Kentucky Financial Statement Form - Husband and Wife Joint

Description

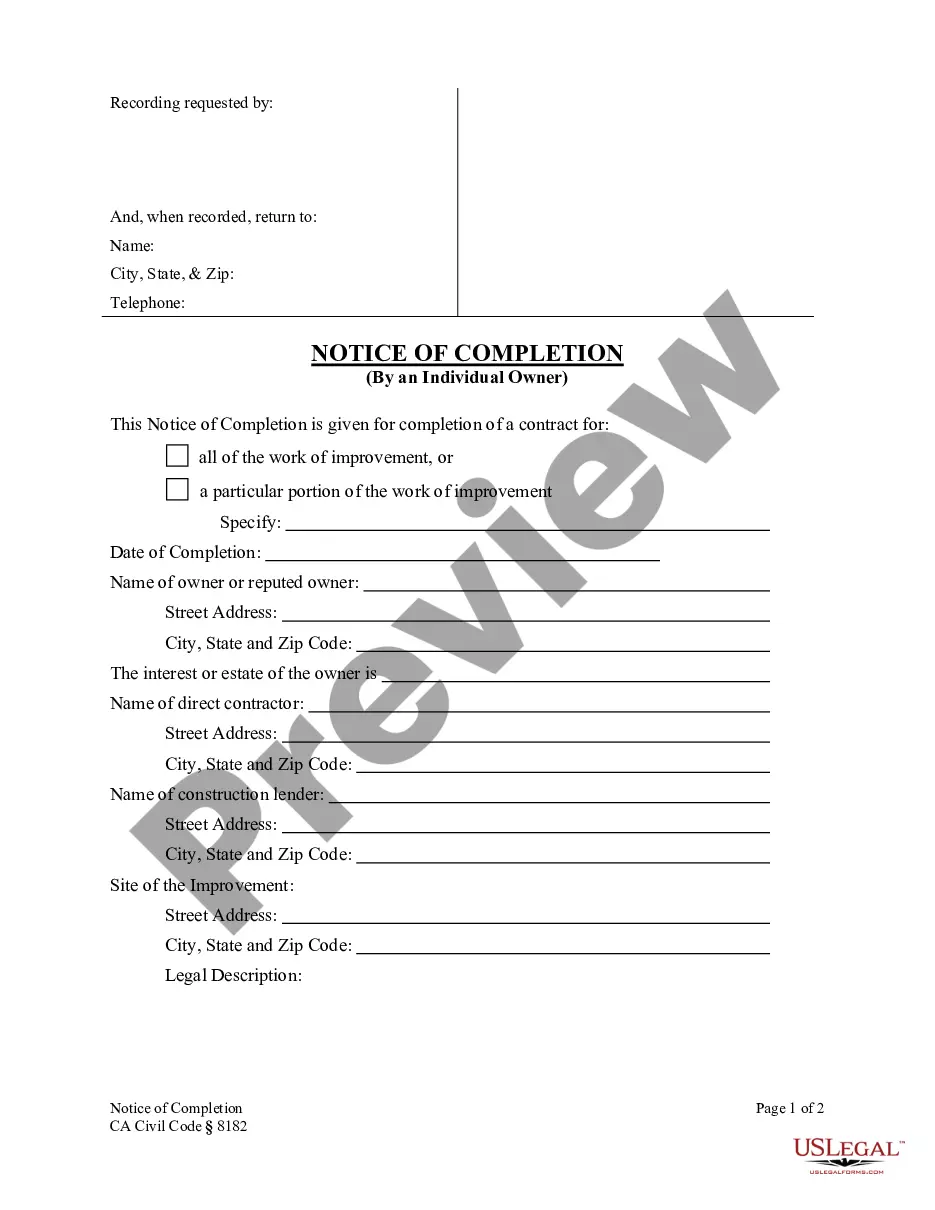

How to fill out Financial Statement Form - Husband And Wife Joint?

You can dedicate time online searching for the valid document template that meets the federal and state requirements that you need.

