Kansas Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor

Description

How to fill out Partial Release Of Mortgage / Deed Of Trust On A Mineral / Royalty Interest Sold By Grantor?

Choosing the best lawful document web template could be a have a problem. Of course, there are a lot of templates available online, but how will you discover the lawful kind you require? Make use of the US Legal Forms website. The support provides 1000s of templates, such as the Kansas Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor, that you can use for company and private requirements. All the forms are checked out by pros and fulfill state and federal needs.

Should you be currently authorized, log in to the profile and then click the Down load button to obtain the Kansas Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor. Use your profile to look from the lawful forms you might have ordered formerly. Visit the My Forms tab of your own profile and get an additional copy of your document you require.

Should you be a brand new user of US Legal Forms, here are straightforward instructions that you should follow:

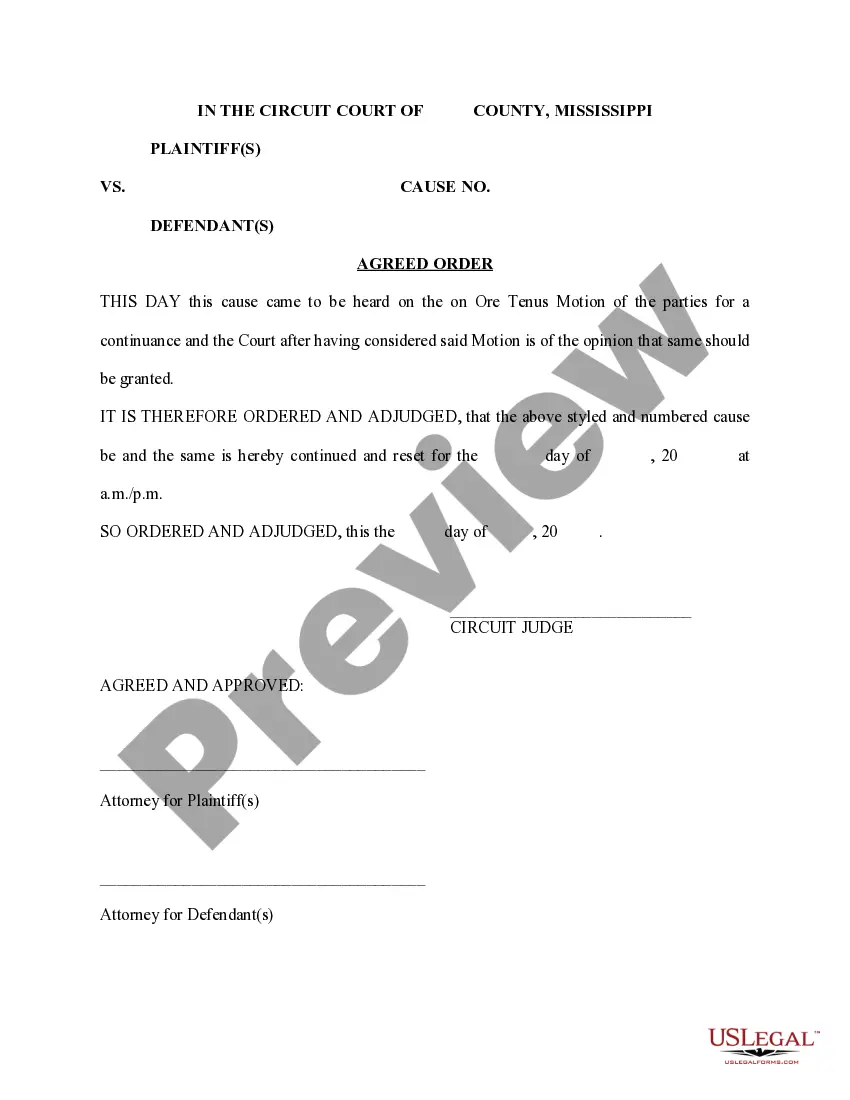

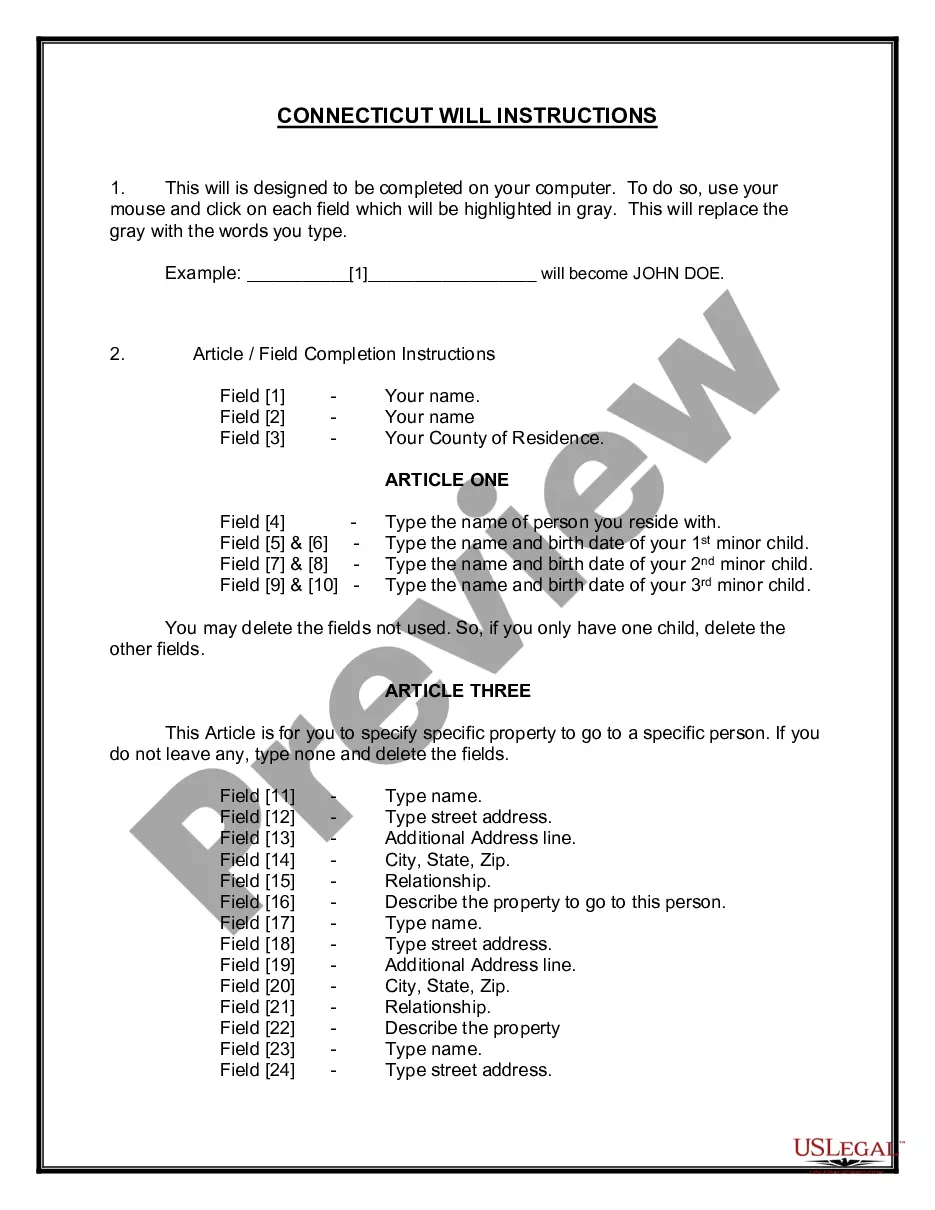

- Very first, make sure you have selected the proper kind for the town/area. You are able to look over the form making use of the Review button and read the form explanation to make certain it will be the best for you.

- If the kind is not going to fulfill your requirements, use the Seach discipline to discover the right kind.

- When you are positive that the form is acceptable, click the Purchase now button to obtain the kind.

- Opt for the costs strategy you want and enter the required information. Design your profile and purchase your order making use of your PayPal profile or bank card.

- Choose the data file formatting and acquire the lawful document web template to the system.

- Comprehensive, modify and print and sign the received Kansas Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor.

