Kansas Contract Administrator Agreement - Self-Employed Independent Contractor

Description

How to fill out Contract Administrator Agreement - Self-Employed Independent Contractor?

Locating the appropriate legal document template can be a challenge. Of course, there are numerous templates accessible online, but how do you discover the legal form you require? Utilize the US Legal Forms website. This service offers a plethora of templates, including the Kansas Contract Administrator Agreement - Self-Employed Independent Contractor, which you may use for business and personal purposes. All of the forms are vetted by experts and meet federal and state standards.

If you are already registered, Log In to your account and click on the Download button to access the Kansas Contract Administrator Agreement - Self-Employed Independent Contractor. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account and obtain another copy of the document you require.

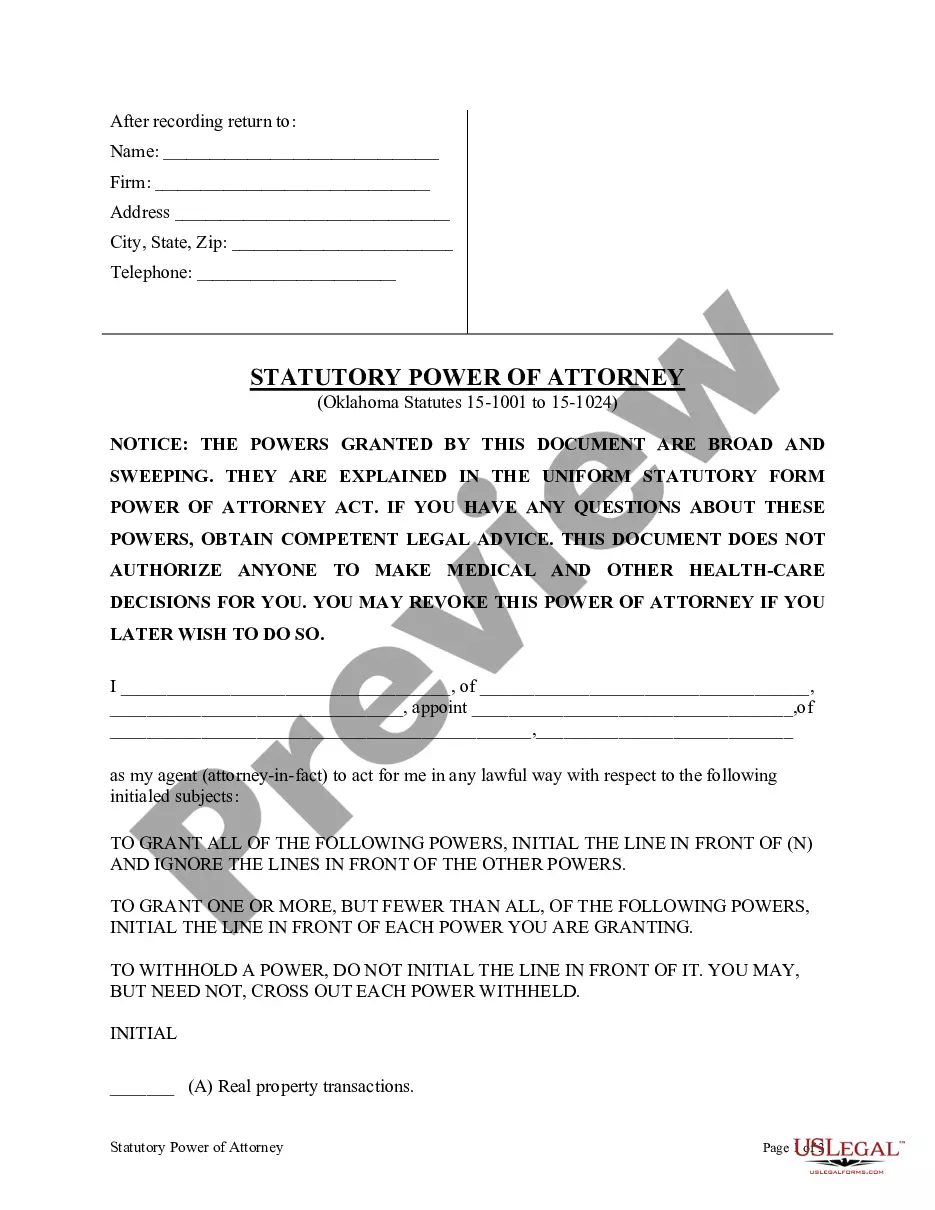

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your region/county. You can review the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search field to locate the correct form. Once you are confident that the form is accurate, click on the Buy now button to procure the form. Choose the pricing plan you desire and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received Kansas Contract Administrator Agreement - Self-Employed Independent Contractor.

By leveraging US Legal Forms, you can simplify the process of finding and obtaining the necessary legal documents.

- US Legal Forms is the largest repository of legal documents where you can find various document templates.

- Utilize the service to obtain professionally crafted papers that adhere to state regulations.

- Access a wide range of forms for both personal and business needs.

- Ensure compliance with legal standards by using vetted templates.

- Easily manage your purchased documents through your account.

- Take advantage of the user-friendly interface for searching and downloading forms.

Form popularity

FAQ

Typically, either the business hiring the contractor or the contractor themselves writes the independent contractor agreement. For a Kansas Contract Administrator Agreement - Self-Employed Independent Contractor, it’s essential that the agreement accurately reflects the working relationship. Engaging a legal professional can be beneficial to ensure all necessary terms are included. Utilizing resources like US Legal Forms can also help streamline this process.

To create an independent contractor agreement, first identify the work scope, payment terms, and deadlines. You can draft a customized agreement using templates designed for a Kansas Contract Administrator Agreement - Self-Employed Independent Contractor. Utilizing platforms like US Legal Forms can simplify this process, providing easy-to-follow templates. Once drafted, both parties should review the document for understanding before signing.

Yes, an independent contractor agreement is a legally binding contract between two parties. This document outlines the terms of work, payment, and responsibilities specific to the Kansas Contract Administrator Agreement - Self-Employed Independent Contractor. By defining this relationship, both parties gain clarity on expectations. Therefore, it protects the rights of both the contractor and the employer.

Filling out an independent contractor form requires specific information about the contractor and the services provided. Ensure you include essential elements like payment information, duration of the contract, and other important conditions. By using a structured Kansas Contract Administrator Agreement - Self-Employed Independent Contractor form from uslegalforms, you can easily complete it with confidence and clarity.

Writing an independent contractor agreement involves outlining the expectations for both parties in clear language. Start with the details of the contractor and the scope of work, including responsibilities and timelines. Consider utilizing the templates offered by uslegalforms that focus on Kansas Contract Administrator Agreements - Self-Employed Independent Contractors for a comprehensive and legally sound document.

To fill out an independent contractor agreement, begin with the basic information of both parties, such as names and addresses. Then, clearly describe the services to be provided, payment structure, and confidentiality terms. A well-structured Kansas Contract Administrator Agreement - Self-Employed Independent Contractor template can simplify this process and ensure compliance with local laws.

Filling out a contract agreement involves providing accurate information about all parties involved, including names, addresses, and contact details. Next, outline the services offered, deadlines, and payment terms. For a Kansas Contract Administrator Agreement - Self-Employed Independent Contractor, it's beneficial to use reliable templates that guide you through each section.

To create a contract agreement for a freelancer, start by clearly defining the scope of work you expect. Include details such as deliverables, deadlines, and payment terms. Utilizing a platform like uslegalforms can help you access templates specifically designed for Kansas Contract Administrator Agreements - Self-Employed Independent Contractors, ensuring you cover all necessary legal aspects.