Kentucky Computer Software License Agreement and Data Base Update Agreement

Description

How to fill out Computer Software License Agreement And Data Base Update Agreement?

If you wish to total, download, or print valid document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site’s simple and user-friendly search to find the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are unsatisfied with the form, utilize the Search area at the top of the screen to find additional forms in the legal form template.

Step 4. After you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your credentials to register for the account.

- Use US Legal Forms to obtain the Kentucky Software License Agreement and Database Update Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to retrieve the Kentucky Software License Agreement and Database Update Agreement.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

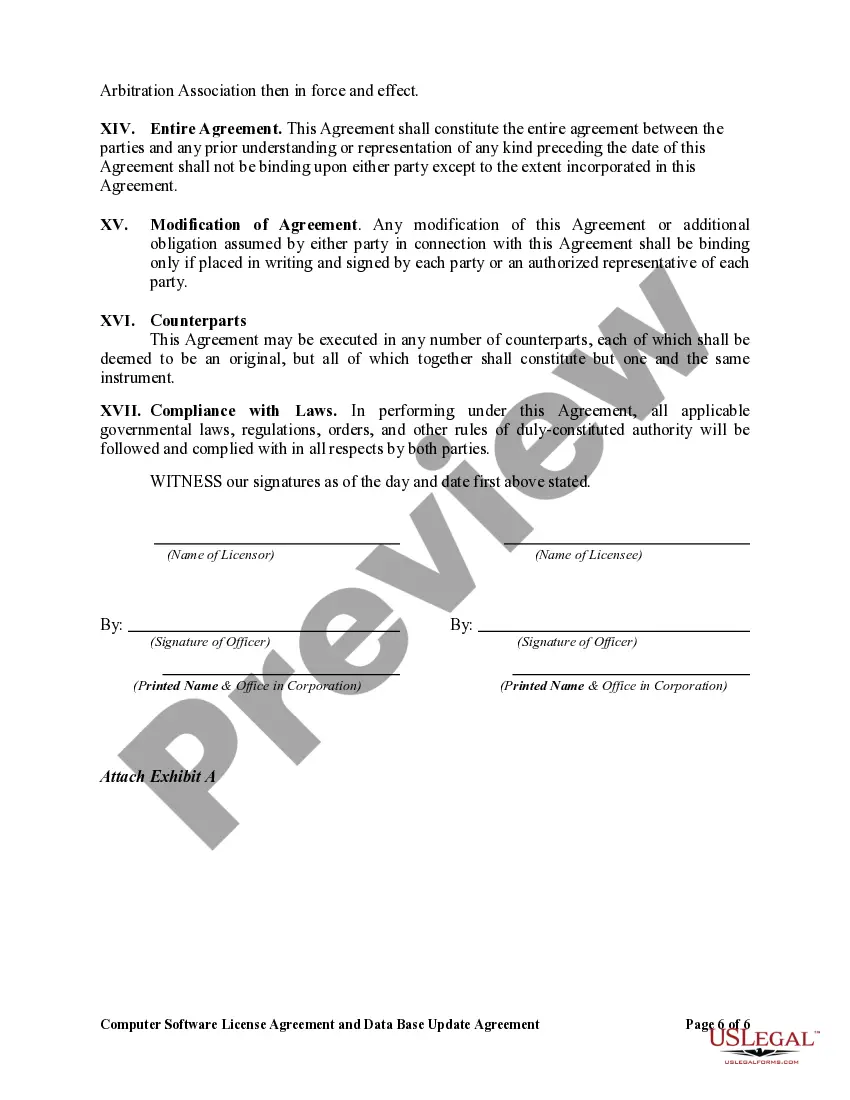

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

Form popularity

FAQ

Software license agreements function as contracts between the software creator and the end user. They outline how the software can be used, detailing rights and responsibilities. Understanding the provisions of a Kentucky Computer Software License Agreement and Data Base Update Agreement is crucial for compliance. It is advisable to consult resources or services, such as uslegalforms, to navigate agreement intricacies.

Before accepting an end user license agreement (EULA), carefully read its terms. Consider whether the agreement meets your requirements for using the software. If the Kentucky Computer Software License Agreement and Data Base Update Agreement does not align with your goals, you may want to negotiate or create a specialized version. Always make informed decisions about what you accept.

Creating a license agreement involves identifying key terms, such as ownership, user rights, and restrictions. Start by specifying the software and the permissions granted to users. It's essential to understand the nuances of a Kentucky Computer Software License Agreement and Data Base Update Agreement, ensuring all necessary elements are included. Using platforms like uslegalforms can simplify the process by providing templates and legal insights.

A license agreement serves to define the relationship between a software developer and the user. It establishes the terms under which the software can be used, protecting both parties' rights. Understanding the specifics of a Kentucky Computer Software License Agreement and Data Base Update Agreement ensures compliant use, ultimately safeguarding your interests. This agreement promotes fair practices in software usage.

Accepting Microsoft's license agreement depends on your needs. Review the terms to determine if they align with your intended use of their software. If you require customization or specific provisions, consider crafting your own Kentucky Computer Software License Agreement and Data Base Update Agreement instead. Always understand what you agree to before proceeding.

To write an effective end user license agreement (EULA), start by outlining your terms clearly. Include sections that define the software, user rights, limitations, and responsibilities. Keep your language simple and direct to ensure users understand the Kentucky Computer Software License Agreement and Data Base Update Agreement. For a streamlined process, consider using platforms like uslegalforms that offer templates and guidance.

Yes, software as a service (SaaS) is generally considered taxable in Kentucky. This applies to transactions governed by the Kentucky Computer Software License Agreement and Data Base Update Agreement. Ensure you keep informed about any changes in regulations and consult with a tax expert when necessary.

Software maintenance services are typically considered taxable in Kentucky. This includes update agreements in which the Kentucky Computer Software License Agreement and Data Base Update Agreement may apply. It’s essential to assess the details of your services and consult a tax expert to ensure compliance.

In Kentucky, many services are not subject to sales tax. However, certain services related to tangible goods and specific software agreements, such as the Kentucky Computer Software License Agreement and Data Base Update Agreement, may incur taxation. To ascertain the tax implications for your service offerings, consider reviewing Kentucky's tax regulations or consulting with a tax advisor.

Repairs performed on tangible personal property are generally taxable in Kentucky. This includes repairs associated with software solutions; however, specific agreements, like the Kentucky Computer Software License Agreement and Data Base Update Agreement, may have unique provisions. Consulting a tax professional can clarify whether your situation necessitates tax collection.