Kansas Bookkeeping Agreement - Self-Employed Independent Contractor

Description

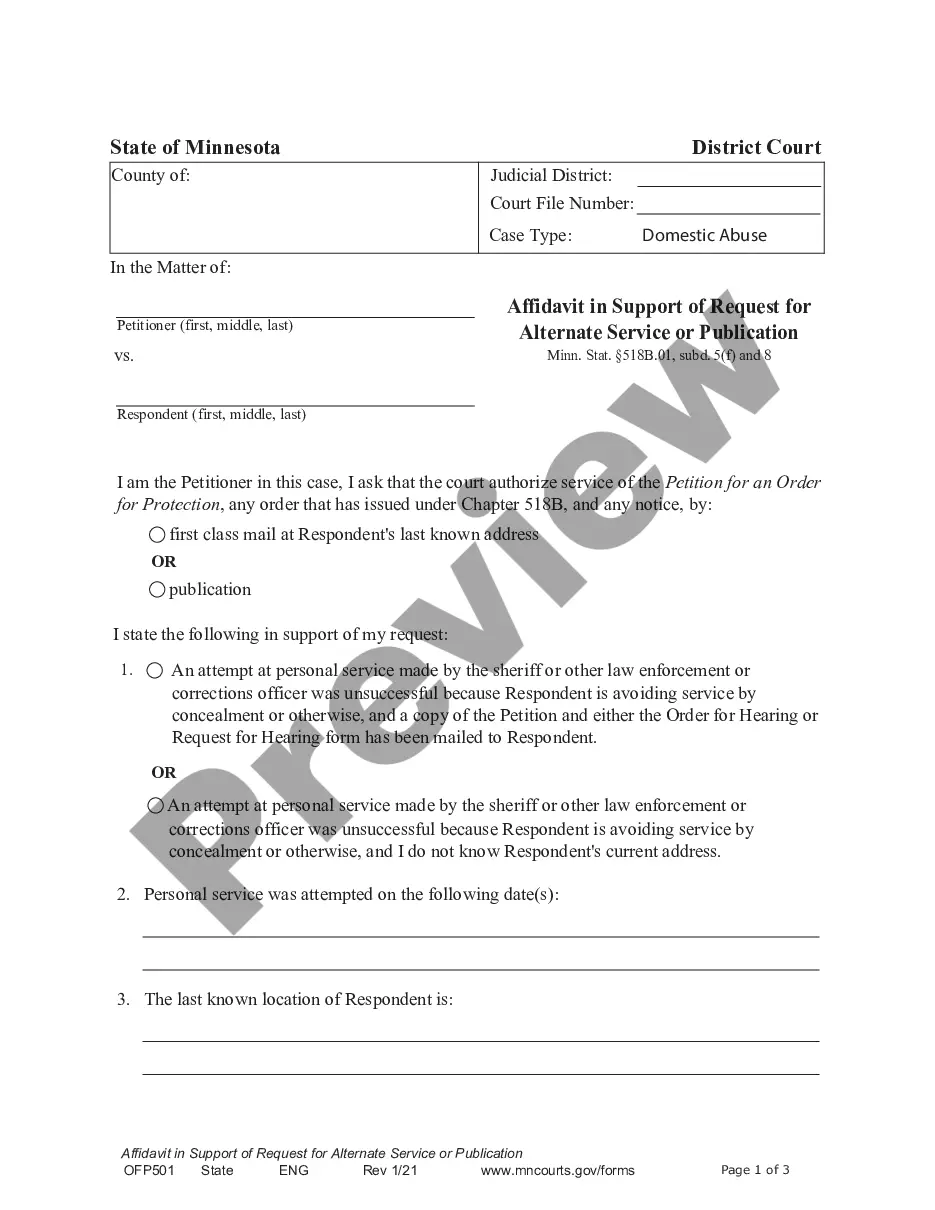

How to fill out Bookkeeping Agreement - Self-Employed Independent Contractor?

