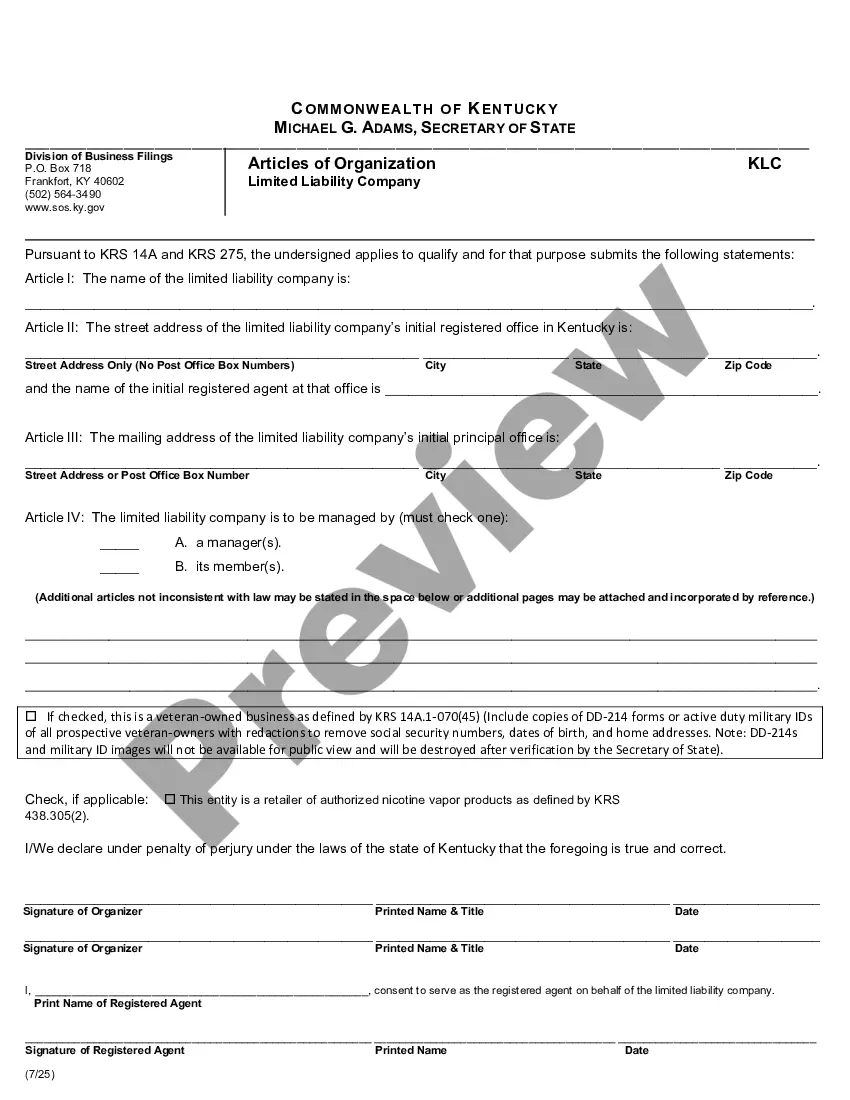

Articles of Organization contain the defining information for the PLLC. File the Articles with the Secretary of State to form the PLLC for the practice of a state-licensed profession.

Articles of Organization for a Kentucky Professional Limited Liability Company PLLC

Description

How to fill out Articles Of Organization For A Kentucky Professional Limited Liability Company PLLC?

Searching for Articles of Organization for a Kentucky Professional Limited Liability Company (PLLC) forms and completing them could be a challenge.

To save time, expenses, and effort, utilize US Legal Forms and locate the right template specifically for your state within just a few clicks.

Our legal experts prepare all documents, so you only need to complete them. It's truly that straightforward.

Choose your plan on the pricing page and set up your account. Select your payment method via card or PayPal. Download the file in your preferred format. You can print the Articles of Organization for a Kentucky Professional Limited Liability Company (PLLC) form or fill it out using any online editor. Don’t worry about typos, as your template can be used, submitted, and printed as many times as you need. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to download the sample.

- Your downloaded templates are saved in My documents and are available anytime for future use.

- If you haven’t registered yet, you need to create an account.

- Review our comprehensive instructions on how to acquire the Articles of Organization for a Kentucky Professional Limited Liability Company (PLLC) form in a few minutes.

- To obtain a valid template, confirm its applicability for your state.

- View the form using the Preview option (if available).

- If there's a description, read it to understand the key details.

- Click on the Buy Now button if you find what you're looking for.

Form popularity

FAQ

Alison Lundergan Grimes. Office of the Secretary of State. PO Box 718. Room 154, Capitol Building. 700 Capital Avenue. Frankfort, KY 40601. Room 154, Capitol Building. 700 Capital Avenue. Frankfort, KY 40601.

Do the Articles of Organization need to be notarized? Some states require that you have your Articles of Organization documents notarized. For your state's notarization requirements, choose your state from the drop-down list above.

