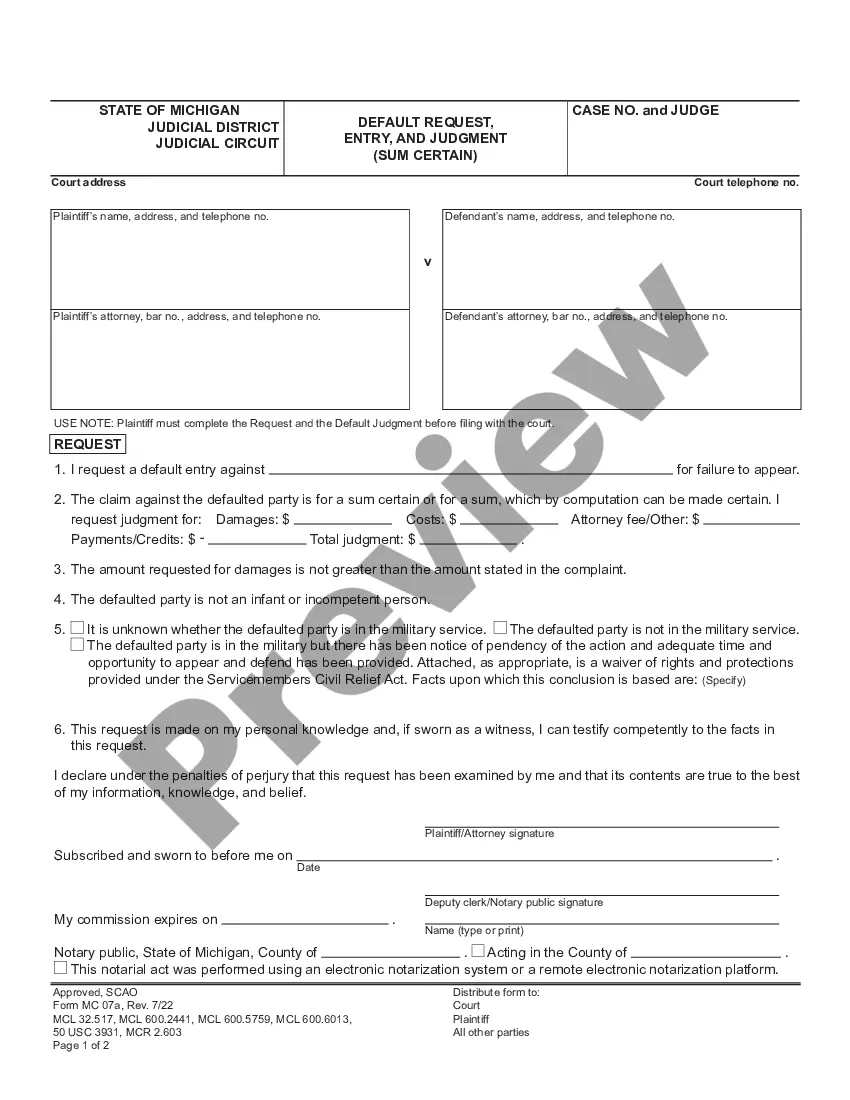

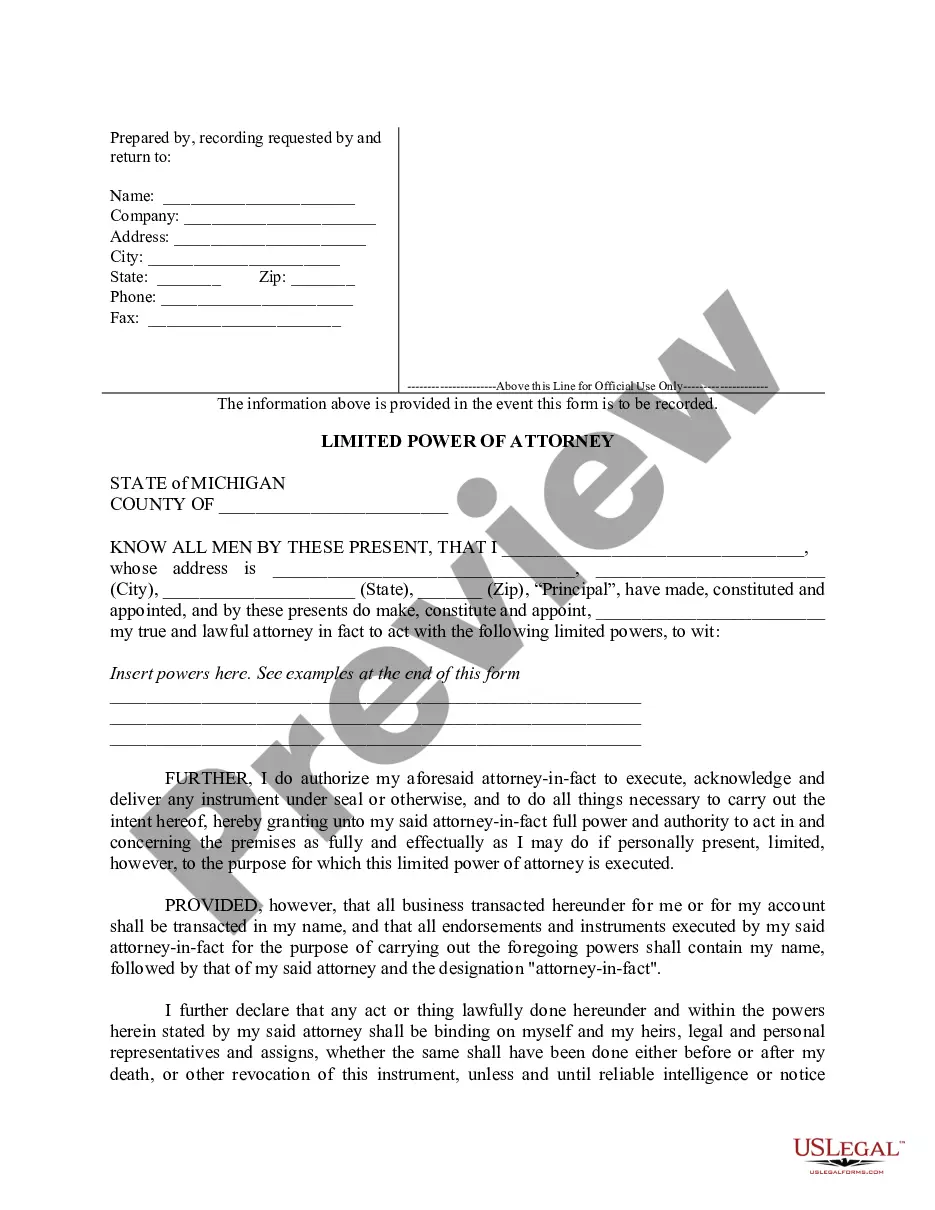

This office lease form is a tenant's letter of credit to the owner in the place of a security deposit. The letter of credit maintains effect at all times during the term of the lease following delivery thereof. A clean, unconditional and irrevocable letter of credit shall have an expiration date no earlier than the first anniversary of the date of issuance and shall provide that it shall be automatically renewed from year to year unless terminated by a bank by notice to the owner. The final expiration date of the letter of credit (including any renewals) shall be no earlier than sixty days after expiration date of lease.

Kansas Tenant Letter of Credit in Lieu of a Security Deposit

Description

How to fill out Tenant Letter Of Credit In Lieu Of A Security Deposit?

US Legal Forms - one of several most significant libraries of lawful kinds in the States - gives a wide range of lawful record layouts you are able to download or print. Utilizing the site, you can get thousands of kinds for company and specific uses, sorted by groups, suggests, or keywords and phrases.You can get the newest models of kinds such as the Kansas Tenant Letter of Credit in Lieu of a Security Deposit in seconds.

If you already possess a monthly subscription, log in and download Kansas Tenant Letter of Credit in Lieu of a Security Deposit in the US Legal Forms collection. The Download button can look on every single develop you see. You have access to all previously delivered electronically kinds within the My Forms tab of your respective accounts.

If you want to use US Legal Forms the very first time, listed here are easy guidelines to obtain began:

- Make sure you have picked out the right develop to your metropolis/state. Click on the Review button to analyze the form`s content. Look at the develop information to ensure that you have chosen the appropriate develop.

- In the event the develop does not match your requirements, make use of the Look for discipline near the top of the monitor to discover the one that does.

- Should you be content with the shape, validate your option by simply clicking the Acquire now button. Then, select the pricing prepare you prefer and offer your accreditations to sign up for the accounts.

- Process the transaction. Use your charge card or PayPal accounts to finish the transaction.

- Select the formatting and download the shape on the gadget.

- Make modifications. Load, change and print and indicator the delivered electronically Kansas Tenant Letter of Credit in Lieu of a Security Deposit.

