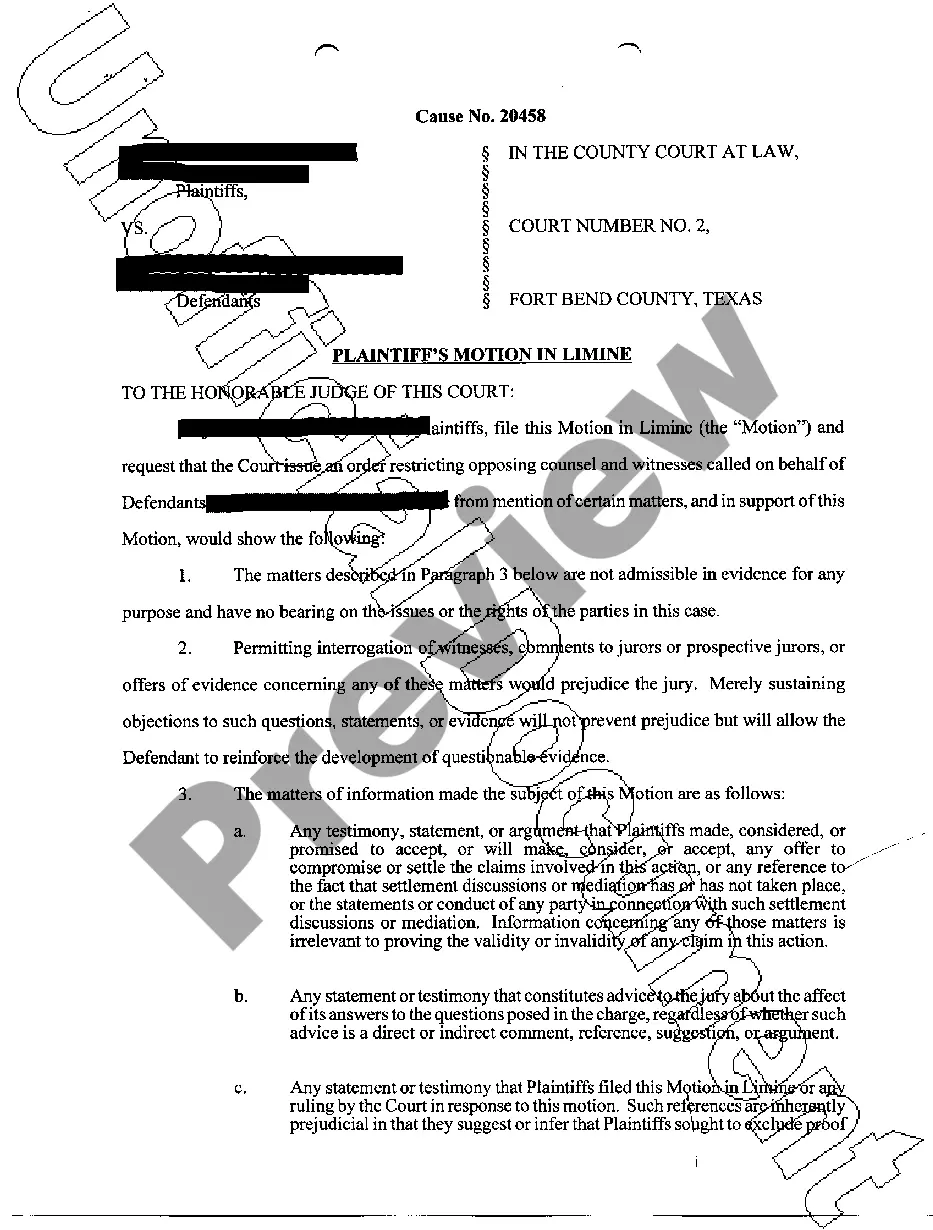

This memorandum offers an overview of the Initial Public Offering ("IPO") for a high-tech company. It addresses issues relating to the company, its disclosure policy, stock plans, insider trading policies and other "big picture" aspects of going public.

Kansas Comprehensive Pre-IPO Memo for High-Tech Companies

Description

How to fill out Comprehensive Pre-IPO Memo For High-Tech Companies?

