic extensions for certain tax forms, including Ky Form 720. However, it is essential to submit a request for an extension before the original due date to avoid penalties. When dealing with complex scenarios like the Kentucky Officers Bonus in form of Stock Issuance - Resolution Form, taking advantage of an extension can be beneficial for thorough planning. For detailed assistance in managing extensions, consider the tools available on the US Legal Forms platform.

The tax rate for Ky Form 720 varies depending on the income levels and specific types of revenues reported. Typically, the rate can range from 5% to 6%, but it’s important to check the latest state guidelines for updates. If you are issuing Kentucky Officers Bonus in form of Stock Issuance - Resolution Form, understanding this tax rate will assist you in calculating potential liabilities accurately. Consulting resources on the US Legal Forms site can provide clarity on current rates.

Ky Form 720 is a crucial tax form in Kentucky used for reporting various taxes, including income tax, corporate taxes, and certain fees. For companies considering Kentucky Officers Bonus in form of Stock Issuance - Resolution Form, using Ky Form 720 correctly is vital for timely and accurate compliance. This form helps businesses outline their tax responsibilities so that both the state and the entity benefit. You can find the necessary resources for completing Ky Form 720 on the US Legal Forms website.

Kentucky Form 725 serves as the official document for reporting income distribution to partners and shareholders. This form becomes essential when dealing with bonuses, especially when issuing Kentucky Officers Bonus in form of Stock Issuance - Resolution Form. By completing this form, you ensure that the distribution is correctly reported to the state and complies with tax regulations. You can easily access this form and others on the US Legal Forms platform for a streamlined experience.

To report stock compensation accurately, you should complete the necessary documentation, including the Kentucky Officers Bonus in form of Stock Issuance - Resolution Form. This form outlines the details surrounding the stock issued as compensation for officers. After filling out the form, you will need to submit it according to IRS guidelines for reporting. Utilizing UsLegalForms can simplify the process, providing you with the correct form and guidance to ensure compliance.

Kentucky Form 720 ES serves as an estimated payment voucher for individuals and businesses. It is vital for managing tax obligations throughout the year rather than waiting until the end of the tax period. Utilizing the Kentucky Officers Bonus in form of Stock Issuance - Resolution Form can help ensure that you have a clear understanding of your expected liabilities and potential bonuses.

Kentucky generally does conform to Section 174, which relates to Research and Experimental expenditures. Understanding this conformity can help businesses make informed decisions regarding their investments. If you are exploring the Kentucky Officers Bonus in form of Stock Issuance - Resolution Form, look at how this section may play a role in your tax strategy.

Form 720 is a payment voucher for businesses in Kentucky to submit their tax payments. This form helps facilitate the payment process for taxes owed. When considering how to manage your accounting effectively, incorporating the Kentucky Officers Bonus in form of Stock Issuance - Resolution Form can offer additional financial strategies.

Kentucky offers various tax incentives that can act like bonuses for businesses that invest in certain sectors. These tax bonuses can reduce tax liabilities, making it beneficial to understand all available options. Make sure to explore how the Kentucky Officers Bonus in form of Stock Issuance - Resolution Form can create additional advantages for your organization.

Yes, Kentucky does recognize bonus depreciation, enabling businesses to take immediate deductions for certain capital investments. This provision can significantly benefit your tax situation, especially when filing for bonuses. Therefore, understanding how to apply the Kentucky Officers Bonus in form of Stock Issuance - Resolution Form can help you maximize your tax benefits.