Each design you added to your bank account does not have an expiry particular date which is yours for a long time. So, in order to download or print an additional copy, just proceed to the My Forms area and then click on the develop you will need.

Get access to the Kansas Tenant Letter of Credit in Lieu of a Security Deposit with US Legal Forms, the most considerable collection of lawful record layouts. Use thousands of specialist and express-specific layouts that fulfill your organization or specific requirements and requirements.

Form popularity

FAQ

58-2553 materially affecting health and safety, the tenant may deliver a written notice to the landlord specifying the acts and omissions constituting the breach and that the rental agreement will terminate upon a periodic rent-paying date not less than thirty (30) days after receipt of the notice.

58-2559 - Material noncompliance by landlord; notice; termination of rental agreement; limitations; remedies; security deposit. 58-2560 - Failure by landlord to deliver possession; remedies.

Kansas statute 58-2557 says a landlord has the right to enter the unit during ?reasonable hours? after providing ?reasonable notice? to the tenant.

Whereas a cash security deposit leaves the tenant's account and can tie up a considerable amount of working capital, a letter of credit keeps the money in their account where it can earn interest.

Landlords in Kansas must abide by a certain limit when it comes to charging tenants a security deposit. The specific amount depends on whether the unit is furnished or unfurnished. If furnished, the security deposit amount must not exceed the equivalent of 1.5X month's rent.

This notice states that if the breach is not solved in the next 14 days, then the lease between the tenant and landlord will end in 30 days. So if you serve or mail a 14/30-day notice to the landlord on the 31st and the problem is not solved by the 14th, then the lease would end on the 30th.

(g) not engage in conduct or allow any person or animal or pet, on the premises with the express or implied permission or consent of the tenant, to engage in conduct that will disturb the quiet and peaceful enjoyment of the premises by other tenants.

Your landlord has a right to enter the property that you rent from them. Normally, your landlord can only enter after giving you reasonable notice (often 24 hours), and entry into the residence should occur during reasonable hours (not too early or too late in the day).