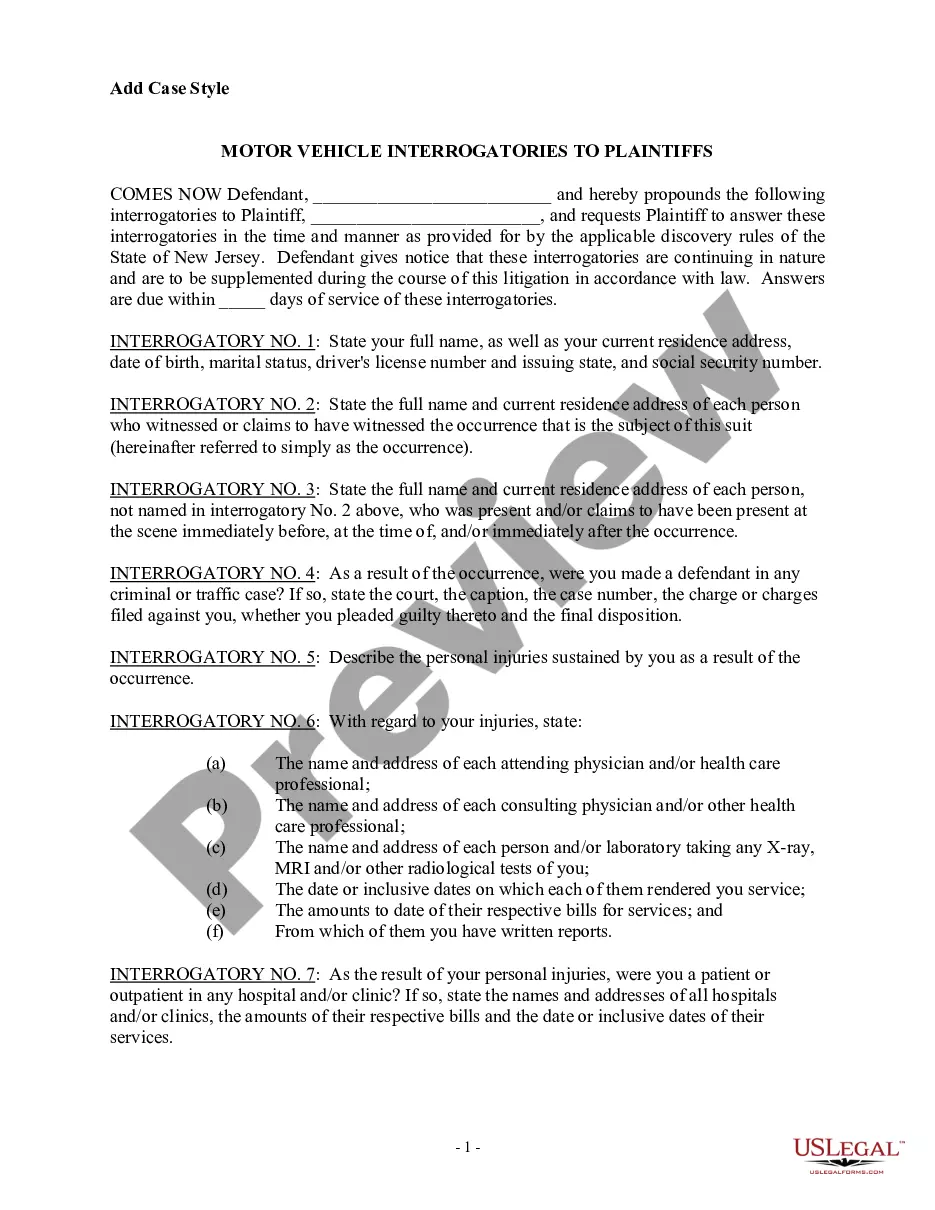

It is possible to spend time on the web looking for the lawful document design that meets the state and federal needs you want. US Legal Forms offers thousands of lawful kinds that happen to be reviewed by specialists. You can actually down load or print the Kansas Comprehensive Pre-IPO Memo for High-Tech Companies from our services.

If you currently have a US Legal Forms accounts, you may log in and click on the Download option. Next, you may complete, revise, print, or indicator the Kansas Comprehensive Pre-IPO Memo for High-Tech Companies. Every lawful document design you get is yours for a long time. To obtain one more duplicate of the obtained form, proceed to the My Forms tab and click on the related option.

If you work with the US Legal Forms site for the first time, keep to the simple guidelines under:

- Initial, make certain you have selected the correct document design to the county/area that you pick. Look at the form information to make sure you have picked the proper form. If available, take advantage of the Review option to appear through the document design too.

- If you wish to discover one more variation of the form, take advantage of the Search field to obtain the design that meets your requirements and needs.

- Once you have identified the design you need, just click Buy now to move forward.

- Pick the costs program you need, enter your accreditations, and register for an account on US Legal Forms.

- Full the deal. You can utilize your credit card or PayPal accounts to fund the lawful form.

- Pick the formatting of the document and down load it for your device.

- Make alterations for your document if needed. It is possible to complete, revise and indicator and print Kansas Comprehensive Pre-IPO Memo for High-Tech Companies.

Download and print thousands of document layouts utilizing the US Legal Forms website, that offers the biggest selection of lawful kinds. Use specialist and status-distinct layouts to tackle your organization or individual requires.

Form popularity

FAQ

IPO preparation process Develop a Strong Understanding of Your Index. Any equity index comes with its own requirements. ... Put Together Your IPO Team. A good team is as important for an IPO as it is for due diligence. ... Construct a Board of Directors. ... Get the Timing Right. ... Preparing the Roadshow. ... Ongoing Communication.

IPO preparation process Develop a Strong Understanding of Your Index. Any equity index comes with its own requirements. ... Put Together Your IPO Team. A good team is as important for an IPO as it is for due diligence. ... Construct a Board of Directors. ... Get the Timing Right. ... Preparing the Roadshow. ... Ongoing Communication.

Buying an IPO first starts with having a brokerage account. From there, you must ensure you meet the eligibility requirements of the IPO. You will then need to request the shares from your broker. A request does not ensure that you will have access to the shares as brokers typically get a set amount.

IPO placement is a sale of large blocks of stock in a company in advance of its listing on a public exchange. The purchaser gets the shares at a discount from the IPO price. For the company, the placement is a way to raise funds and offset the risk that the IPO will not be as successful as hoped.

Most pre-IPO investments are sold in 1 of 3 ways: Venture capital, private equity, angel investors ? These firms provide initial financing and acquire large blocks of shares. Stock options ? Stock options are granted to early employees as part of their compensation.