Kansas Self-Employed Utility Services Contract

Description

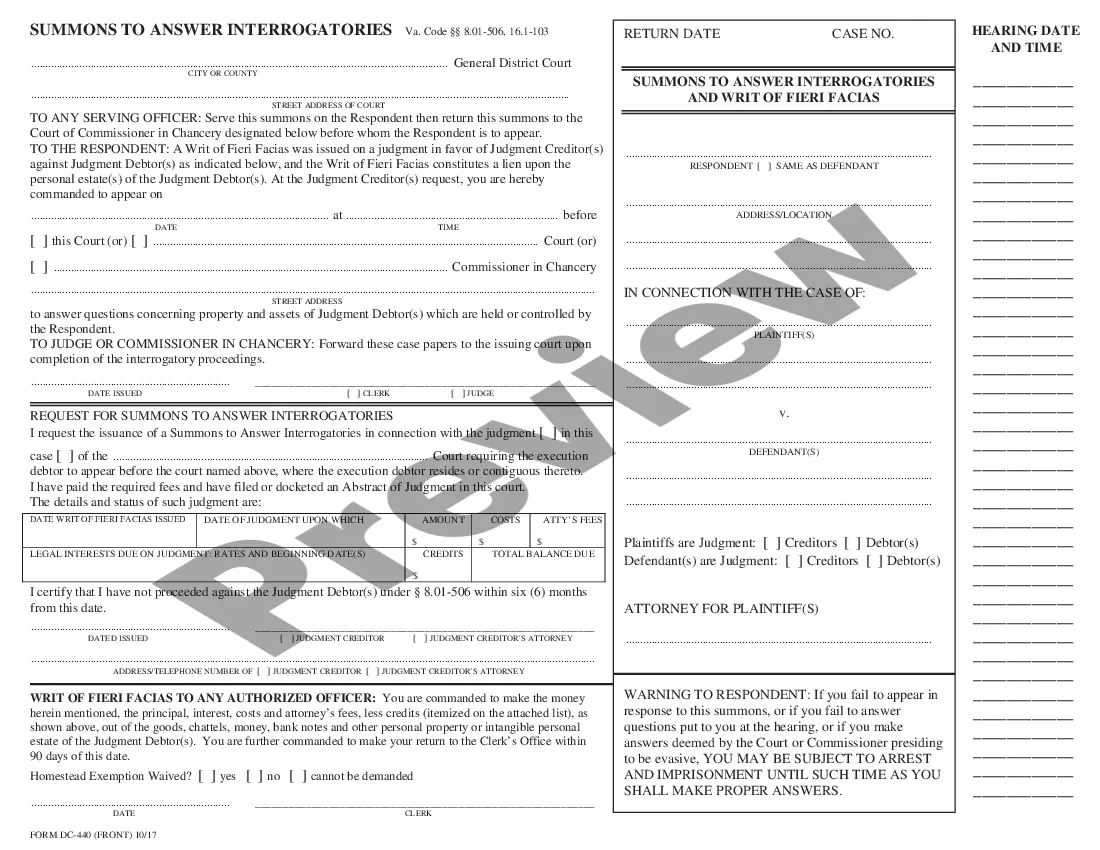

How to fill out Self-Employed Utility Services Contract?

Are you presently in the situation where you need documents for either organization or individual purposes almost every time? There are numerous authorized document templates available online, but locating types you can trust is not simple. US Legal Forms offers a vast selection of form templates, such as the Kansas Self-Employed Utility Services Contract, that are designed to comply with state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Kansas Self-Employed Utility Services Contract template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Kansas Self-Employed Utility Services Contract anytime, if necessary. Just click on the desired form to download or print the document template.

Utilize US Legal Forms, one of the most extensive collections of authorized forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- Obtain the form you require and ensure it is for your correct city/region.

- Use the Review option to examine the form.

- Check the description to confirm that you have chosen the right form.

- If the form isn’t what you’re looking for, utilize the Lookup field to find the form that suits your needs and requirements.

- Once you find the correct form, click on Get now.

- Select the pricing plan you want, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Service labor in Kansas can be taxable depending on the nature of the service provided. For example, labor associated with utility services under a Kansas Self-Employed Utility Services Contract may incur tax obligations. It's essential to differentiate between taxable and non-taxable services, as this can affect your overall tax liability. To navigate these complexities, consider leveraging resources from US Legal Forms for accurate information and forms.

Yes, a Kansas LLC is required to file a tax return, even if it does not generate revenue. This includes submitting any necessary forms to report income, deductions, and credits. Properly handling your business taxes is crucial for maintaining compliance and avoiding penalties. Utilizing services like US Legal Forms can simplify this process by providing the necessary documentation and guidance.

In Kansas, certain services are subject to sales tax. Specifically, services related to utility services, like those covered under the Kansas Self-Employed Utility Services Contract, may be taxable. It's important to understand that the specifics can vary, so consulting with a tax professional can provide clarity on your obligations. Always stay informed about any changes in tax regulations to ensure compliance.

Absolutely, you can have a self-employed contract. This contract serves as a formal agreement between you and your client, detailing the services you will provide, payment terms, and other essential details. Creating a self-employed contract is a vital step in establishing professional relationships and ensuring both parties are on the same page. For those in utility services, a Kansas Self-Employed Utility Services Contract is a solid choice.

Yes, contract work is typically considered self-employed. When you work under a contract, you operate as an independent entity rather than an employee of a company. This arrangement allows you flexibility and control over your work, but it also comes with additional responsibilities, such as managing your taxes. If you are in this situation, consider using a Kansas Self-Employed Utility Services Contract to formalize your agreements.

Self-employed contracts work by defining the terms of service between you and your client. These contracts outline the scope of work, payment terms, and any deadlines. Having a clear contract helps prevent misunderstandings and provides a reference point for both parties. For self-employed individuals in utility services, a well-structured Kansas Self-Employed Utility Services Contract can significantly benefit your business.

Both terms can be used interchangeably, but 'self-employed' generally refers to individuals who own their businesses, while 'independent contractor' often describes those who provide services under a contract. Choosing the right term may depend on your specific situation and how you want to present your business. Regardless of the term you use, ensure your contracts, such as a Kansas Self-Employed Utility Services Contract, clearly reflect your status.

The Kansas Contract for Deed Act governs agreements where a buyer makes payments directly to a seller for property, while the seller retains the title until full payment is made. This act offers protections for both buyers and sellers in real estate transactions. Understanding this act is essential if you are entering into any contracts related to property in Kansas, including those as part of your Kansas Self-Employed Utility Services Contract.

The self-employment tax rate in Kansas is currently 15.3%, which includes Social Security and Medicare taxes. As a self-employed individual, you are responsible for paying this tax on your net earnings. It is crucial to budget for these taxes to avoid surprises during tax season. Utilizing resources like USLegalForms can help you navigate these requirements effectively.

Yes, you can have a contract if you are self-employed. A self-employment contract outlines the terms of your services, payment, and responsibilities. This document protects both you and your clients, ensuring clarity in your business relationships. For those in the Kansas Self-Employed Utility Services Contract space, having a well-drafted agreement is essential.