US Legal Forms offers thousands of valid documents that have been vetted by professionals.

You can easily download or print the Kentucky Financial Statement Form - Husband and Wife Joint from the services.

To find another version of the form, utilize the Search field to locate the template that satisfies your needs and requirements.

- If you possess a US Legal Forms account, you can sign in and select the Obtain option.

- Subsequently, you can complete, modify, print, or sign the Kentucky Financial Statement Form - Husband and Wife Joint.

- Every valid document template you purchase is yours forever.

- To have an additional copy of any purchased form, go to the My documents tab and choose the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Check the form description to verify that you have chosen the correct form.

Form popularity

FAQ

The statement of financial condition is a formal report that outlines an individual’s or couple's assets, liabilities, and equity at a given time. For those utilizing the Kentucky Financial Statement Form - Husband and Wife Joint, this document provides essential insights into the couple's joint financial situation. It allows them to track net worth over time and supports joint financial planning efforts. Using this statement strategically can enhance financial transparency and communication between partners.

Financial condition refers to the overall health of an individual or household's finances. It encompasses current income, debt levels, savings, and overall financial stability. By using tools like the Kentucky Financial Statement Form - Husband and Wife Joint, couples can evaluate their financial condition together. This evaluation can lead to better budgeting and financial decision-making, ensuring a secure future.

The main purpose of a statement of financial position (SOFP) is to provide a clear and concise snapshot of an individual's or couple's financial standing. For those completing the Kentucky Financial Statement Form - Husband and Wife Joint, this means listing all financial resources and obligations. Lenders often require this information to assess creditworthiness, confirming that the couple is financially stable. Thus, a well-prepared SOFP becomes a crucial document for joint financial planning.

A statement of financial condition, also known as a balance sheet, reflects the financial status of an individual or entity at a specific point in time. For couples filing jointly, such as with the Kentucky Financial Statement Form - Husband and Wife Joint, this document summarizes assets, liabilities, and equity. Understanding this statement helps both partners gain clarity about their combined financial health. Using this form can simplify discussions about finances in a marriage.

In Kentucky, a partnership typically files Form 765 to report income, deductions, and credits. This form is essential for partnerships to document their financial activities accurately. If you are a partner in a Kentucky-based business, ensure you understand how this interacts with your personal filings, including the Kentucky Financial Statement Form - Husband and Wife Joint. Consider using uslegalforms for guidance and detailed information.

Married couples may choose to file separately under various situations. For instance, if one spouse has significant medical expenses or miscellaneous deductions, filing separately might be advantageous. Moreover, if there are concerns about liability for the other’s tax obligations, separating the filings could provide clarity. Evaluating these factors while filling out the Kentucky Financial Statement Form - Husband and Wife Joint will help clarify the best path forward.

When you file married filing separately, you may forfeit several tax credits, including the Earned Income Tax Credit and education credits. Additionally, certain deductions may be limited or unavailable. Therefore, carefully consider your options and prepare your Kentucky Financial Statement Form - Husband and Wife Joint with all pertinent information in mind. Making informed decisions can help protect your financial interests.

There is no direct penalty for choosing to file separately when married in Kentucky. However, by doing so, you may miss out on certain tax benefits that couples filing jointly typically enjoy. It's crucial to consider the implications on your filing status when preparing your Kentucky Financial Statement Form - Husband and Wife Joint. Being informed will help you avoid unnecessary financial consequences.

Filing married filing separately may not always result in a larger refund. In fact, many couples find that they lose out on several valuable tax credits and deductions when choosing this option. Thus, it is essential to evaluate your financial situation and complete your Kentucky Financial Statement Form - Husband and Wife Joint efficiently. Consulting a tax professional can provide insights tailored to your circumstances.

Yes, you can file as married filing separately in Kentucky. This option may be suitable for various reasons, such as managing individual tax liabilities or dealing with personal financial issues. However, both parties will need to complete their own Kentucky Financial Statement Form - Husband and Wife Joint. Consider reviewing your situation carefully to decide if this option is right for you.