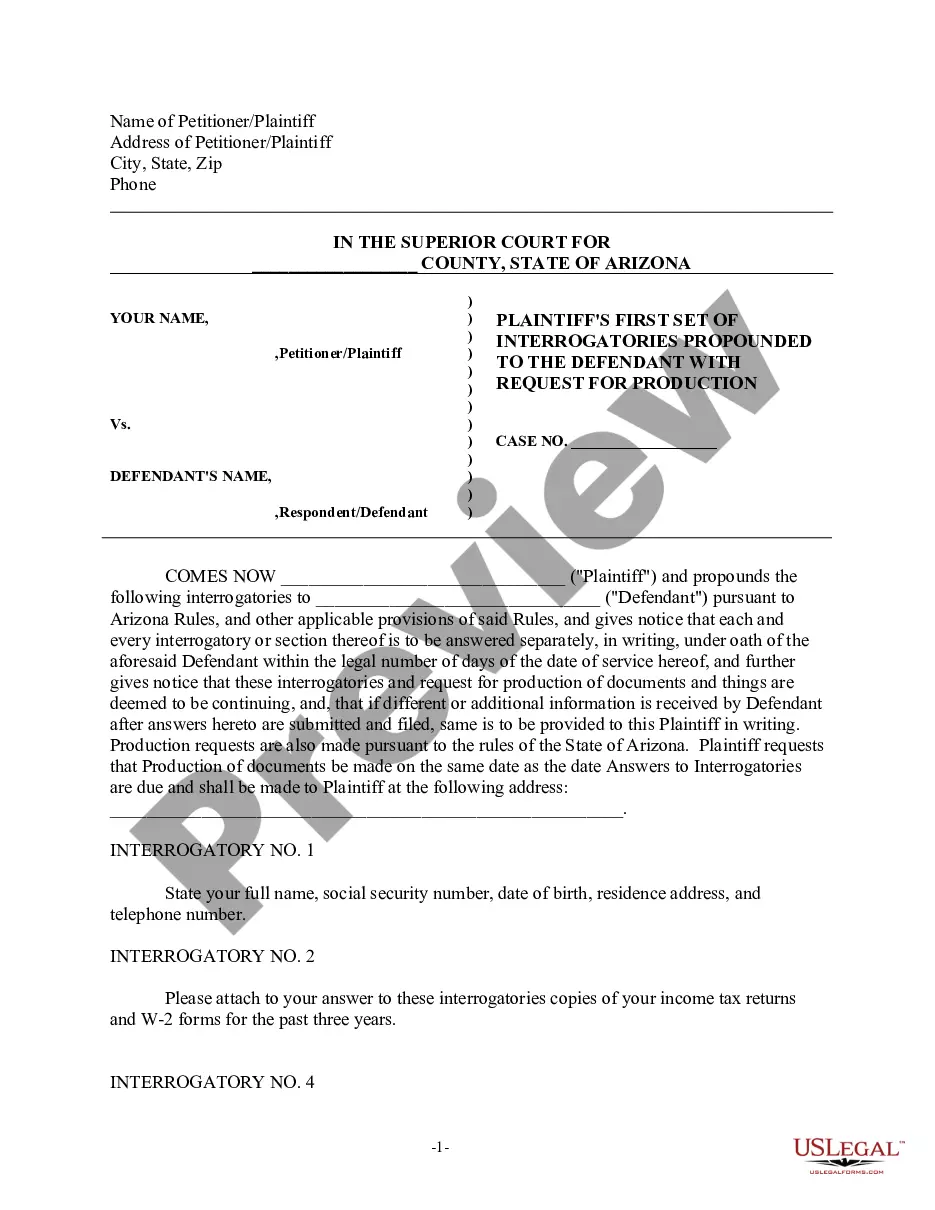

Kansas Release of Production Payment by Party Who Was Assigned or Reserved the Production Payment

Description

How to fill out Release Of Production Payment By Party Who Was Assigned Or Reserved The Production Payment?

You may commit hours on the Internet trying to find the legitimate document template that fits the state and federal needs you want. US Legal Forms gives 1000s of legitimate kinds which can be evaluated by pros. It is simple to down load or print out the Kansas Release of Production Payment by Party Who Was Assigned or Reserved the Production Payment from your assistance.

If you currently have a US Legal Forms profile, you are able to log in and then click the Obtain option. Following that, you are able to comprehensive, edit, print out, or indication the Kansas Release of Production Payment by Party Who Was Assigned or Reserved the Production Payment. Every single legitimate document template you purchase is yours permanently. To get yet another version of the bought develop, visit the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms site the first time, stick to the basic directions beneath:

- Very first, ensure that you have chosen the right document template for the county/city of your choosing. Read the develop explanation to ensure you have picked out the right develop. If offered, make use of the Preview option to search with the document template too.

- If you want to discover yet another version of your develop, make use of the Search field to obtain the template that suits you and needs.

- Upon having located the template you desire, just click Buy now to carry on.

- Select the costs strategy you desire, type in your credentials, and register for an account on US Legal Forms.

- Comprehensive the purchase. You can utilize your bank card or PayPal profile to pay for the legitimate develop.

- Select the structure of your document and down load it for your gadget.

- Make adjustments for your document if possible. You may comprehensive, edit and indication and print out Kansas Release of Production Payment by Party Who Was Assigned or Reserved the Production Payment.

Obtain and print out 1000s of document templates making use of the US Legal Forms web site, which offers the greatest variety of legitimate kinds. Use skilled and express-certain templates to handle your business or person demands.

Form popularity

FAQ

(1) The term production payment means, in general, a right to a specified share of the production from mineral in place (if, as, and when produced), or the proceeds from such production. Such right must be an economic interest in such mineral in place.

A quick definition of production payment: A production payment is a type of agreement in the oil and gas industry where a person or company receives a share of the oil and gas produced from a property. This share is given without having to pay for the costs of production.

What Is Volumetric Production Payment? A Volumetric Production Payment (VPP) is a type of structured investment that involves the owner of an oil or gas interest selling or borrowing money against a specific volume of production associated with that field or property.

A volumetric production payment (VPP) is a means of financing used predominantly in the oil and gas industry wherein the owner of an oil or gas property sells a percentage of the total production for an upfront cash payment. It allows the issuer to monetize his/her assets without diluting his control on them.