US Legal Forms will be the biggest collection of lawful forms in which you can find various document templates. Make use of the company to acquire professionally-manufactured files that follow condition needs.

Form popularity

FAQ

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults. What is a Deed of Trust? | LendingTree lendingtree.com ? deed-of-trust-vs-mortgage lendingtree.com ? deed-of-trust-vs-mortgage

Mortgages are used, but they are rare. A security deed (deed to secure debt) is the customary security instrument in Georgia. Georgia does not use a Deed of Trust. Two witnesses are required to witness the signature of the grantor for a security deed to be recorded.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ... Deed of trust (real estate) - Wikipedia wikipedia.org ? wiki ? Deed_of_trust_(real_est... wikipedia.org ? wiki ? Deed_of_trust_(real_est...

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

Georgia is a redeemable deed state, which means that they sell you the deed, but the property owner is given a year to redeem it. If the property owner redeems, then you get all of your money back plus 20%. Is Georgia a Tax Lien or Tax Deed State? - Get a Free Course tedthomas.com ? is-georgia-a-tax-lien-or-tax-deed... tedthomas.com ? is-georgia-a-tax-lien-or-tax-deed...

With a deed of trust, a trustee holds the interest. With a mortgage, the bank holds an interest. This means that if you have a mortgage, you are directly giving the bank your money, rather than having a trustee hold onto it until the bank or courts need it.

A mortgage or deed of trust is an agreement in which a borrower puts up title to real estate as security (collateral) for a loan. People often refer to a home loan as a "mortgage." But a mortgage isn't a loan agreement. The promissory note promises to repay the amount you borrowed to buy a home. What's the Difference Between a Mortgage and Deed of Trust? Nolo ? legal-encyclopedia ? whats-t... Nolo ? legal-encyclopedia ? whats-t...