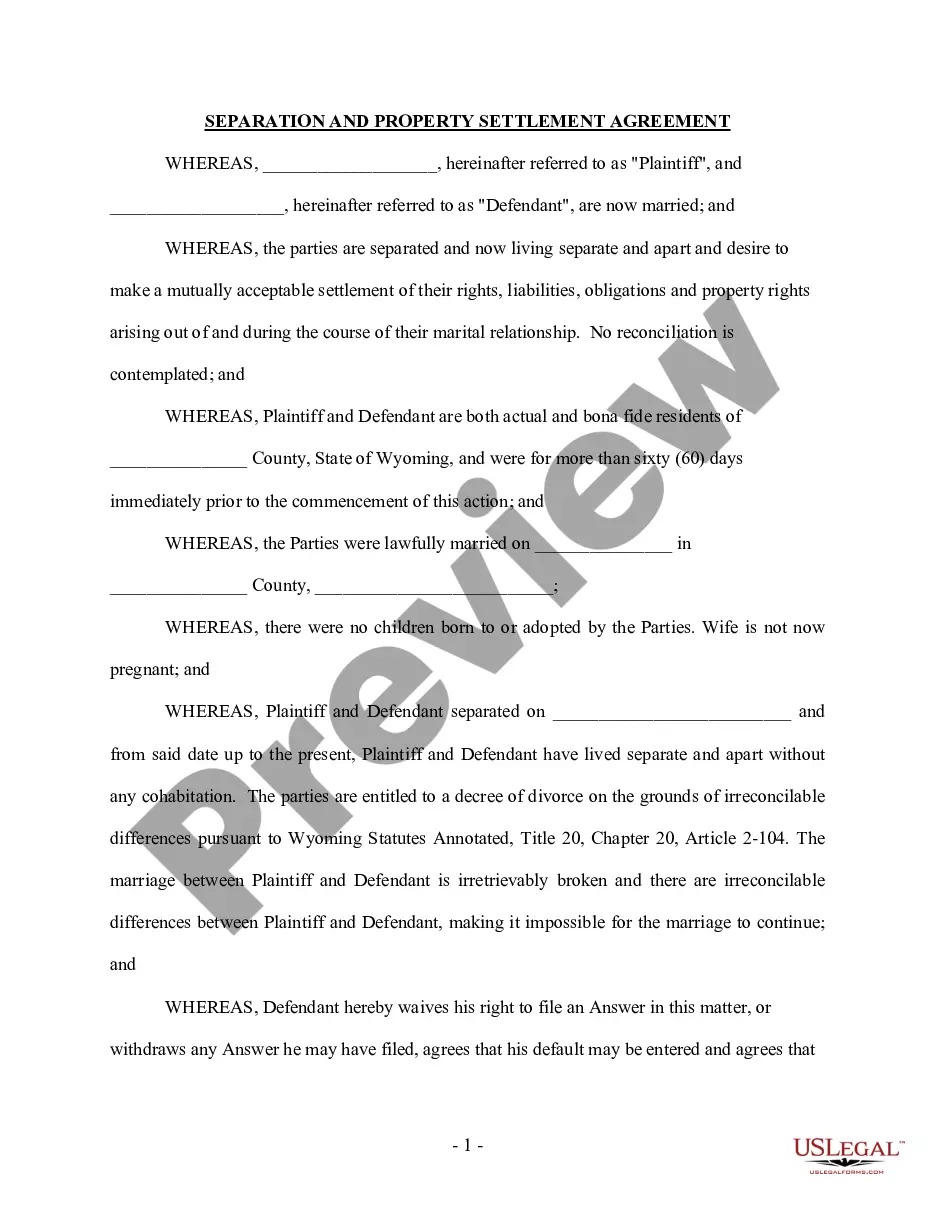

Regarding the management flexibility and taxation, a PLLC has the same advantages of an LLC. The difference between the two is that the PLLC has some restrictions on who may be a member of the PLLC and the limitation of liability of the members. With an LLC, anyone can be a member, or owner, of the business.

Some states require an LLC to draft an operating agreement and file it with the Secretary of State. Other states merely require the LLC have an operating agreement but have no filing requirement.LLCs are not corporations and do not use articles of incorporation. Instead, LLCs form by filing articles of organization.

Articles of organization are part of a formal legal document used to establish a limited liability company (LLC) at the state level. The materials are used to create the rights, powers, duties, liabilities, and other obligations between each member of an LLC and also between the LLC and its members.

Organizational documents for LLC primarily include an articles of organization that creates your LLC. An LLC is a legal entity created within the state you reside in and mixes aspects of a partnership and corporation.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

Obtain an EIN. Draft and Finalize Corporate Bylaws. Hold an Organization Meeting. Open a Business Bank Account. Apply for Any Licenses or Permits. Hold an Annual Shareholder Meeting. File an Annual Report.

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.