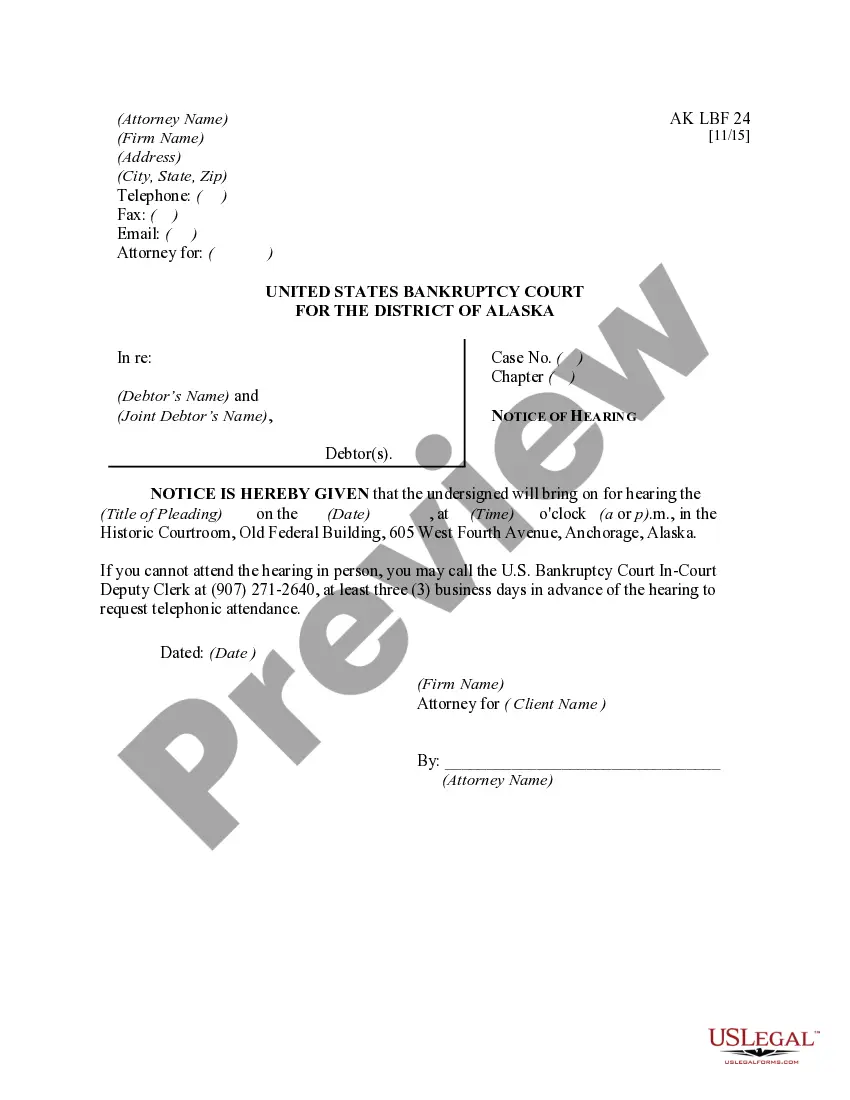

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print. By using the website, you will find thousands of forms for business and personal needs, organized by categories, states, or keywords. You can find the latest forms such as the Kansas Bookkeeping Agreement - Self-Employed Independent Contractor within moments.

If you possess a subscription, Log In and download the Kansas Bookkeeping Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download option will appear on every form you view. You have access to all previously acquired forms from the My documents tab of your account.

To utilize US Legal Forms for the first time, here are simple steps to get you started: Make sure you have selected the correct form for your area/region. Click the Preview option to review the form’s details. Check the form summary to confirm you have chosen the right form. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Purchase now option. Then, select the payment plan you prefer and provide your details to register for the account. Complete the transaction. Use your credit card or PayPal account to finalize the transaction. Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the acquired Kansas Bookkeeping Agreement - Self-Employed Independent Contractor. Every template you added to your account has no expiration date and is yours forever. So, if you wish to download or print another copy, just visit the My documents section and click on the form you need.

- Access the Kansas Bookkeeping Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most comprehensive collections of legal form templates.

- Utilize a vast number of professional and state-specific templates that meet your business or personal requirements and needs.

- Navigate the website easily to find the forms you need.

- Enjoy unlimited access to your purchased forms without time restrictions.

- Customize your documents according to your specifications.

- Experience a straightforward transaction process for all your legal form needs.

Form popularity

FAQ

Filling out an independent contractor agreement involves several key steps. Start by clearly defining the scope of work, payment terms, and confidentiality clauses. Include both parties' contact information and signatures for clarity and legality. For additional guidance, consider templates available on uslegalforms, particularly the Kansas Bookkeeping Agreement - Self-Employed Independent Contractor, which provides a comprehensive starting point.

Yes, bookkeepers can operate as 1099 contractors. This classification allows them to work independently while receiving compensation without traditional employee benefits. By using the 1099 form, you maintain a business relationship with your clients, enhancing your work autonomy. Utilizing a Kansas Bookkeeping Agreement - Self-Employed Independent Contractor simplifies this process and ensures legal compliance.

Absolutely, a bookkeeper can work as an independent contractor. This arrangement allows them to serve multiple clients without being an employee of any single business. Many companies prefer this model to avoid the costs associated with full-time employees. If you decide to pursue this route, consider implementing a Kansas Bookkeeping Agreement - Self-Employed Independent Contractor for clarity.

Yes, you can be a self-employed bookkeeper. Many choose this path to enjoy the benefits of managing their own business and client relationships. Being self-employed as a bookkeeper allows you flexibility in your work schedule and client selection. A Kansas Bookkeeping Agreement - Self-Employed Independent Contractor provides a structured framework for your services.

Writing a Kansas Bookkeeping Agreement for a Self-Employed Independent Contractor involves detailing the responsibilities, compensation, and duration of the agreement. Clearly state the terms and conditions to ensure both parties understand their obligations. If you need assistance, consider using UsLegalForms, which offers customizable templates to help you create a comprehensive agreement effortlessly.

Filling out an independent contractor form requires you to input your personal information, including your tax identification number and contact details. Be sure to describe the scope of work you will undertake, the payment structure, and any specific agreement terms. With resources from UsLegalForms, you can simplify this process and ensure you capture all necessary details accurately.

To create a Kansas Bookkeeping Agreement for a Self-Employed Independent Contractor, start by outlining the essential elements such as the services provided, payment terms, and deadlines. Clearly define the expectations for both parties to avoid misunderstandings. You may consider using a template from a trusted platform like UsLegalForms, as it offers legally sound options tailored for your needs.